Technical analysis by GoldFxMinds about Symbol PAXG on 10/11/2025

GoldFxMinds

طلا در سکوت؛ فشار ساختاری قبل از انفجار بزرگ (تحلیل H4)

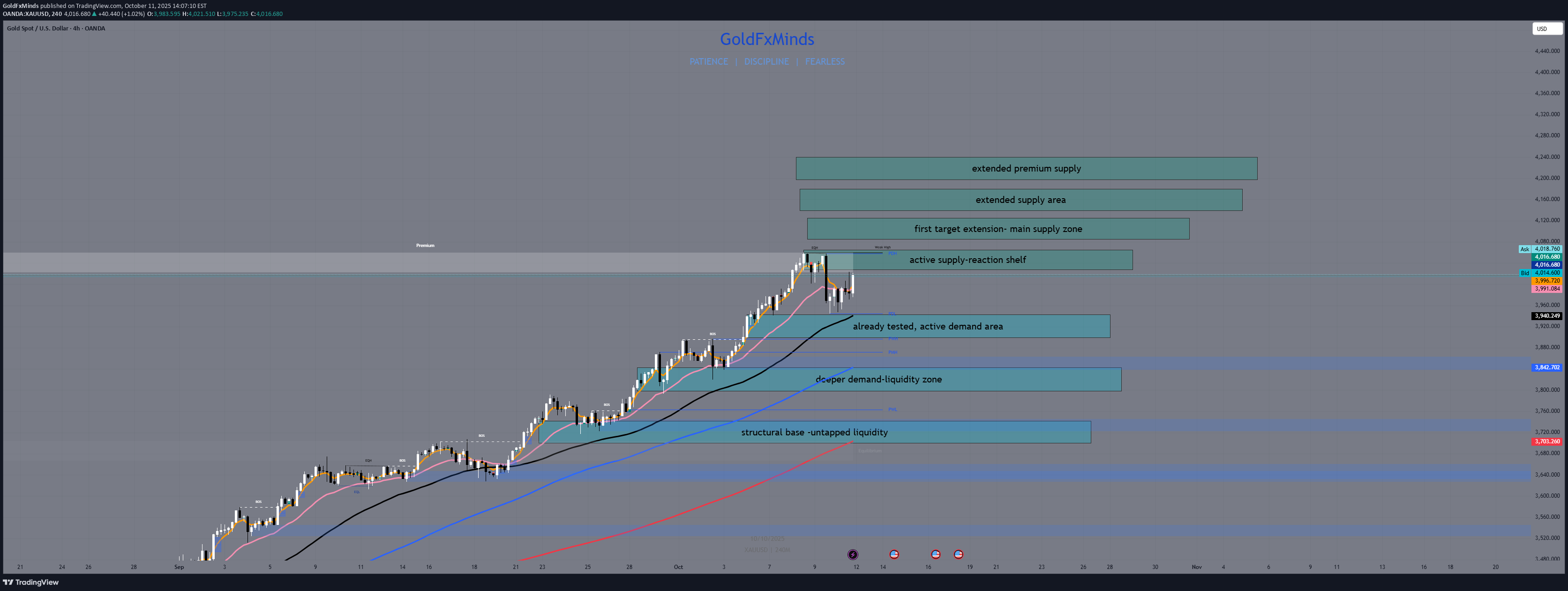

Gold ended its impulsive sprint near 4,100 and now moves in silence. Price is trapped between thick institutional layers — controlled selling above, strategic accumulation below. Every move feels heavy, deliberate, engineered. This is not weakness — it’s calm before displacement. The market is building pressure; volatility is sleeping under structure. 🌍 Macro Pulse The coming week (13–17 Oct) brings another round of Fed voices — Powell, Waller, Bowman, Barr, Schmid — plus Core PPI, Retail Sales, and Jobless Claims. Tone, not numbers, will drive volatility. Gold’s structure is perfectly positioned for reactive plays: premium zones above to fade, discount zones below to reload. 🧭 H4 Structural Flow Macro trend remains bullish, but local flow is rotational, correcting the last vertical impulse. EMAs converge, volume contracts — classic structural pause before the next controlled move. No break of macro flow yet — just equilibrium restoration. 🗺️ H4 Structural Map Upper Liquidity Sweep (4,200 – 4,240) Untested liquidity cluster above the previous high. A sweep here would complete the weekly liquidity grab before correction resumes. Extended Premium Zone (4,140 – 4,180) Residual imbalance from the late-week extension. Expect liquidity hunts and wick traps before structural rejection. Main Distribution Zone (4,085 – 4,125) The strongest supply layer on H4. Institutional distribution confirmed; this remains the real ceiling for the week. Re-test Ceiling (4,025 – 4,065) Post-impulse reaction block. If reclaimed cleanly, buyers could reattempt pressure into the higher supply zones. Primary Reaccumulation Zone (3,940 – 3,900) First structural base of support. Strong confluence of prior BOS reaction — where buyers defend structure integrity. Discount Reaccumulation Zone (3,840 – 3,800) Secondary layer of demand, shaped by consolidation and imbalance mitigation. If reached, expect tactical reloads and long wicks before reversal. Deep Structural Base (3,740 – 3,700) The foundation of the H4 macro leg. Untapped liquidity + unmitigated orders; a full reaccumulation area if the week turns defensive. 🎯 Tactical Scenarios If gold holds above 3,900, bullish rotations remain favored: → 4,025–4,065 → 4,085–4,125 → 4,140–4,180 → 4,200–4,240 If price rejects the 4,085–4,125 zone and loses 3,900, → correction extends toward 3,840–3,800 → possibly 3,740–3,700. Each move this week will be reactive — liquidity first, direction second. 🧠 Bias Macro: bullish H4: neutral–rotational Market Character: controlled compression before expansion ✨ Gold isn’t done — it’s just coiling for precision. Follow, like and comment GoldFxMinds | Precision. Structure. Flow.