Technical analysis by Wick-Sniper about Symbol PAXG on 10/26/2025

Wick-Sniper

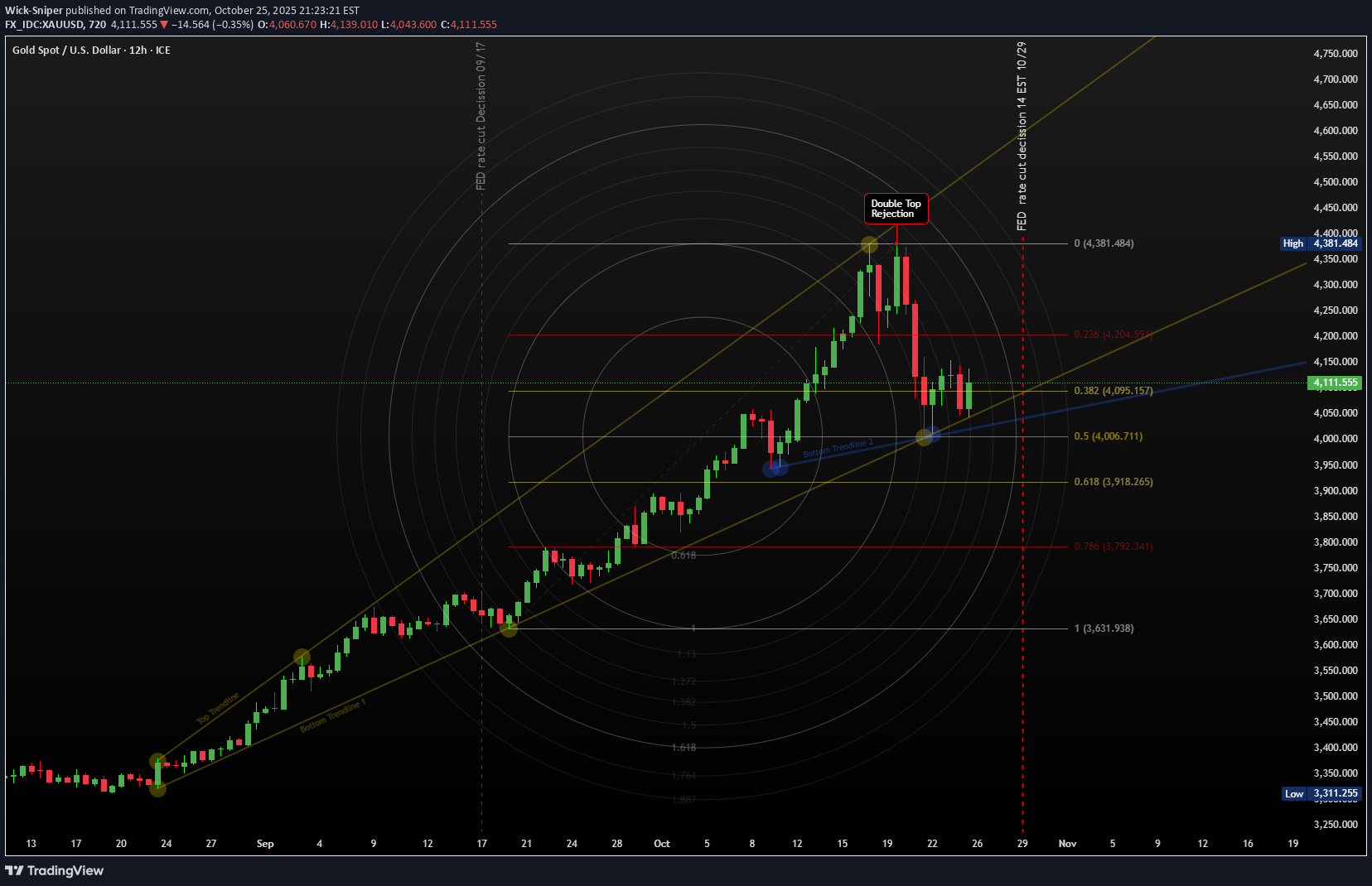

طلا آماده انفجار است؟ راز حرکت بزرگ بعدی در بازار XAUUSD فاش شد!

Hold onto your hats, traders! It's been a very wild ride in the XAUUSD market, proving that what goes up (to a Double Top 🏔️🏔️) must come down (with a vengeance!). After a decisive rejection at the $4381 peak, Gold took a spectacular 8.64% dive last Tuesday, landing sharply at the $4002 low 📉. Talk about a waterfall! 🌊 But don't count the bulls out yet! Gold showed some backbone, bouncing 3.97% back up to $4161 before settling into a cage match. It's now consolidating in a classic Triangle pattern (a.k.a. Compression) 📐, ranging from the $4002 floor up to the stronger resistance near $4135. The Great Consolidation: Triangle Tension 😮💨 The key takeaway? That $4000 psychological support is a BEAST. 💪 It survived test after test during the Asia, EU, and US sessions last Tuesday and Wednesday! This resilience allowed Gold to build support: first at the $4065 level (the Fib 0.382) and then down to the $4043 low, followed by rock-solid support near the $4000 zone. As Friday closed out the week, Gold was still testing the lower $4100 area, pulling back to $4096. So, what’s next for the shiny metal? That $33 candle Friday, was a direct reaction to the release of the slightly softer-than-expected US September Consumer Price Index (CPI) inflation data. My Outlook: Patience is Gold, But the FED is Key 🔑 While some market watchers are singing a bearish tune 🐻, I see this as a healthy consolidation phase. Gold has already corrected 50% from its massive move (from $3631 low to the $4381 high). While a deeper correction to the 0.618 Fib at $3918 is possible, I don't see the catalyst right now to push it that far. My bet? Gold will continue to consolidate in $4050 - $4150 range until the major announcement from the FED 🏦. The sharp reversal from the Double Top might just be the clean-out needed to launch prices higher once the rate cut announcement (or even just the dovish talk of future cuts) takes place! The last inflation data was a mixed bag, which gives the FED room to sound reassuringly dovish. The FED Announcement is the main event this week. Mark your calendars! 🗓️ 🔥 Key Economic Events: Central Bank Super Week! 🔥 This week is absolutely jammed with market-moving events across the globe. Get ready for volatility! 🌪️ Monday, October 27, 2025 8:30 AM ET: USD 🇺🇸 Durable Goods Orders (MoM) (Sep) 10:00 AM ET: USD 🇺🇸 New Home Sales (Sep) Tuesday, October 28, 2025 10:00 AM ET: USD CB Consumer Confidence (Oct) Wednesday, October 29, 2025 (The Fed Day) 🏦 All Day: HKD Holiday - Chung Yeung Day 9:45 AM ET: CAD BoC Interest Rate Decision 10:30 AM ET: USD Crude Oil Inventories 2:00 PM ET: USD Fed Interest Rate Decision 2:30 PM ET: USD FOMC Press Conference 10:00 PM ET (Approx.): JPY BoJ Interest Rate Decision Thursday, October 30, 2025 (ECB and GDP Day) 2:00 AM ET: EUR German GDP (QoQ) (Q3) 4:00 AM ET: EUR German CPI (MoM) (Oct) 8:15 AM ET: EUR Deposit Facility Rate (Oct) 8:15 AM ET: EUR ECB Interest Rate Decision (Oct) 8:30 AM ET: USD GDP (QoQ) (Q3) 8:45 AM ET: EUR ECB Press Conference 9:30 PM ET: CNY Manufacturing PMI (Oct) Friday, October 31, 2025 (Inflation and Month End) 6:00 AM ET: EUR CPI (YoY) (Oct) 8:30 AM ET: USD Core PCE Price Index (MoM) (Sep) 8:30 AM ET: USD Core PCE Price Index (YoY) (Sep) 9:45 AM ET: USD Chicago PMI (Oct) ------------------------------------------------------------------------- This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly. Good luck and safe trading! 🚀📊