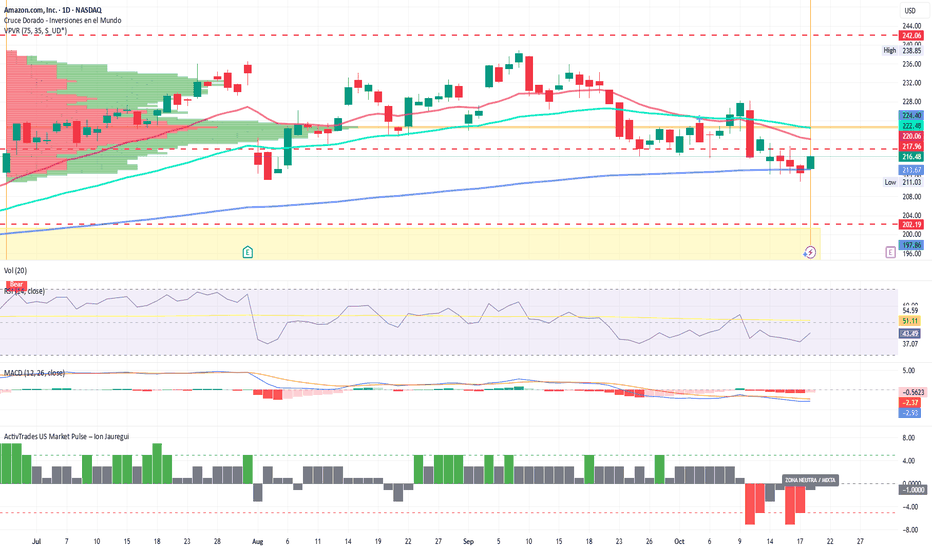

Technical analysis by ActivTrades about Symbol AMZNX: Buy recommendation (10/21/2025)

ActivTrades

قطعی جهانی آمازون (AWS): آیا وابستگی به یک غول، جهان دیجیتال را فلج کرد؟

By Ion Jauregui – Analyst at ActivTrades From the early hours of Monday, October 20, 2025, Amazon Web Services (AWS) —Amazon’s cloud computing division— suffered a global outage that disrupted thousands of companies and users worldwide. The disruption, originating in AWS’s Northern Virginia (U.S.) data centers, took down websites, applications, payment systems, and everyday platforms. The failure, described by several experts as one of the company’s most serious in recent years, triggered a chain reaction that temporarily paralyzed much of the digital economy. Among the affected platforms were Canva, Asana, Perplexity AI, McDonald’s, Roblox, and Crunchyroll, as well as numerous financial and communication services. One of the most visible effects occurred in payment systems: many card readers stopped working, preventing electronic payments, while ATMs and services such as Bizum also went offline, making it impossible to withdraw cash or send instant transfers. For several hours, many businesses were forced to accept only cash or close their points of sale. AWS acknowledged the incident through its official service status page, confirming “network operation issues in the Northern Virginia region.” Technical teams worked urgently to restore connectivity, and although services gradually returned to normal throughout the day, the event highlighted the global dependence on Amazon’s digital infrastructure. With over 30% of the global cloud services market, AWS underpins a large portion of internet operations, from streaming and gaming platforms to payment systems, banks, and public administrations. Its outage reignites the debate on technological centralization and the need for greater diversification among cloud providers. Technical Analysis – Amazon (Ticker AT: AMZN) Amazon shares (NASDAQ: AMZN) fell 2.3% following AWS’s technical issues, though they managed to recover part of the losses, closing the session around $216.48. Despite the reputational setback, the financial impact is expected to be short-lived and does not alter the company’s positive long-term trend, driven by sustained growth in its e-commerce, advertising, and web services divisions. Since Friday, October 10, the stock had corrected below the $217.96 support level after the 50-day moving average crossed below the 100-day, amplifying downside pressure. However, Monday’s move showed a technical rebound at the 200-day moving average, suggesting potential short-term support. At present, the price appears to be forming a technical floor above the $211.03 lows. The Point of Control (POC) stands at $222.08, a key level to break in order to confirm a sustained rebound. Should this threshold be surpassed, the next target lies at $232, followed by $238.35, whose breakout could lead to a new bullish impulse. Conversely, a loss of support could drive the stock to retest the $202 area, signaling a possible trend reversal. The RSI, around 43.49%, indicates slight oversold conditions, while the MACD shows signs of lateral movement, consistent with the “Risk Off” sentiment prevailing in recent sessions, as reflected by the ActivTrades US Market Pulse indicator. Clouds on the Horizon The incident leaves one clear conclusion: in an increasingly digitalized world, a cloud failure can turn into a global storm. AWS has pledged to strengthen its redundancy and security protocols, but the October 20 outage will remain a reminder that even tech giants are not immune to vulnerability. ******************************************************************************************* The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication. All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.