Technical analysis by GoldFxMinds about Symbol PAXG on 10/11/2025

GoldFxMinds

سقف طلای 10 هفتهای: آیا قیمت به کجا میرسد؟ (پیشبینی هفته آینده)

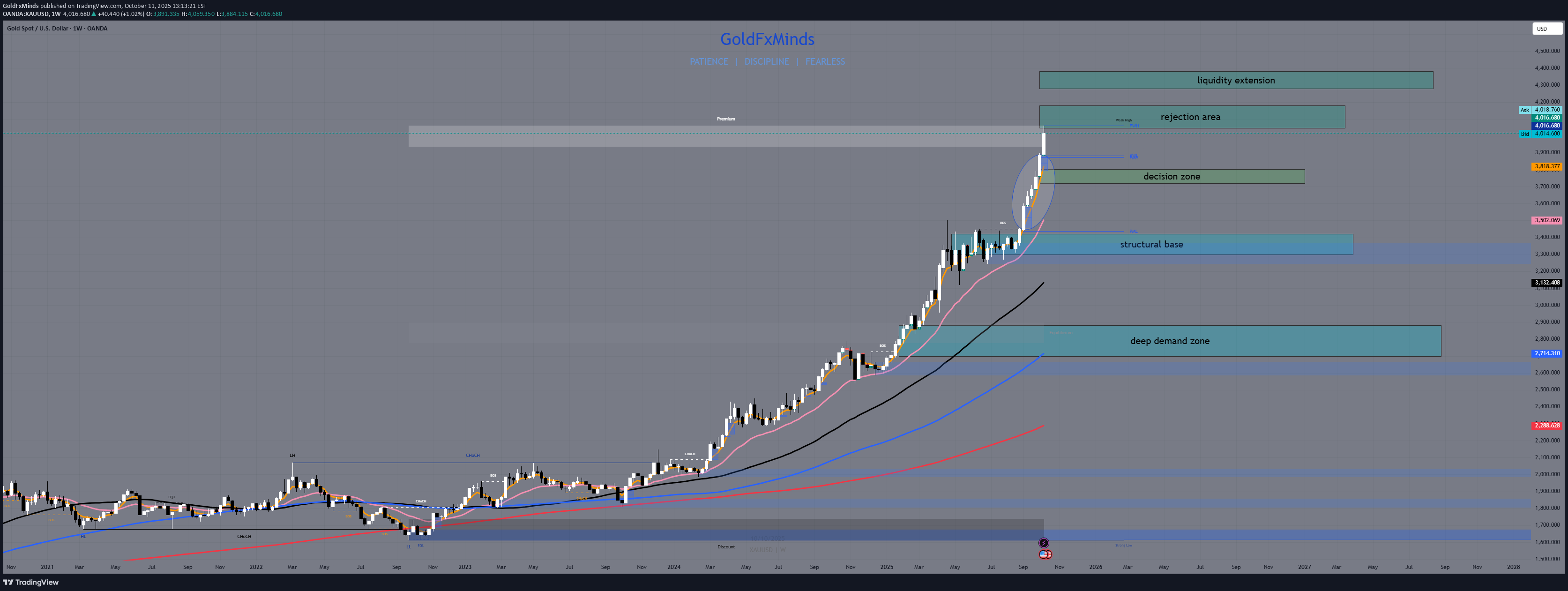

For ten straight weeks, gold has climbed without looking back. But every rally meets gravity — and this one now stands at the top of its own empire. The market breathes in thin air above 4,000, where profit-taking becomes a language, not a choice. Macro Context The week of October 13–17 brings a storm of FOMC voices: Powell, Waller, Bowman, Barr, Schmid — all speaking into the same fragile market. Add Retail Sales, Core PPI, and Jobless Claims, and volatility becomes inevitable. Gold won’t move on data alone — it will react to tone, sentiment, and timing. Weekly Structural Bias The macro trend remains bullish, but momentum is stretched. Candles are extended far above equilibrium (21–50 EMA zone), while RSI prints soft divergence — the classic signature of an overextended leg. This week likely marks a phase of distribution inside a bullish macro trend, not the start of reversal. Institutional Structural Map Major Supply Zone – Premium Distribution Range 4,050 – 4,180 Derived from the 2025 expansion leg, this is where institutional selling historically begins. Imbalance is nearly filled — profit-taking zone before any new leg forms. A weekly close above 4,180 would confirm continuation into uncharted macro territory. Secondary Supply Zone – Upper Liquidity Extension 4,280 – 4,380 Untapped liquidity resting above current highs. If the Fed’s tone turns unexpectedly soft, this area could be swept before retracement. Decision Zone – Weekly Equilibrium Band 3,720 – 3,800 The structural midpoint of the last impulse — equilibrium between buyers and sellers. A revisit here defines whether the trend holds or a correction unfolds. Primary Demand Zone – Structural Reaccumulation Base 3,420 – 3,300 The institutional base from which the last expansion began. If price returns here, it will likely form the foundation for the next bullish cycle. Secondary Demand Zone – Macro Discount Range 2,880 – 2,700 The untouched 2024 accumulation layer — deep macro liquidity pool. Ultimate structural support if USD strength dominates. Bullish Scenario If gold holds 3,800 and macro tone softens, buyers may attempt another controlled push into 4,100–4,180. Only a weekly close above 4,180 confirms further expansion toward 4,280. Bearish Scenario Failure to hold 3,800 and a weekly break below 3,720 would confirm short-term exhaustion and rotation toward 3,420. Stronger USD + hawkish Fed = deeper move toward the 3,300 base or even 2,880 macro floor. Conclusion Gold remains in a bullish macro structure — but now trades inside the ceiling of its own creation. Momentum fades, volatility returns, and control will be decided within the 4,050–3,720 corridor. Above that lies liquidity; below, the next reaccumulation phase. Bias: bullish macro, corrective momentum phase. Key zones: 4,050–4,180 — premium supply 3,720–3,800 — equilibrium 3,420–3,300 — institutional demand The map is drawn — now the market decides. Comment , like & follow GoldFxMinds to stay one move ahead.