Technical analysis by PingTechAcademy about Symbol PAXG: Sell recommendation (10/14/2025)

PingTechAcademy

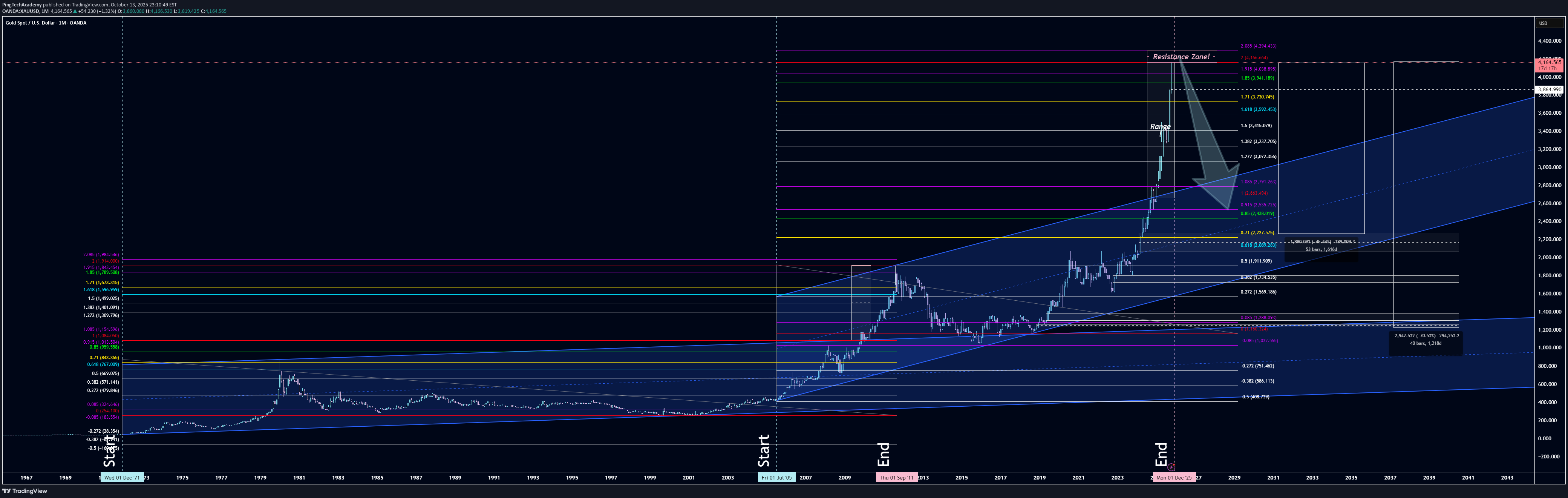

پایان 50 ساله طلا: آیا قیمت طلای جهانی به سقف تاریخی رسید؟

🟡 Gold Macro Structure — The End of a 50-Year Bullish Epoch Symbol: XAU/USD (OANDA Data) Timeframe: 1M (Monthly Candles) Published by: Ping Tech Academy 🕰️ The Story of Gold — Between Faith, Fear, and Cycles Gold has never been just a commodity — it is the mirror of human belief in value. When trust in fiat weakens, gold rises; when confidence returns, it retreats. Since the dollar was detached from gold in December 1971, every cycle has reflected the rhythm of fear and faith across the global economy. Now, after more than half a century of expansion, gold stands at what appears to be the final chapter of its generational bull cycle. 🔹 Historical Context (1971–2009) From December 1st, 1971, gold traded within a long-term ascending channel, with its lower boundary near $43.50 and its upper boundary reaching around $1,195.40. That upper structure was broken and retested on November 2nd, 2009, marking the beginning of a new macro bullish channel that defined the modern era of gold movement. 🔹 The Second Channel (2005–2024) The base of the current macro structure was established on July 1st, 2005, at $417.90, while its top expanded to around $2,663.50, reached on September 2nd, 2024. This high was broken and retested — a textbook continuation signal — leading gold to its recent peak near $4,165 (October 2025). ⚠️ Critical Resistance Zone — Structural Completion Based on price symmetry and long-term channel geometry, gold has reached its final structural target of the 50-year ascending cycle: 📍 $4,166.66 (OANDA XAU/USD) Allowing for a technical deviation, the potential reversal range stands between: 📉 $4,166.66 – $4,294.43 This area represents a major exhaustion zone, likely to act as the macro top of the cycle before a multi-year correction begins. 🧭 Long-Term Downside Targets (Macro Correction Path) If the market confirms rejection within the 4.16–4.29k range, the following structural targets may unfold sequentially: $3,940 $3,730 $3,415 $3,072 $2,791 → Key Level $2,535 → Critical Foundation Zone 🔹 This region is viewed as the potential final structural base for gold — a level where a new long-term accumulation phase could begin. However, breaking below $2,535 would indicate the start of a deep macro revaluation, potentially driving gold to unexpectedly low levels, but such a move would likely require a period of global economic stability and geopolitical peace — a rare alignment that historically marks the end of systemic fear cycles. $2,438 $2,227 $2,089 → Final macro target if bearish continuation persists 🧠 Market Psychology & Cyclic Behavior Each gold supercycle follows a familiar psychological rhythm: Accumulation (Smart Money Phase): Institutions accumulate quietly when sentiment is exhausted and prices are undervalued. Expansion (Public Awareness): Momentum builds; narratives like inflation, rate cuts, or war become surface-level catalysts. Euphoria (Public Participation): Retail investors flood in at new highs, while institutions distribute positions into strength. Distribution → Correction: Price weakens, volatility expands, optimism fades — the new cycle begins where fear returns. Gold currently displays late-euphoria characteristics, suggesting the distribution phase of the macro cycle is well underway. 🧩 Conclusion Gold appears to be completing a 50-year structural expansion that began in 1971 — a cycle that reshaped global perceptions of value. While minor overshoots beyond $4,294 remain possible, the risk-to-reward profile now favors defensive or profit-taking strategies. A multi-year corrective phase is expected before a new generational accumulation begins. ⚖️ Disclaimer This analysis is provided for educational and informational purposes only and does not constitute financial or investment advice. All price levels and projections are based on historical modeling and macro-technical analysis. Financial markets involve risk — past performance does not guarantee future results. Always conduct independent analysis or consult a licensed professional before making investment decisions. 📘 Ping Tech Academy “Trade Smart. Trade Fearless.” © 2025 – All Rights Reserved.