Technical analysis by Kiu_Coin about Symbol PAXG on 10/24/2025

Kiu_Coin

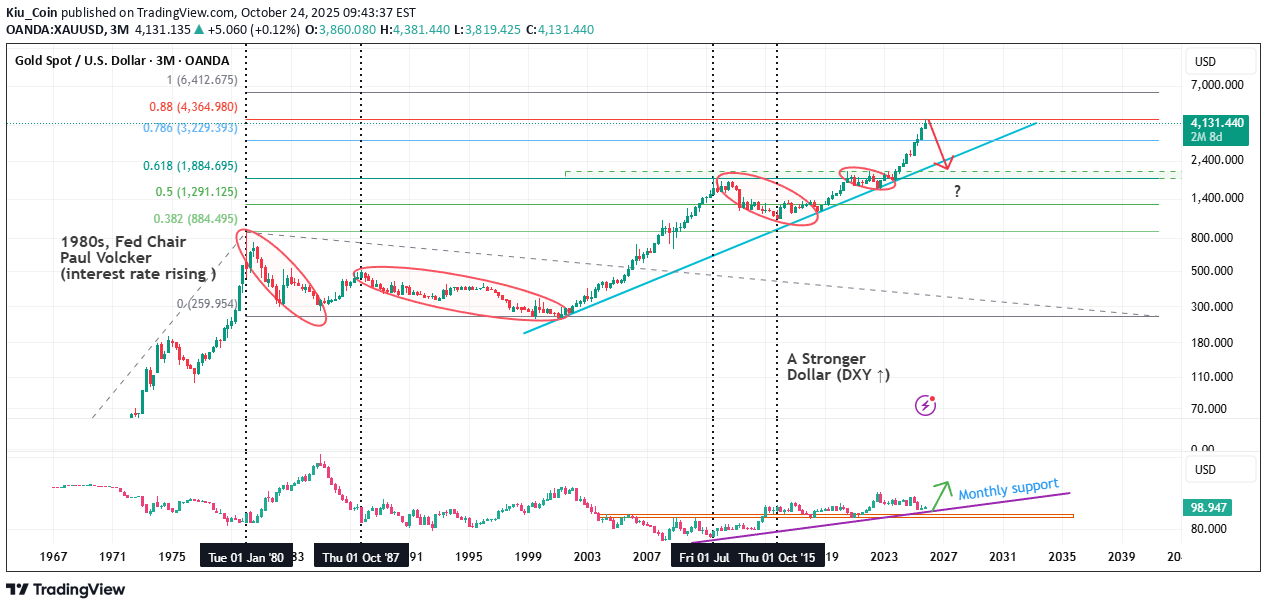

علت سقوطهای بزرگ طلا در تاریخ چه بود؟ (از دهه 70 تا امروز)

Hello Traders 🐺 Throughout history, every major bear market in gold has been deeply connected to macro factors, monetary policy, and investor psychology. Here I’ve summarized the key factors behind gold’s biggest crashes since the 1970s 👇 🧩 Key Factors Behind Historical Gold Crashes 1️⃣ Rising Real Interest Rates (↑) The biggest historical enemy of gold. Since gold has no yield, when real interest rates (nominal rates – inflation) turn positive, investors prefer bonds or the U.S. dollar. Example: In the 1980s, Fed Chair Paul Volcker raised rates above 15% to fight inflation. Result: gold dropped from $850 (1980) to around $300 by the mid-80s — a 65% crash, marking the longest bear market in gold’s history (1980–1999). 2️⃣ A Stronger Dollar (DXY ↑) Gold usually moves inversely to the dollar index. When the dollar strengthens (especially vs EUR and JPY), gold comes under pressure. Example: Between 2011–2015, DXY rose from 73 → 100, while gold fell from $1920 → $1050 (≈45% decline). 3️⃣ End of Crises or Return of Market Confidence When fear fades and confidence returns (e.g., after financial crises or geopolitical tensions ease), investors move away from safe-haven assets like gold. Example: After the 2008 crisis, once markets stabilized, gold entered a prolonged bear market (2012–2015). 4️⃣ Central Banks Stopping Gold Purchases When central banks reduce or halt their gold accumulation, supply pressure builds. Example: In the late 1990s, European central banks sold large portions of their reserves (known as the Central Bank Gold Agreement 1999), which accelerated gold’s decline. 5️⃣ Strong Stock Market Returns When equities deliver strong real returns, capital often rotates out of gold. Example: From 1995–2000, the S&P 500 rallied massively, while gold suffered one of its weakest decades. 6️⃣ Low Inflation & Economic Stability Gold thrives on uncertainty and high inflation. When inflation is low and stable, investors see little reason to hold gold. Example: Between 1985–2000, inflation in the U.S. stayed low — and gold traded sideways between $250–$400 for nearly 20 years. 7️⃣ Technical & Sentiment Breakdown When key supports break and sentiment turns bearish, fear-driven selling usually accelerates the downtrend. Example: In 2013, gold broke below the $1550 support, triggering a rapid 20% selloff within months. My final thought: Every time gold enters a euphoric phase, history reminds us that the higher it climbs, the harder it falls. So what do you think right know ? is GOLD about to fall ? let me know in the comment section down below this idea 😉🤔 So stay disciplined, watch the macro shifts carefully — and as always remember: 🐺 Discipline is rarely enjoyable, but almost always profitable. 🐺 🐺 KIU_COIN 🐺