Technical analysis by ProjectSyndicate about Symbol PAXG: Buy recommendation (10/26/2025)

پیشبینی طلای هفته آینده: سطوح حیاتی حمایت و مقاومت برای معاملهگران

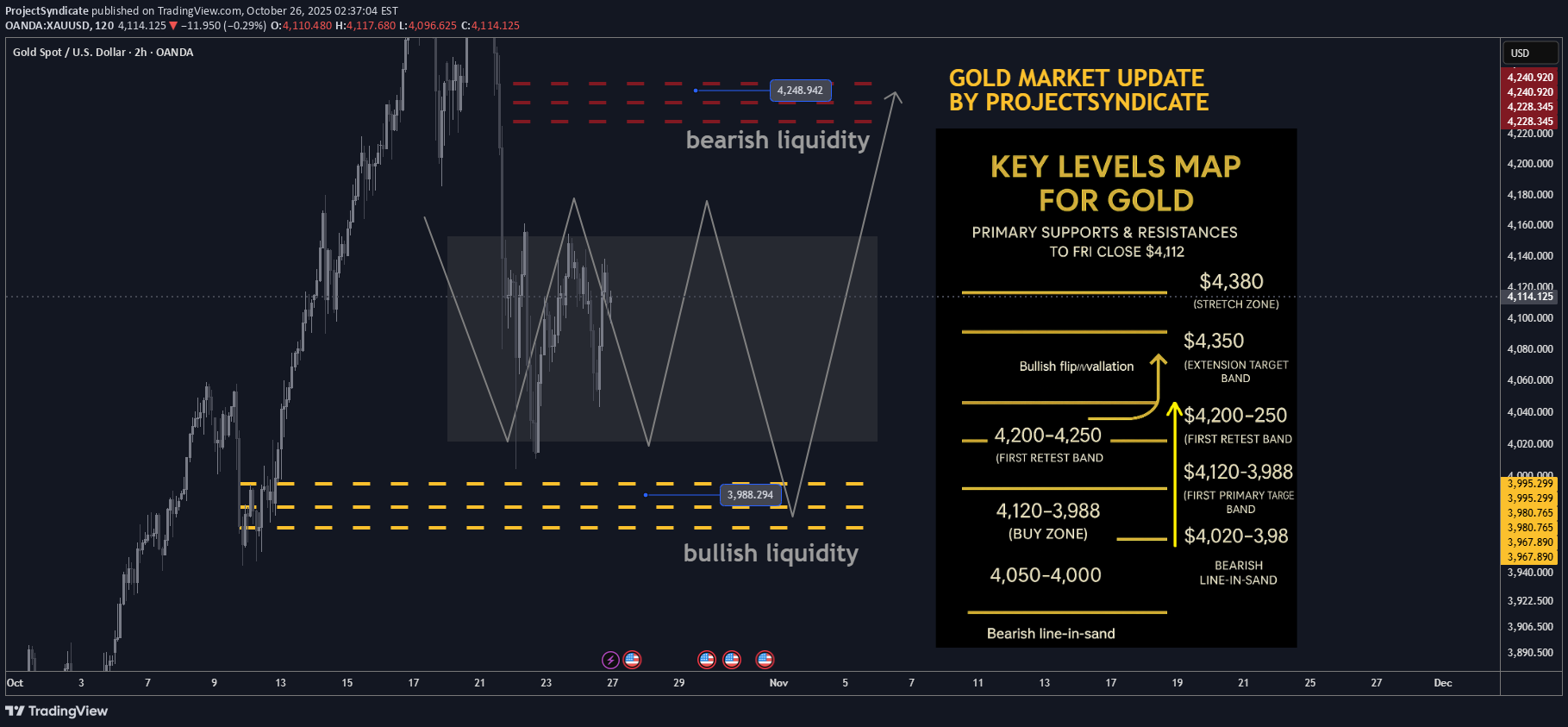

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,380 → ~$4,112 — lower close within range; momentum cooled but holding the $4,000 handle. 📈 Trend: Uptrend intact > $4,000; oversold into $4.1k—setup favors reflex bounce. 🛡 Supports: $4,120–$4,080 → $4,020–$3,988 (bullish liquidity) → $4,000/3,980 must hold. 🚧 Resistances: $4,200 / $4,250 (bearish liquidity) / $4,300 → stretch $4,350–$4,380. 🧭 Bias next week: Buy-the-dip $4,020–$3,988; momentum regain above $4,200 targets $4,250 → $4,300–$4,350. Invalidation < $3,980 risks a deeper flush to $3,950. 🌍 Macro tailwinds: • Policy: Easing real yields supportive on dips. • FX: Softer USD tone = constructive backdrop. • Flows: Central-bank buying + tactical ETF interest underpin $4k. • Geopolitics: Trade/tariff & regional tensions keep safety bids alive. 🎯 Street view: Select houses still float $5,000/oz by 2026 on policy easing & reserve-diversification narratives. ________________________________________ 🔝 Key Resistance Zones • $4,200–$4,230 immediate supply from the weekly close • $4,250 bearish liquidity / primary target • $4,300–$4,350 extension band • $4,380 prior spike high / stretch 🛡 Support Zones • $4,120–$4,080 first retest band below close • $4,020–$3,988 buy zone (bullish liquidity) • $4,000 / $3,980 must-hold shelf ________________________________________ ⚖️ Base Case Scenario Expect pullbacks into $4,120–$4,080 and $4,020–$3,988 to attract buyers, rotating price back toward $4,200 then $4,250. Acceptance above $4,250 invites a drive into $4,300–$4,350. 🚀 Breakout Trigger A sustained push/acceptance > ~$4,250 unlocks $4,300 → $4,350, with room toward $4,380 if momentum persists. 💡 Market Drivers • Real-yield drift lower (supportive carry backdrop) • USD softness aiding metals • Ongoing CB accumulation; ETF flows stabilizing on dips • Headline risk (trade/geopolitics) sustaining safe-haven demand 🔓 Bull / Bear Trigger Lines • Bullish above: $4,020–$4,100 (buyers defend pullbacks) • Bearish below: $3,980 (risk expands; threatens $3,950) 🧭 Strategy Buy low from bullish liquidity (~$3,988) with a target at $4,250; oversold conditions favor a strong bounce. Add on strength above $4,200 toward $4,300–$4,350. Keep risk tight below $3,980–$4,000 to invalidate.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Outlook And Targets: 5000 USD/7500 USD1️⃣ High/Close: $4,380 → $4,112 — momentum cooled but trend intact. 2️⃣ Trend: Still bullish above $4,000; oversold = bounce setup. 3️⃣ Supports: $4,120–$4,080 → $4,020–$3,988 💪 4️⃣ Resistances: $4,200 / $4,250 / $4,300–$4,350 🚧 5️⃣ Bias: Buy dips near $4,020–$3,988 → target $4,250–$4,350. 6️⃣ Invalidation: < $3,980 = bearish risk ⚠️ 7️⃣ Macro tailwinds: Soft USD, lower yields, CB buying 🌍 8️⃣ Breakout: > $4,250 opens $4,300–$4,380 🚀 9️⃣ Street view: $5,000/oz by 2026 still on table 🎯 🔟 Strategy: Accumulate dips ➕ hold above $4,000 🧭