Khan_YIK

@t_Khan_YIK

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

XAU/USD 19 December 2025 Intraday Analysis

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. Price has printed according to my analysis dated 15 December where I mentioned price will target weak internal high priced at 4,353.555 following bearish pullback to discount of 50% internal EQ. Price has printed a bearish CHoCH, therefore, price is now contained within an established internal range. Intraday expectation: Price to trade down to either M15 demand zone, or discount of 50% internal EQ before targeting weak internal high, priced at 4,374.655 Note: Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions. With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common. Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold. M15 Chart:

XAU/USD 18 December 2025 Intraday Analysis

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as yesterday's analysis dated 15 December 2025. As mentioned in my analysis and intraday expectation dated 11 December that I will allow price to print pause and to confirm an internal high. Price has printed a bearish CHoCH and reacted at almost precisely 50% internal EQ. Intraday expectation: Price to target weak internal high priced at 4,353.555. Note: Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions. With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common. Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold. M15 Chart:

XAU/USD 17 December 2025 Intraday Analysis

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as yesterday's analysis dated 15 December 2025. As mentioned in my analysis and intraday expectation dated 11 December that I will allow price to print pause and to confirm an internal high. Price has printed a bearish CHoCH and reacted at almost precisely 50% internal EQ. Intraday expectation: Price to target weak internal high priced at 4,353.555. Note: Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions. With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common. Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold. M15 Chart:

XAU/USD 16 December 2025

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as yesterday's analysis dated 15 December 2025. As mentioned in my analysis and intraday expectation dated 11 December that I will allow price to print pause and to confirm an internal high. Price has printed a bearish CHoCH and reacted at almost precisely 50% internal EQ. Intraday expectation: Price to target weak internal high priced at 4,353.555. Note: Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions. With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common. Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold. M15 Chart:

تحلیل طلا (XAU/USD) 15 دسامبر 2025: نوسانات شدید با تاثیر فدرال رزرو و ترامپ!

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. As mentioned in my analysis and intraday expectation dated 11 December that I will allow price to print pause and to confirm an internal high. Price has printed a bearish CHoCH and reacted at almost precisely 50% internal EQ. Intraday expectation: Price to target weak internal high priced at 4,353.555. Note: Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions. With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common. Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold. M15 Chart:

تحلیل طلا (XAU/USD) برای امروز: نوسانات شدید در انتظار معاملهگران!

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. As per analysis dated 14 November 2025, price has printed a bearish CHoCH to indicate, but not confirm bearish pullback phase initiation. Price is currently trading within an established internal range. Intraday expectation: Price to trade down to either discount of 50% internal EQ, or M15 demand zone before targeting weak internal high, priced at 4,245.195 Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart:

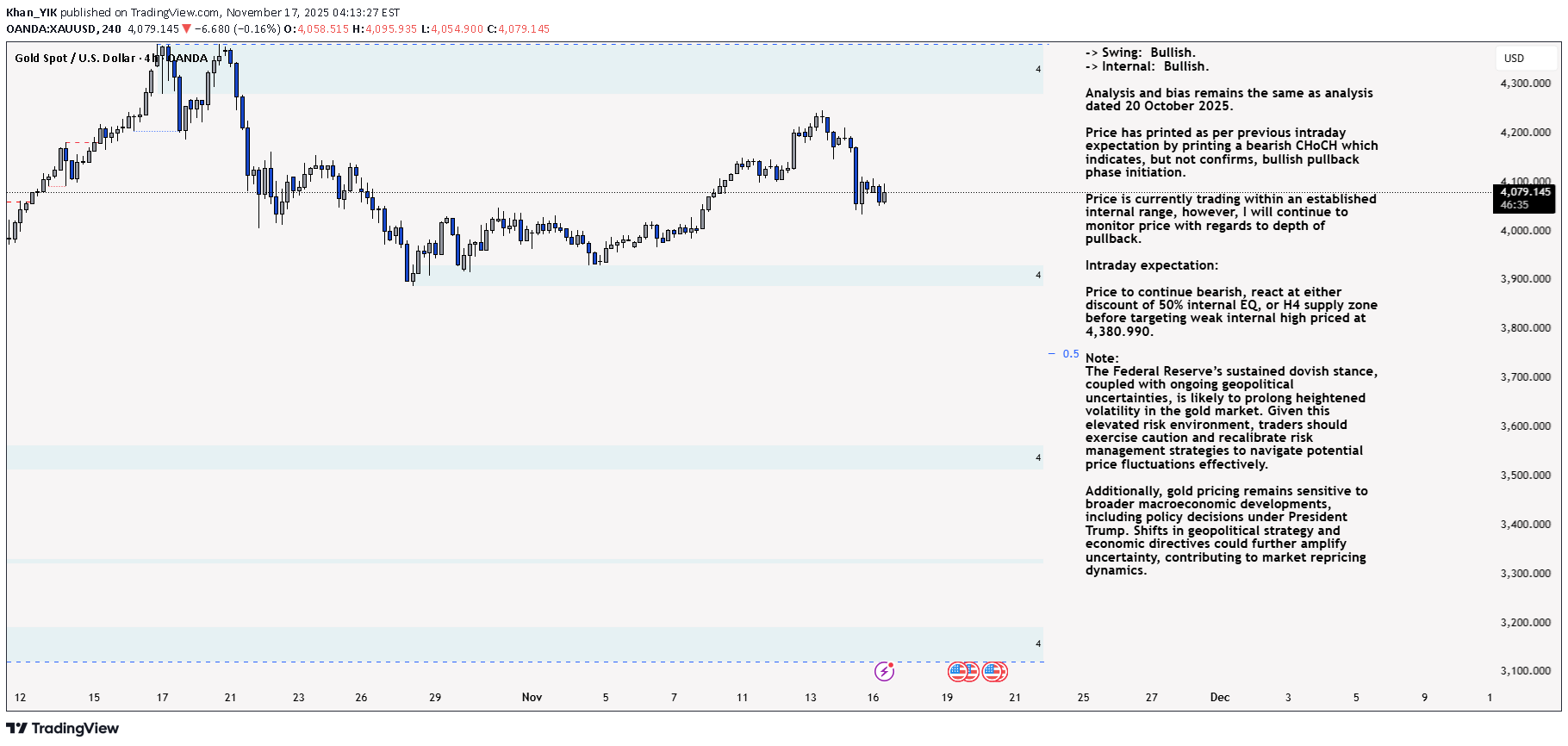

تحلیل طلا (XAU/USD) امروز: آیا سقوط قریبالوقوع است؟ (تحلیل 17 نوامبر 2025)

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. As per analysis dated 14 November 2025, price has printed a bearish CHoCH to indicate, but not confirm bearish pullback phase initiation. Price is currently trading within an established internal range. Intraday expectation: Price to trade down to either discount of 50% internal EQ, or M15 demand zone before targeting weak internal high, priced at 4,245.195 Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart:

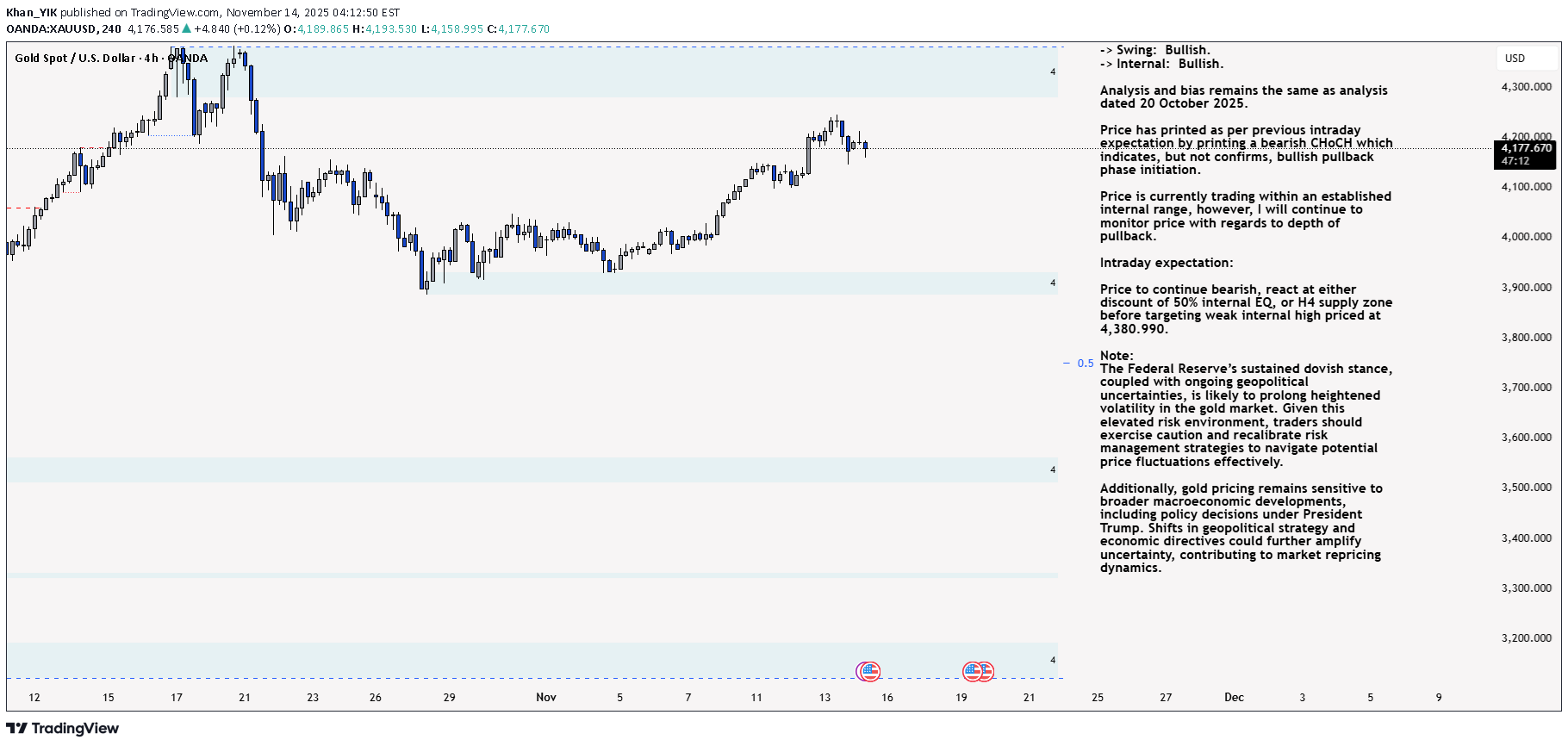

تحلیل طلا (XAU/USD) امروز: پیشبینی نوسانات شدید و حرکت قیمت تا تاریخ ۱۴ نوامبر ۲۰۲۵

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. As per yesterday's analysis, price has printed a bearish CHoCH to indicate, but not confirm bearish pullback phase initiation. Price is currently trading within an established internal range. Intraday expectation: Price to trade down to either discount of 50% internal EQ, or M15 demand zone before targeting weak internal high, priced at 4,245.195 Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart:

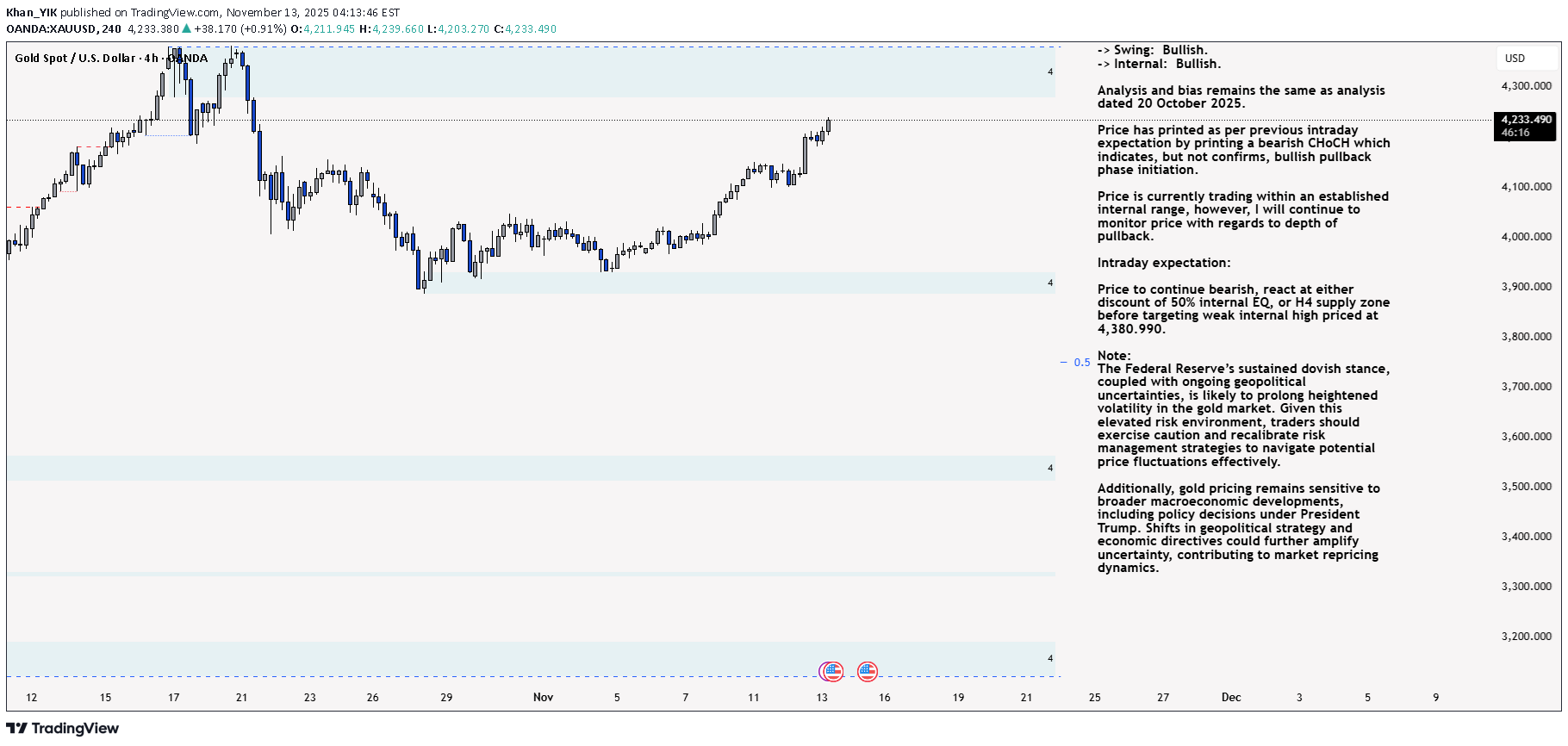

تحلیل طلا (XAU/USD) 13 نوامبر: آیا نوسانات شدید ادامه دارد؟ (پیشبینی روزانه)

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bullish. Price did not print according to my analysis. Price instead targeted strong internal high by printing a bullish iBOS. This could potentially indicate H4 bearish pullback phase is complete. Price has since printed a couple of bearish CHoCH's, however, I will not mark them as such due to very insignificant depth of pullback. Intraday expectation: Price to indicate bearish pullback phase initiation by printing a bearish CHoCH. CHoCH positioning is demoted with a blue horizontal dotted line. Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart:

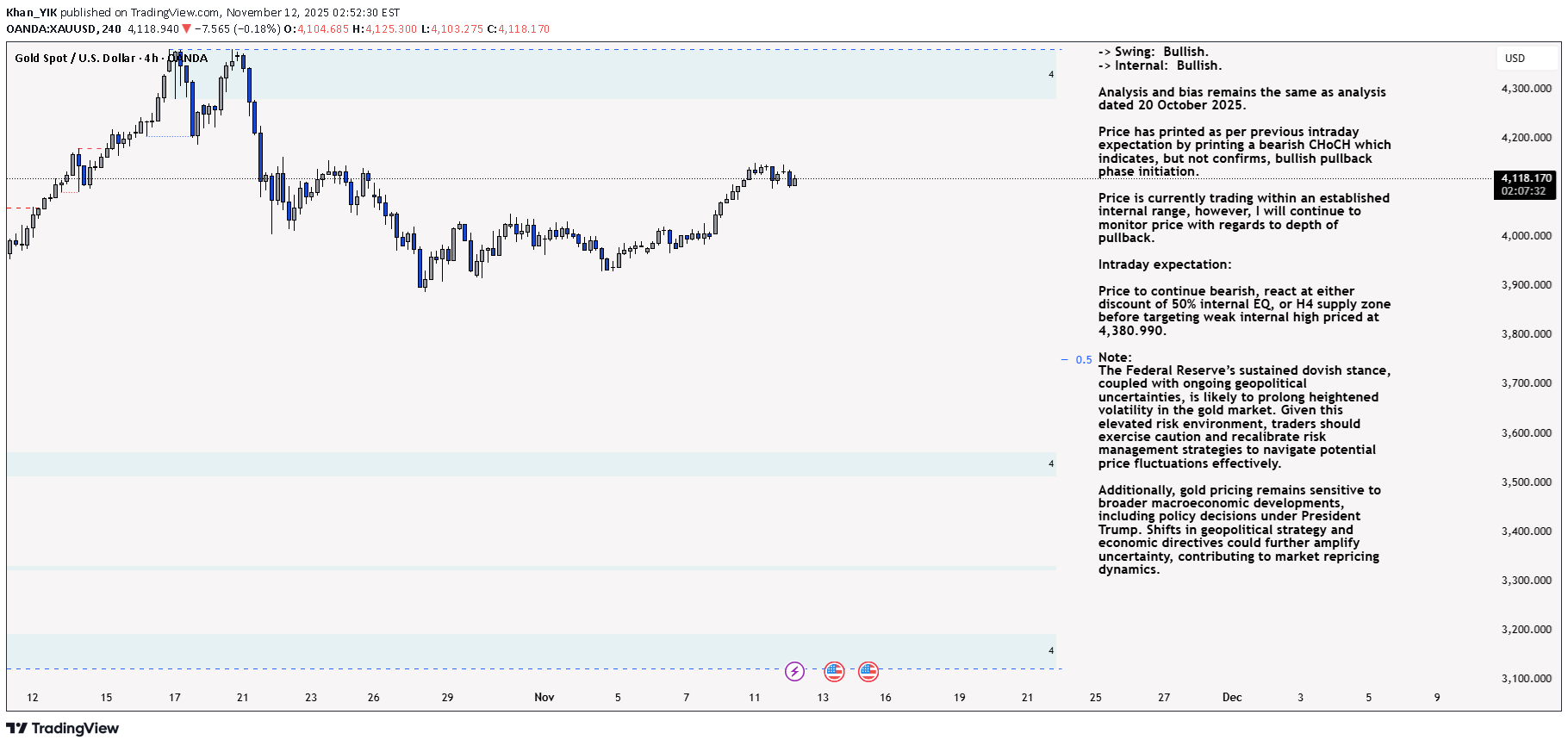

تحلیل طلا (XAU/USD) 12 اکتبر 2025: نوسانات شدید، پیشبینی حرکتهای لحظهای و هشدار ریسک فدرال رزرو

H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Analysis and bias remains the same as analysis dated 20 October 2025. Price has printed as per previous intraday expectation by printing a bearish CHoCH which indicates, but not confirms, bullish pullback phase initiation. Price is currently trading within an established internal range, however, I will continue to monitor price with regards to depth of pullback. Intraday expectation: Price to continue bearish, react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,380.990. Note: The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively. Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics. H4 Chart: M15 Analysis: -> Swing: Bullish. -> Internal: Bearish. You will note how price remains contained in consolidation between a supply and demand zone. The rest of my analysis and bias remains the same as bias date 29 October 2025. As expected, price has printed a bullish CHoCH to indicate bullish pullback phase initiation. Price is now trading within an established internal range. Intraday expectation: Price to continue bullish, react at either premium of internal 50% EQ or M15 demand zone before targeting weak internal low, priced at 3,886.465. Note: Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment. Additionally, President Trump’s tariff announcements, particularly against China, are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws. M15 Chart:

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.