Technical analysis by GoldFxMinds about Symbol PAXG on 10/4/2025

GoldFxMinds

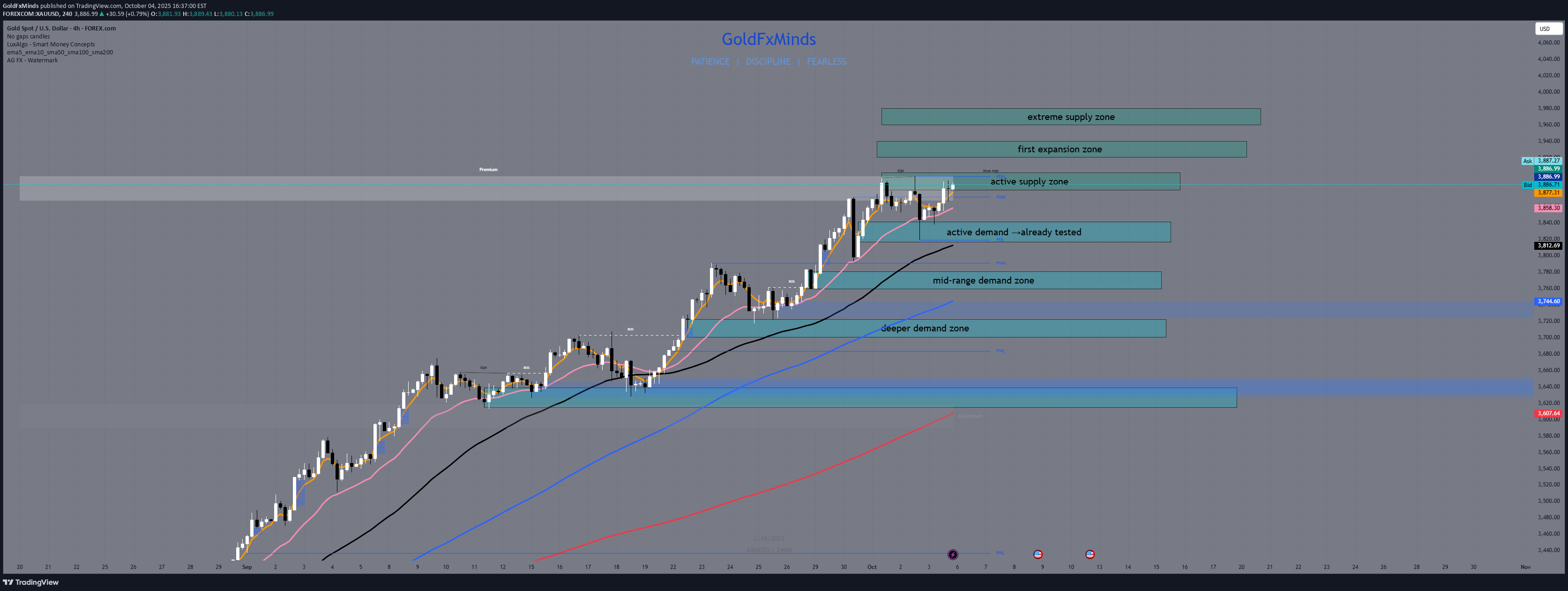

طلا در آستانه انفجار: فشردهسازی کنونی قبل از صعود یا سقوط بزرگ (تحلیل 4 ساعته)

Gold holds its ground under a tightening ceiling — momentum steady, but pressure visible. This is the H4 tactical outlook for the next 1–3 sessions, focused purely on structure and flow. Macro & News Context The week brings a dense lineup of FOMC speeches, Powell, and NFP. The market stands still ahead of key data — liquidity building, volatility loading. Gold trades inside premium territory, waiting for a trigger that will define direction. Bias — Bullish but congested Structure remains bullish with consistent higher highs and higher lows. However, the recent sequence of equal highs and short-bodied candles under 3,900 signals exhaustion. Bulls are still in control, but the market is in a compression phase before expansion. 🟥 H4 Supply Zones 3,880 – 3,900 → Immediate Supply Zone Current ceiling where repeated rejection wicks formed — liquidity heavy. 3,920 – 3,940 → Expansion Supply Zone Next upside pocket, clean continuation target once 3,900 breaks decisively. 3,960 – 3,980 → Extreme Supply Zone Extended resistance area — high-probability reaction zone if volatility expands post-news. 🟦 H4 Demand Zones 3,820 – 3,840 → Short-Term Demand Zone Latest bullish base — the structural floor built before the last impulsive move. 3,760 – 3,780 → Mid-Range Demand Zone Solid re-test area from previous breakout — likely to attract buyers if short-term pullback unfolds. 3,700 – 3,720 → Deep Demand Zone Broader re-accumulation block — where prior liquidity grab originated, foundation of the current trend. Bullish Scenario If price holds above 3,820–3,840, buyers can regroup for a new breakout through 3,900, opening the way to 3,920–3,940, and possibly 3,960–3,980 if macro data supports continuation. Momentum confirmation comes from sustained strong-bodied candles closing above 3,900. Bearish Scenario Rejection from 3,880–3,900 could trigger rotation back into 3,820–3,840. A clean break below this pocket may extend toward 3,760–3,780, where structure could rebuild before deciding the next leg. If volatility spikes lower, 3,700–3,720 remains the key deep re-test zone. Targets (H4 Context Only) Upside Zones: 3,920–3,940 → 3,960–3,980 Downside Zones: 3,760–3,780 → 3,700–3,720 Conclusion Gold stands in a tight structural equilibrium — bullish context intact, but compression thickening near resistance. The next 1–3 sessions will reveal whether buyers break above 3,900 or if the market breathes out into the lower demand blocks. Patience here is precision — the breakout will come from this squeeze. Price always whispers before it moves — the structure tells the truth. That’s not luck, it’s discipline and timing. Follow, like and comment if you map the move before it happens ⚡