Technical analysis by CrowdWisdomTrading about Symbol TSLAX: Buy recommendation (10/20/2025)

CrowdWisdomTrading

سهام تسلا در مسیر ۵۰۰ دلار: چرا اوجگیری فروش خودروهای برقی ادامه دارد؟

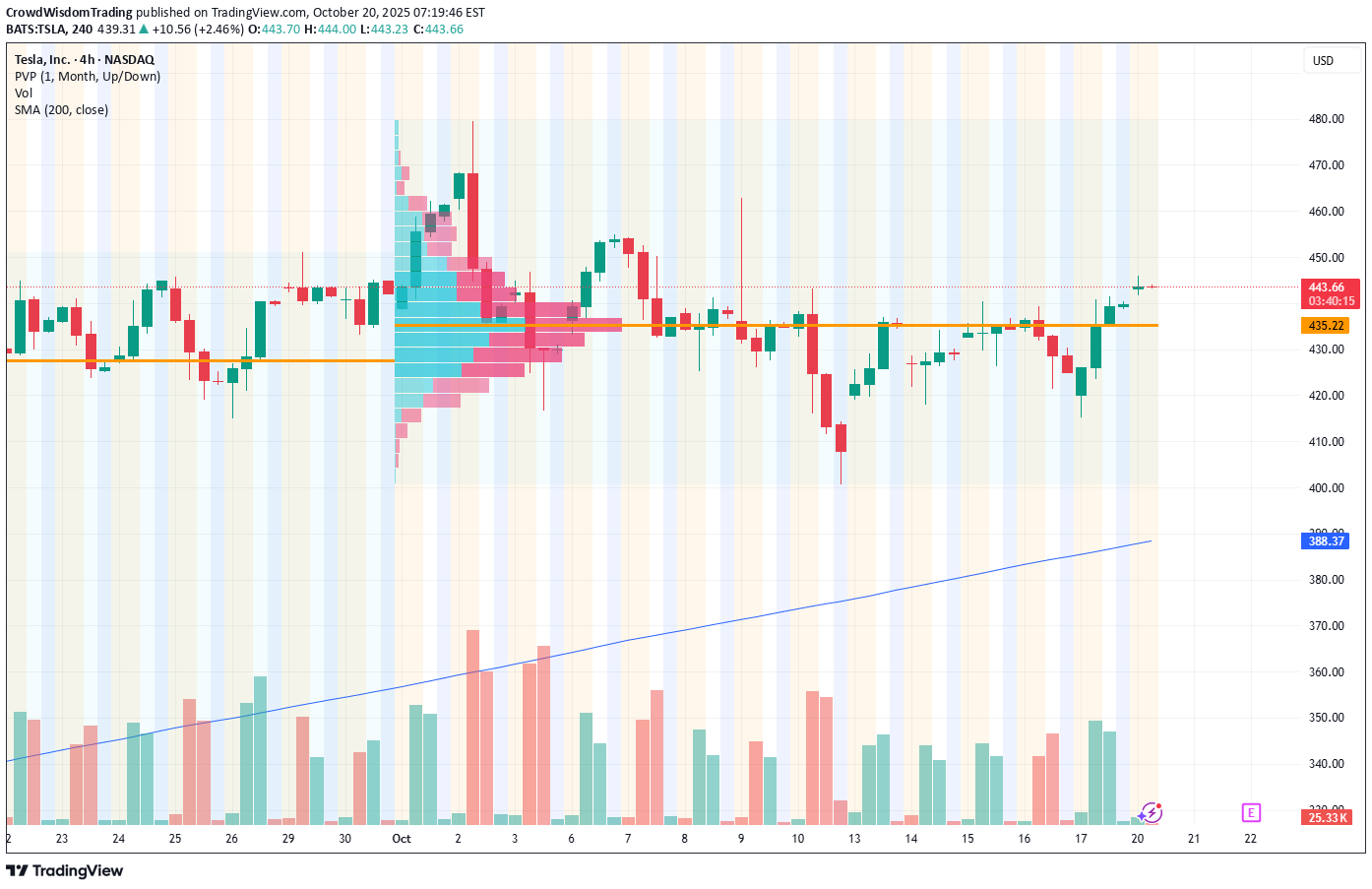

Current Price: $439.31 Direction: LONG Targets: - T1 = $465.00 - T2 = $500.00 Stop Levels: - S1 = $425.00 - S2 = $410.00 **Wisdom of Professional Traders:** This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. Tesla’s stock continues to draw significant interest as traders align around the increasing demand for its electric vehicles and growing revenues from complementary businesses such as energy storage solutions, vehicle software offerings, and charging networks. Professional sentiment suggests that Tesla’s leadership in autonomous driving and robust infrastructure investments may drive further upside. **Key Insights:** Tesla’s strong positioning in the EV market has seen ongoing demand even in 2025 despite the tightening macroeconomic environment. Analyzing recent trading patterns, Tesla’s robust revenue growth across Q3 showcases resilience, supported by increased adoption of advanced batteries like the new-generation 4680 cells. The CEO’s remarks about scaling manufacturing facilities globally—especially the Gigafactory expansion in Mexico—carry forward the vision of doubling production capacity, stimulating long-term growth prospects. Tesla’s diversified revenue streams, including solar and energy storage products, provide an additional financial buffer as they tap into global sustainability trends. The recent rally in the stock price further underscores positive investor sentiment, with large institutional inflows reflecting faith in Tesla’s brand and technological advantage. Additionally, the sustained consumer demand for higher-margin vehicles such as the Model X and S continues to buoy the stock’s fundamentals. **Recent Performance:** Tesla’s stock surged by approximately 6% over the past two weeks, recovering from previous volatility tied to concerns over EV pricing pressure. As of October 2025, Tesla’s improved gross margins—highlighted in the Q3 earnings call—provide relief and optimism, with the stock stabilizing above $430. High trading volume has reaffirmed consolidation zones, indicating strong levels of support near $420 while opening room for upside potential heading into the next fiscal quarter. **Expert Analysis:** Market analysts are bullish on Tesla following its strong Q3 beat on earnings-per-share estimates, confirming its profitability is intact despite pricing challenges and increased competition. Tesla’s use of AI in its Full Self-Driving (FSD) beta saw meaningful adoption rates recently, further increasing its moat against rival automakers. Additionally, Tesla’s financial prudence ensures that it remains one of the few tech-centric automakers able to consistently operate without dilutive equity raises. Technicals reveal Tesla has formed a solid base above its 200-day moving average with an RSI currently neutral but trending bullish—signaling momentum for a further breakout. Resistance zones at $450 have been tested and surpassed, with the next confluence zone near $465 aligning estimates for an extended move higher. **News Impact:** Tesla’s announcement of upcoming fleet expansion and partnerships with global logistics firms significantly reinforce its scaling potential while easing investor worries about profitability. Furthermore, Tesla's transparency in discussing supply chain improvements during the Q3 earnings call lends credibility to its operational growth outlook. These factors, paired with advancements in autonomous driving technology, could bolster Tesla’s revenue potential in 2025 and further validate its premium valuation. **Trading Recommendation:** Based on technical analysis, recent financial performance, and strong fundamentals, Tesla presents a compelling LONG opportunity with targets set at $465 and $500, supported by growing market dominance and consistent operational excellence. Investors should watch for confirmation of support levels at $425 to manage risk effectively. With institutional confidence high, traders are well-positioned to benefit from Tesla’s growth trajectory as the company continues its strong performance in the EV market and sustainable energy sectors. Do you want to save hours every week? Register for the free weekly update in your language!