Technical analysis by PingTechAcademy about Symbol VET: Buy recommendation (10/21/2025)

PingTechAcademy

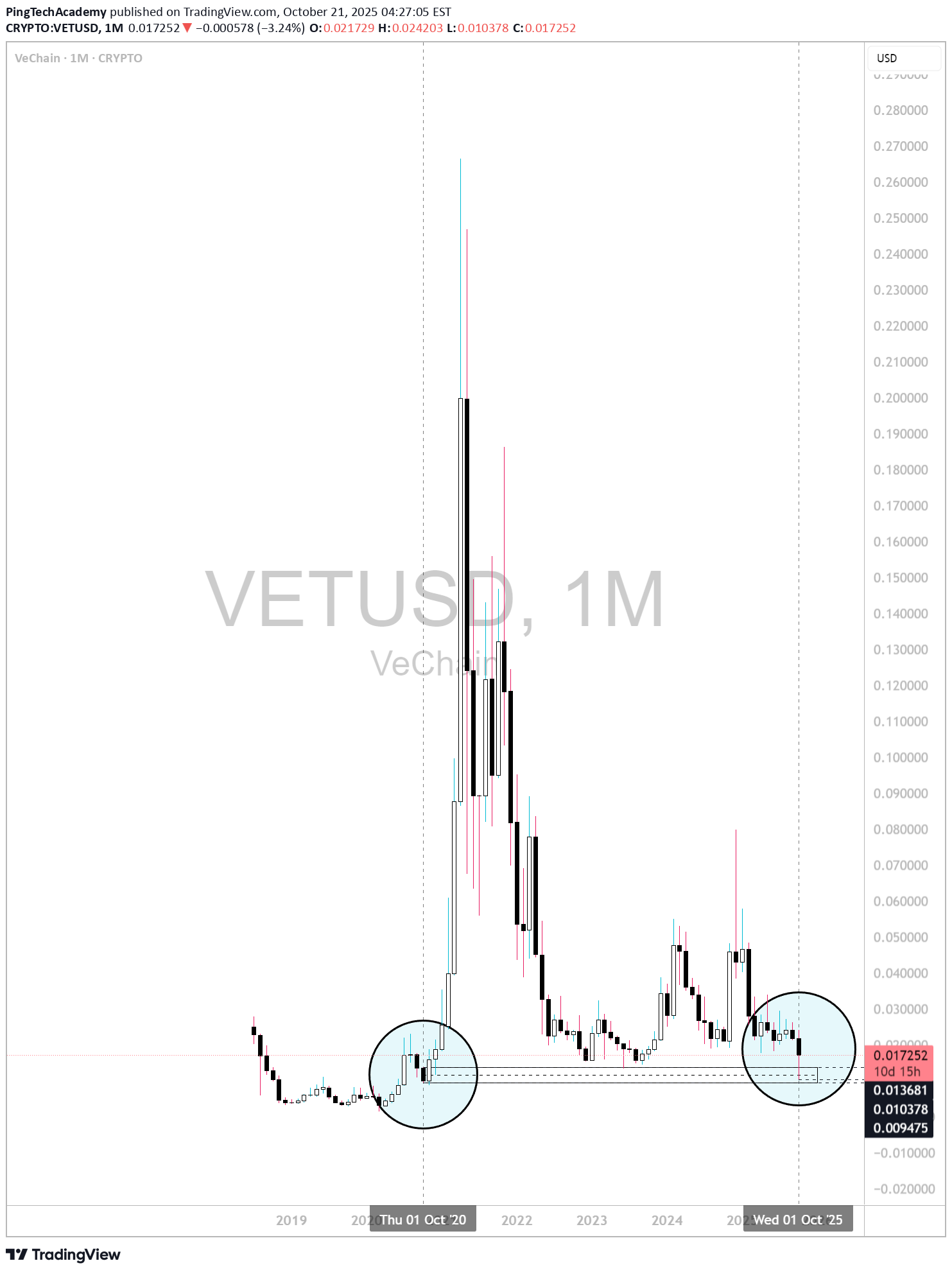

فرصت طلایی خرید VET: آیا تاریخ تکرار میشود؟ (تحلیل حمایت حیاتی 2020)

## **VeChain (VET/USD) — Macro Structural Analysis | Monthly Outlook** ### 🧭 **Market Context** As of **October 2025**, VeChain (VET) has returned to the **same macro demand zone** that formed in **October 2020**, the foundation of its previous bull cycle. The **flash crash this month** brought the price down to a historical accumulation level between **$0.009 – $0.013**, creating a structural mirror of the early 2020 setup before the 2021 rally. This move suggests that VET is now testing a **critical long-term support**, aligning with the broader market phase where altcoins typically consolidate before a new expansion cycle. --- ### 📊 **Technical Structure** * **Support Zone:** $0.009 – $0.013 * **Resistance Range:** $0.035 – $0.050 * **Macro Invalidation:** Monthly close below $0.009 The current monthly candle shows **a deep wick and strong price rejection**, signaling possible *liquidity absorption* at the lows. Maintaining this structural base above **$0.013** could confirm a **macro bottom formation**, with potential continuation toward **$0.05 – $0.07** during **Q2–Q3 2026**, particularly if **Bitcoin dominance** begins to decline as projected. --- ### 🪙 **Fundamental Overview** VeChain remains one of the leading **enterprise-focused Layer-1 blockchains**, providing real-world solutions in **supply chain management, logistics, and carbon tracking**. * **Market Cap:** ≈ $1.25B * **Circulating Supply:** ≈ 72.5B VET * **On-Chain Metrics:** Stabilizing activity and rising VTHO consumption indicate renewed network usage. This fundamental resilience supports the idea that VeChain could be entering a **re-accumulation phase**, mirroring the 2020–2021 structural rhythm. --- ### 🔭 **Outlook** If this historical symmetry continues, VeChain could remain within a **sideways accumulation structure** until **April 2026**, before initiating a new bullish expansion phase. A confirmed break above **$0.035** would likely mark the first signal of structural recovery across the altcoin sector. --- ### ⚠️ **Disclaimer** This analysis is for **educational and informational purposes only** and does **not constitute financial advice**. All opinions represent my **personal market perspective** and may change without notice. Trading cryptocurrencies involves **significant risk**, and investors should perform their own research or consult a licensed financial advisor before making decisions.