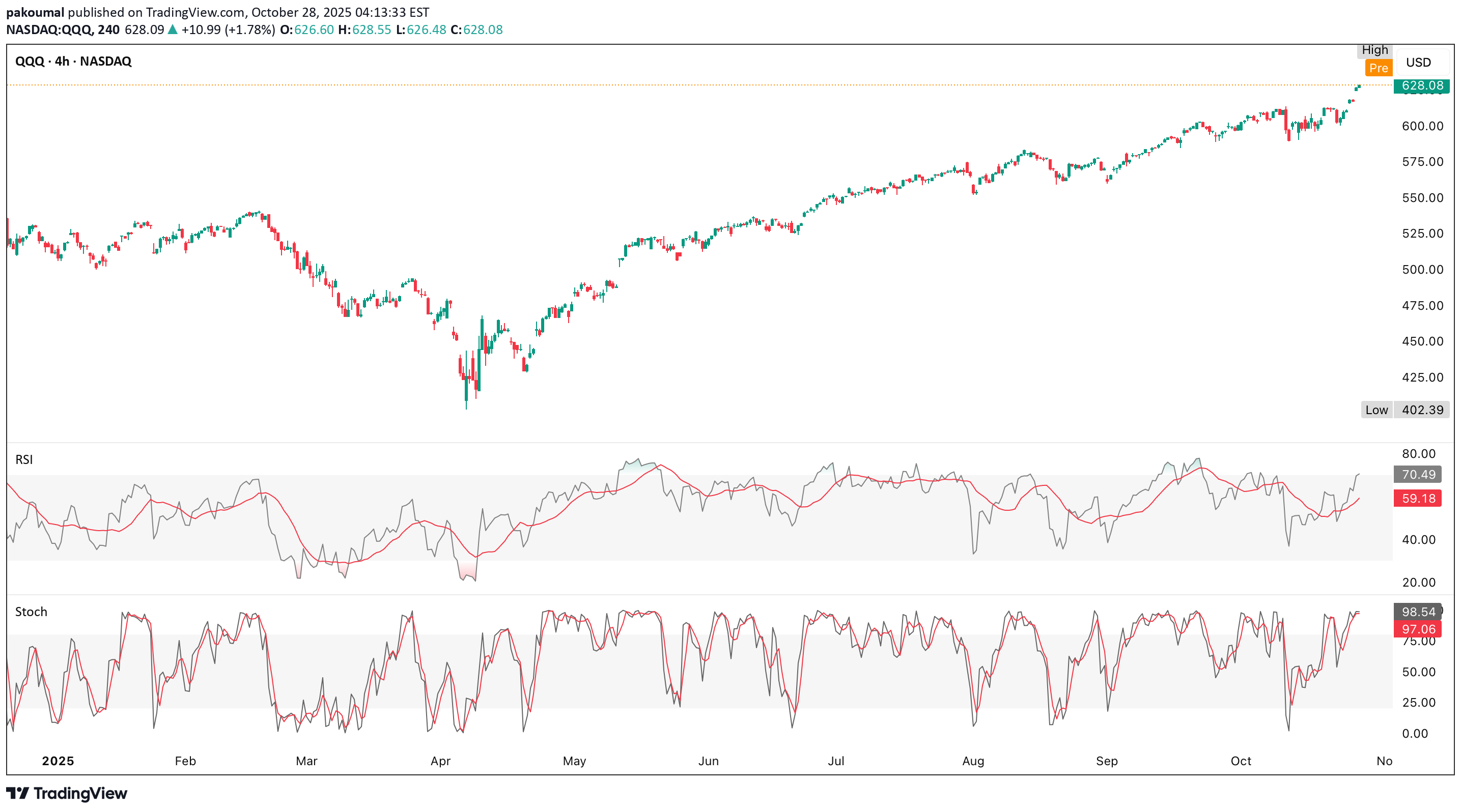

Technical analysis by pakoumal about Symbol QQQX on 10/28/2025

هشدار شدید: شاخصهای داغ QQQ چه زمانی سقوط میکنند؟ (آماده یک اصلاح قیمتی باشید)

Expect a cool-off or pullback within 1-2 sessions - not necessarily a trend reversal, but enough for those gap fills ($625 to $617), historically ~2-3% fade over the next few sessions Market-makers and dealers are short gamma after a week of heavy call buying (Fed cut bets + tech earnings) As QQQ keeps rising, they must buy more QQQ shares to hedge, which pushes prices even higher It’s a self-reinforcing loop… until call buyers stop pressing or IV rolls off Stochastic at 98 is extremely overbought Each prior time the 4H Stoch hit this zone (see late June, late August & mid-October), QQQ pulled back 1.5-3 % within 1-3 candles (roughly 12-24 hours) RSI: 70.5 is at the classic “overbought” threshold RSI’s slope is still positive, but you can already see momentum flattening which is a common pre-fade signal When RSI ≈ 70 + stoch > 95, QQQ often pauses or retraces to the 20d EMA or VWAP on the 4H chart In this case, that support sits near $616-$618, lining up with the open gap from last week If momentum fully resets, a deeper test toward $610-$612 (previous breakout base) becomes possible before bulls step back in The rally from ~$604 to $628 happened in less than three sessions - a parabolic extension It was likely fueled by gamma-hedging flows (dealers buying stock to cover short calls) Once those flows slow, momentum traders often take profits & dealers sell back shares - fast, but contained dip $626-$628 Short-term resistance If rejected here, fade likely $618 First support/minor gap Ideal first-target for any pullback $610–$612 VWAP/20d EMA confluence Stronger support, potential re-entry $635-$640 Upside extension Only if RSI resets & buyers rotate back in