Technical analysis by CrowdWisdomTrading about Symbol AAPLX: Buy recommendation (10/20/2025)

CrowdWisdomTrading

سهام اپل آماده شکستن مقاومت ۲۶۰ دلاری پس از نتایج قوی فصلی!

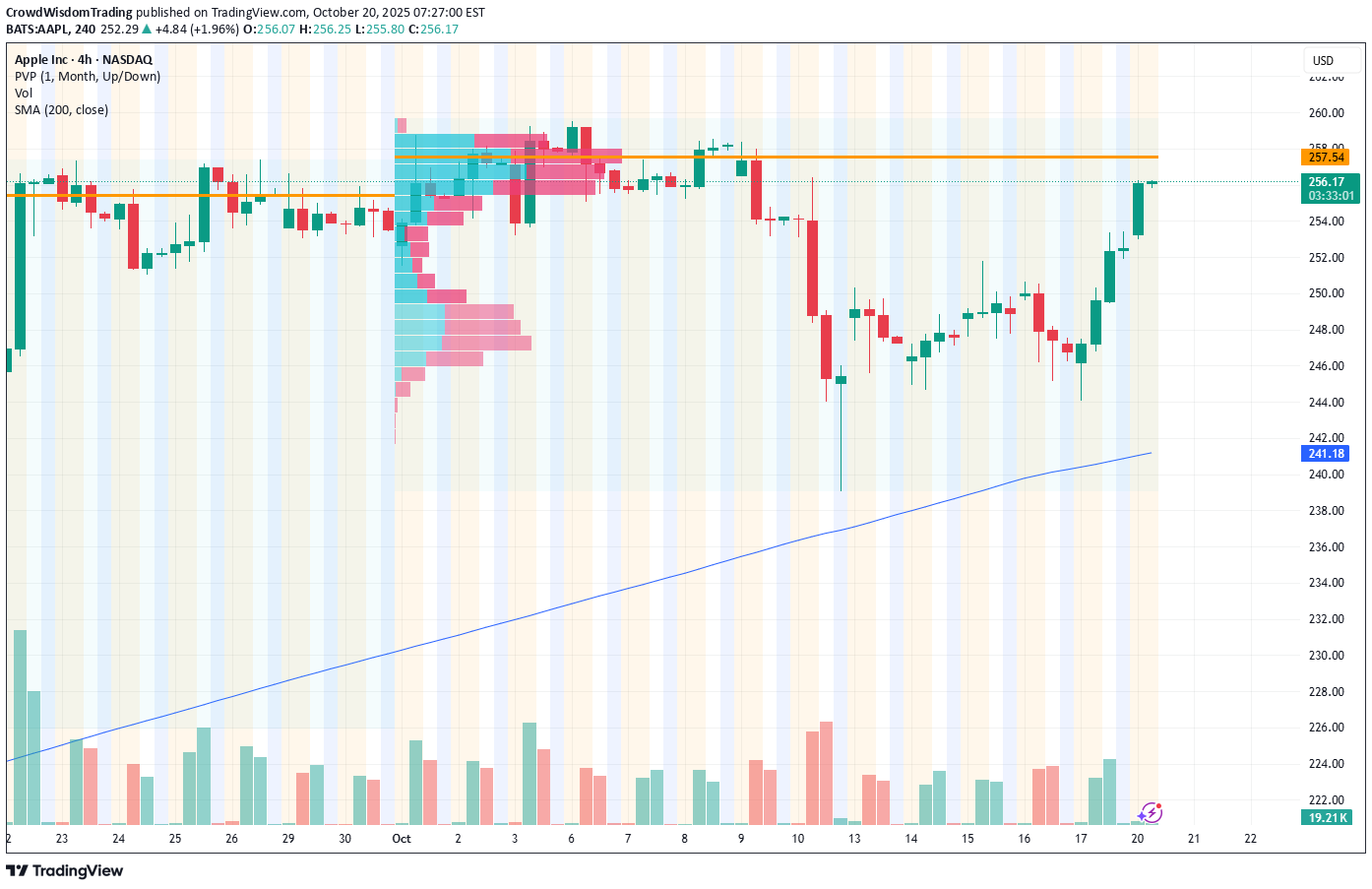

Current Price: $252.29 Direction: LONG Targets: - T1 = $255.50 - T2 = $260.00 Stop Levels: - S1 = $248.00 - S2 = $245.50 **Wisdom of Professional Traders:** This analysis synthesizes insights from thousands of professional traders and market experts, leveraging the principle of crowd wisdom to analyze Apple. The stock recently gained attention due to strong quarterly results and solid guidance into 2025, highlighting its ability to outperform competitors even in a softer macroeconomic environment. Many market participants view Apple’s consistent demand for its flagship products, robust performance in services, and entry into new categories like augmented reality as critical factors driving growth potential. The collective sentiment around Apple suggests stable growth with high upside potential in the near term. **Key Insights:** Apple has continued to showcase resilience despite global macroeconomic uncertainties, primarily driven by stable iPhone demand and impressive growth in its services segment, including subscriptions and cloud services. In its most recent earnings report for Q3 2025, the company posted higher-than-expected revenue, driven by increased adoption in emerging markets such as India, which provides a multi-year growth runway. Another key driver for Apple has been the successful rollout of its mixed-reality headset, Vision Pro, alongside new AI-powered features in its devices and platforms. Analysts highlight that Vision Pro sales could open up incremental high-margin revenue streams as Apple taps into tech enthusiasts and enterprise markets. Meanwhile, cost-management strategies have been effective, driving operational efficiencies and maintaining robust margins in a challenging environment, enabling Apple to guide confidently into the coming quarter. **Recent Performance:** Apple’s stock has demonstrated strong performance, recording a rebound above $250 following its Q3 2025 earnings announcement. The stock gained momentum, driven by market optimism about the upcoming holiday season, which often proves lucrative for Apple’s product lineup. Despite broader market concerns about rising interest rates, Apple’s ability to generate consistent cash flows amid market volatility has fortified investor sentiment. Year-to-date, Apple’s shares are up approximately 21.2%, outperforming the S&P 500. **Expert Analysis:** Technical indicators support a bullish outlook for Apple. The stock has broken above its 50-day moving average and formed a bullish ascending triangle pattern, signaling possible continuation toward higher levels. Furthermore, its Relative Strength Index (RSI) remains below overbought territory, providing ample room for additional price appreciation. Many experts note the stock’s historical seasonality tied to strong holiday sales performance, which aligns with the solid product lineup Apple brings into late 2025, including updated iPhone models and Vision Pro unit expansions globally. A consensus of expert opinions indicates Apple is attracting investment due to its unparalleled brand loyalty and ability to innovate consistently, which positions the company well for sustained performance heading into 2026. Hedge funds and institutional players are reportedly accumulating positions in anticipation of further growth. **News Impact:** Recent news surrounding Apple's Vision Pro headset production ramp-up has sparked upbeat sentiment, suggesting management confidence in demand growth for the product. Additionally, emerging partnerships for its AI-driven technologies add significant value, further diversifying revenue streams in the services ecosystem. Stronger-than-expected Q3 earnings and forward guidance have countered concerns around weaker consumer spending. Combined, these developments reinforce the bullish thesis on Apple’s near-term performance. **Trading Recommendation:** Given the current technical setup and favorable fundamental drivers, a LONG position on Apple is recommended. The stock’s ability to exceed its recent quarterly forecast and strong demand outlook ahead of the holiday season point to bullish price action. With key resistance at $255.50 and $260 acting as critical targets, traders should monitor for sustained upward momentum. Stops are advisable below $248 and $245.50 to manage downside risks. Considering Apple’s market dominance, stable growth prospects, and innovative product developments, it presents a compelling opportunity for traders seeking upside exposure through Q4 2025. Do you want to save hours every week? Register for the free weekly update in your language!