Technical analysis by RakyatTrader about Symbol PAXG: Buy recommendation (10/26/2025)

طلا در نقطه حساس: خریداران یا فروشندگان پیروز میشوند؟ (تحلیل سطح به سطح)

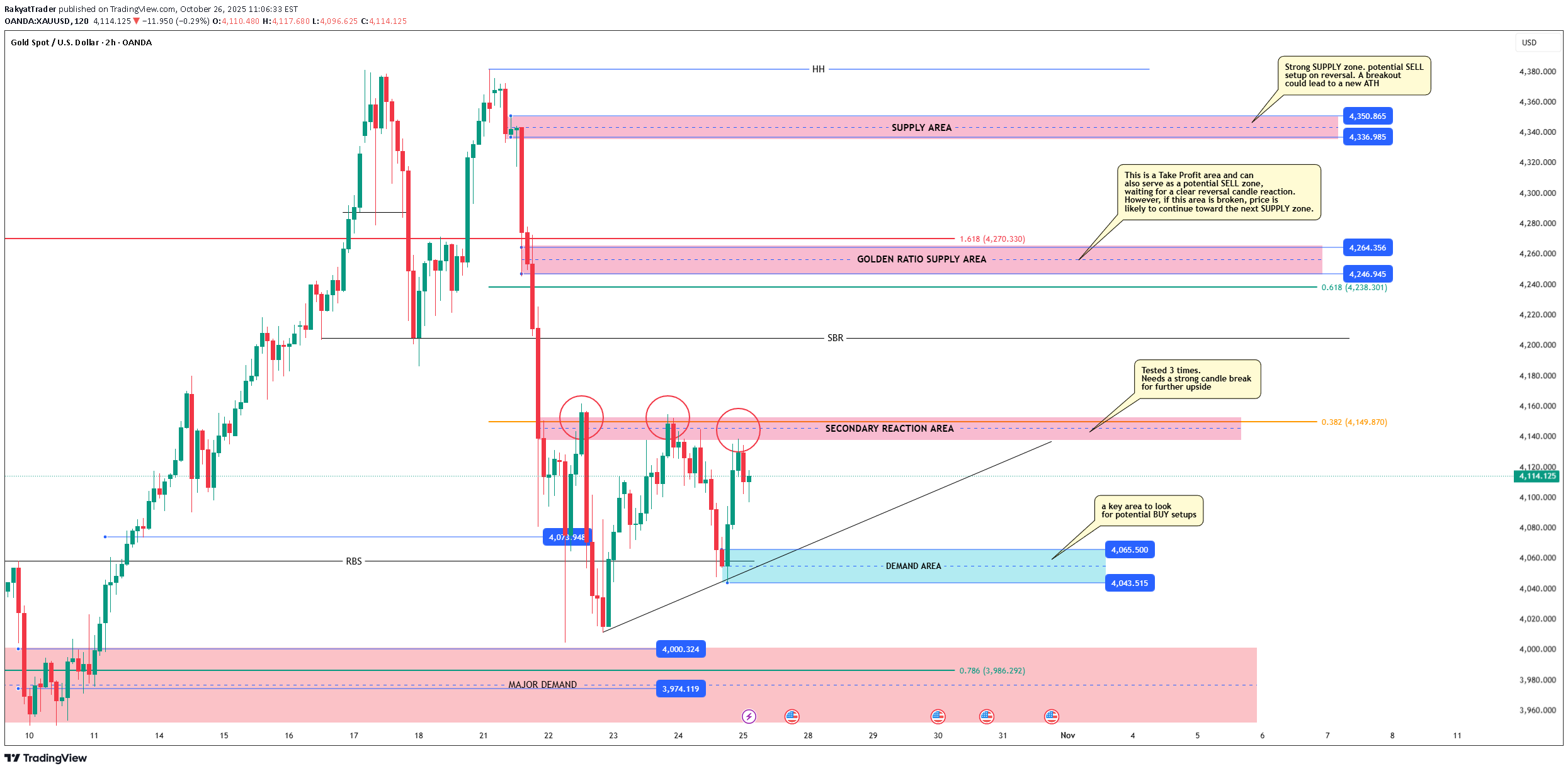

1. Market Structure Overall, gold is currently in a corrective phase following a strong bullish rally. The latest move formed a Higher High (HH) around 4,350–4,360, followed by a sharp rejection — signaling that supply pressure has started to take control. 2. Supply Zone & SELL Potential Strong Supply Zone (4,336–4,350): This is a key resistance area where price previously faced heavy rejection. If price retests this level, it could provide a potential SELL setup, especially if a clear reversal candle such as a bearish engulfing or shooting star appears. However, if this zone is broken with a solid bullish candle, the market could likely print a new All-Time High (ATH) in line with the medium-term bullish momentum. 3. Golden Ratio Supply Area (around 4,246–4,264) This area acts as both a Take Profit zone for prior long positions and a directional confirmation zone. A failure to break above could trigger another rejection and deeper pullback, strengthening short-term bearish pressure. 4. Secondary Reaction Area (around 4,150) This zone has been tested three times, confirming a strong short-term supply presence. Plan: wait for a strong bullish breakout candle above this area to validate a continuation move. If another rejection forms, price could head back toward the Demand Area (4,065–4,043). 5. Demand Area (4,065–4,043) A key level for potential BUY setups. Look for a clear bullish reversal candle before entering. If this zone holds, the market could rebound higher. But if it breaks down, price may extend lower toward the Major Demand zone (3,974–3,986). 6. Major Demand (3,974–3,986) A strong base zone capable of halting further downside movement. Suitable for swing BUY setups with a favorable risk-reward ratio, as long as price stays above this level. Trading Plan Summary BUY PLAN: Wait for bullish confirmation near Demand Area (4,065–4,043) or Major Demand (3,974–3,986). First targets: Secondary Reaction Area (4,150) and Golden Ratio Supply (4,246). SELL PLAN: Wait for clear rejection or reversal candle near Golden Ratio Supply (4,246) or Strong Supply (4,336–4,350). Target: Demand Area (4,065–4,043). Conclusion Gold is currently in a neutral strategic zone, squeezed between strong supply and solid demand. The next directional move will largely depend on how price reacts around the Secondary Reaction Area and Demand Area. The key principle: don’t predict—react to confirmation.