Technical analysis by ThinkMarkets about Symbol PAXG on 10/6/2025

ThinkMarkets

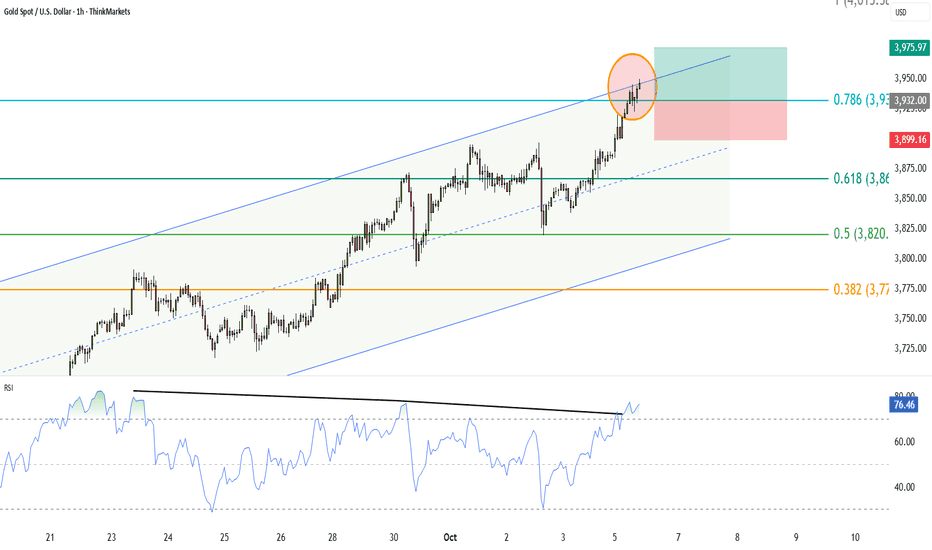

طلا به آستانه ۴۰۰۰ دلار رسید: تحلیل فنی و سطوح حیاتی پس از صورت جلسه فدرال رزرو

Gold smashed through to new all-time highs as fundamental catalysts aligned with a technical breakout. Let's break down the historic rally and critical levels ahead. 🚀 Historic Rally Drivers Government Shutdown Impact : Week 2 of US shutdown delays jobs data, Fed flies blind into Oct 29 meeting Fed Rate Cut Certainty : 95% odds October cut, 85% December follow-up as dollar weakness accelerates Safe Haven Surge : Goldman warns $5,000 possible if Treasury flows shift to gold amid Fed independence threats Technical Breakout: 48% YTD gain (strongest since 1979), ascending channel violation confirms new cycle but rejection could trigger short-term pullback 📊 Technical Analysis Current Price : $3,950 (new ATH), RSI 70 - overbought but momentum intact Channel Proximity : Clean breakout above long-term ascending channel signals price discovery mode Fibonacci Targets : $3,930 (78.6% extension) immediate, $4,000-$4,015 (100% extension) cycle targets confirmed 🎯 Critical Trading Levels Resistance Zones : $3,950-$3,975, $4,000-$4,015 (psychological/Fibo) Support Structure : $3,895 (double top support), $3,865 (Fibo extension), $3,800 (major psychological) 📅 Key Events This Week Wednesday: FOMC minutes (dovish bias expected) Thursday: Powell speech (rate cut guidance) Ongoing: Shutdown impact on economic data flow 💹 Trading Scenarios Bullish Continuation : Above $3,930, target $3,975 then $4,000+ Profit-Taking Risk : Watch for rejection at $3,950, support test at $3,895 Medium-term Breakout : Buy pullbacks to $3,850-$3,875, stops below $3,800 Gold enters a parabolic phase driven by monetary policy uncertainty and geopolitical risk. $4,000 becoming probability rather than possibility. October is historically the strongest month for precious metals, so trend acceleration is likely. This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.