Technical analysis by Khan_YIK about Symbol PAXG on 10/23/2025

تحلیل طلا (XAU/USD) امروز: آیا قیمت صعودی یا نزولی است؟ (23 اکتبر 2025)

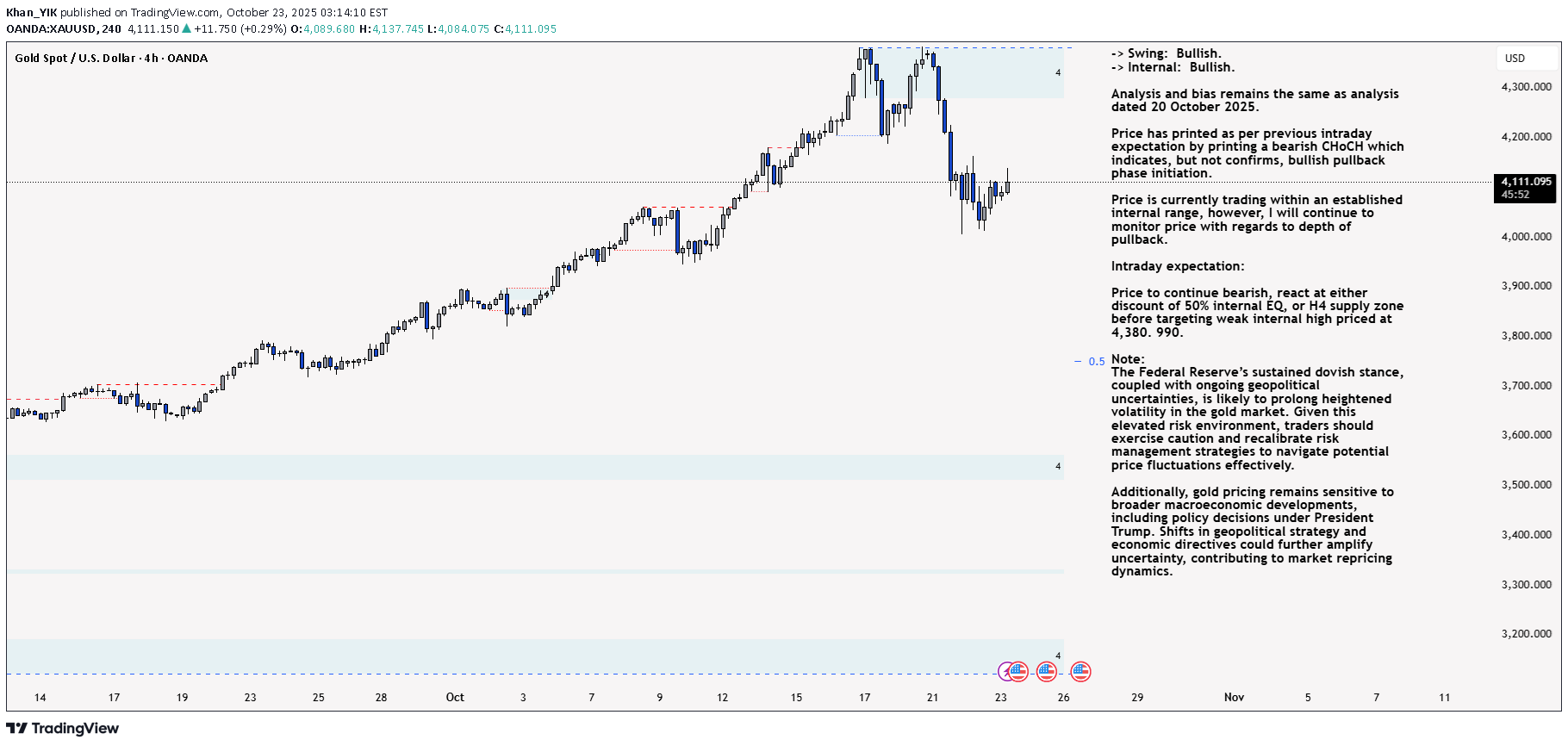

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380. 990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bearish. Analysis and bias remains the same as yesterday's analysis dated 22 October 2025. Price has printed according to my analysis dated 20 October 2025 where I mention that price is to continue bullish, react at either premium of 50% internal EQ, or M15 demand zone, before targeting weak internal low priced at 4,185.910. Price has printed a bearish iBOS and subsequently a bullish CHoCH to indicate, but not confirm bullish pullback phase initiation. Price is now trading within an established internal range. Intraday expectation: Price to react at either premium of 50% internal EQ, or M15 demand zone, before targeting weak internal low priced at 4,004.280. Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart: