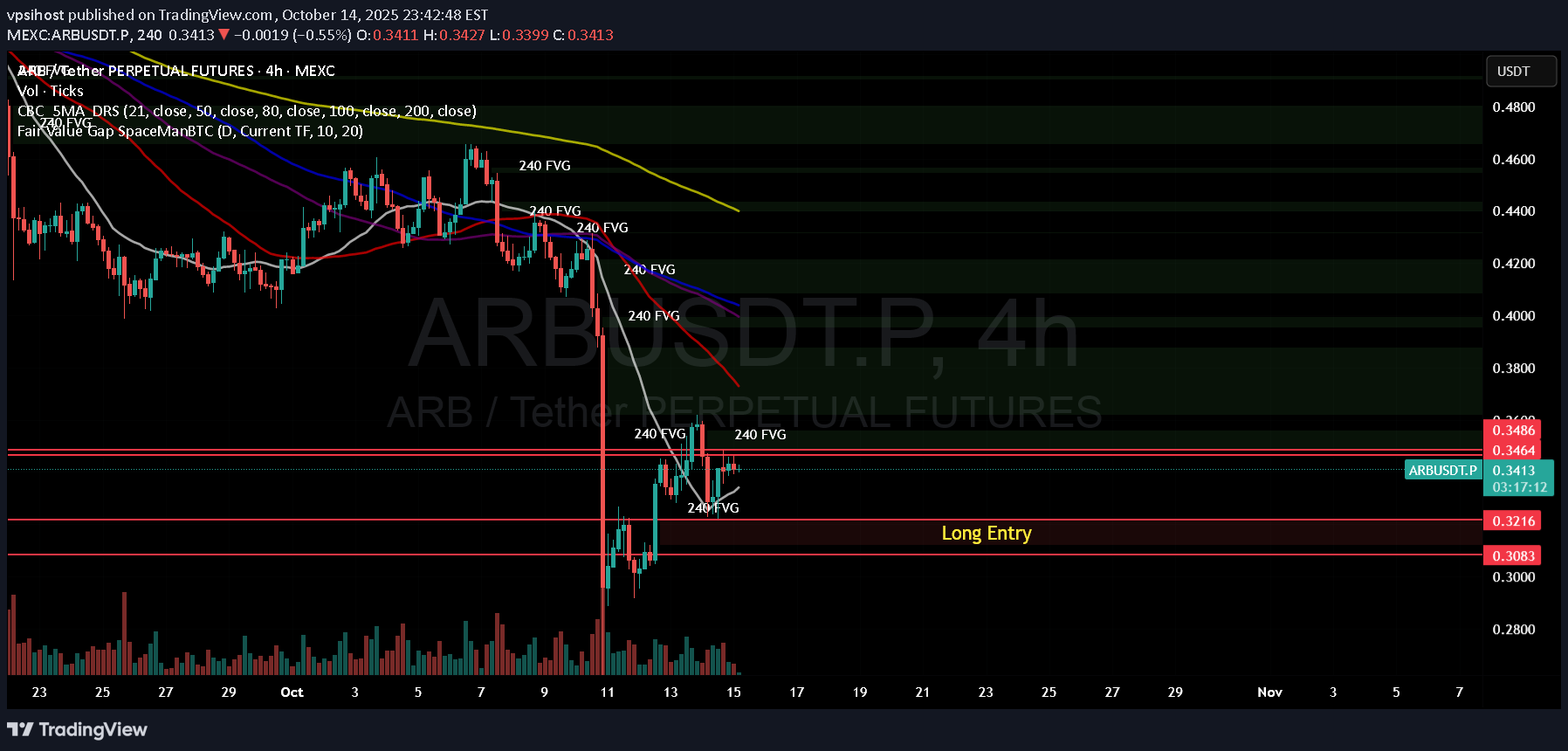

Technical analysis by vpsihost about Symbol ARB: Buy recommendation (10/15/2025)

vpsihost

تحلیل چند زمانیتی ARB: نشانههای انفجار بزرگ قیمت با همترازی نقدینگی!

ARB is showing a rare alignment across all timeframes: 🔹 5m – 15m: Short-term structure consolidating right below a 0.348 liquidity shelf, with multiple small FVGs suggesting a coiled breakout zone. 🔹 30m – 1h: Mid-range compression between 0.334 – 0.348; price continues to defend the 200 EMA and is building higher-low structure. 🔹 1W (Weekly): A clean bullish FVG has formed—if price fills and reclaims this zone, it could unlock nearly 100 % upside potential from current levels. 🔹 1M (Monthly): Macro support sits around 0.32 – 0.34, marking the accumulation floor since early 2024. Together, these setups hint that ARB may be preparing for a strong rotation phase once market liquidity returns. 📈 Key Levels: Support → 0.334 / 0.321 Resistance → 0.348 / 0.36 Macro Target (Weekly FVG Top) → ≈ 0.60 region 💡 Observation: Watch how USDT Dominance behaves around 4.82 %. A rejection there could trigger ARB’s next leg up.