Technical analysis by EconomicanalysAbdulRahman about Symbol PAXG on 10/2/2025

EconomicanalysAbdulRahman

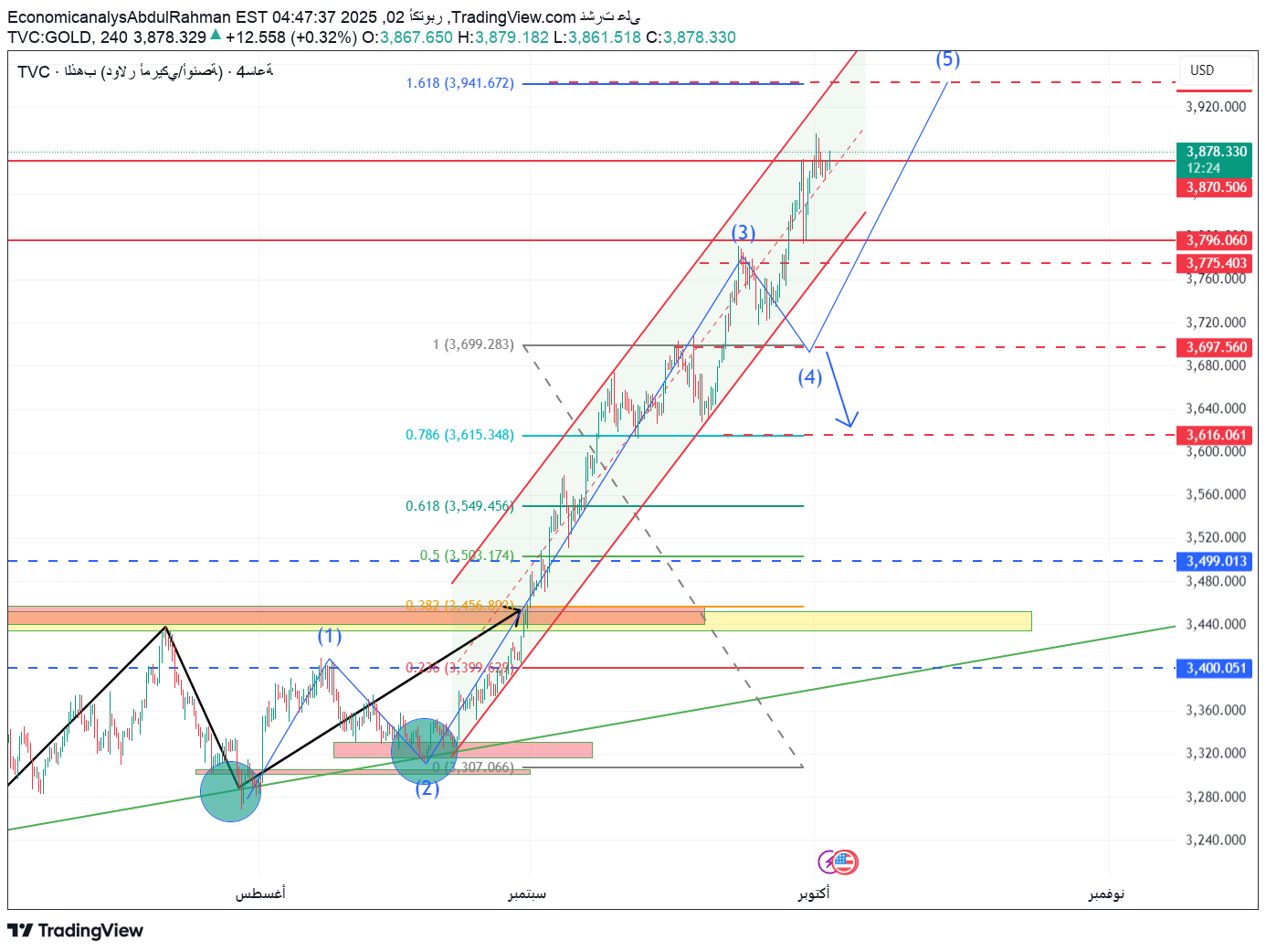

طلاء الذهب عند نقطة تحول: انفجار سعري أم بداية هبوط حاد؟ (تحليل وتوقعات)

Gold opened trading today at $ 3872 to an ounce after a strong movement during the past days, as he succeeded in testing the central resistance at $ 3889 - $ 3893, but so far failed to penetrate it decisively. This region is an essential knot for the next direction, as any explicit penetration above it may push the price towards new peaks, while frequent failure may enhance the correction scenario. On the clocking frame (H1) we note the formation of a short -range emerging channel, supported by gradient support levels, while momentum such as Macd began showing signs of gradual weakness and the possibility of purchasing power. 🔹 The current technical structure The price moves between strong support levels at $ 3847 and a pivotal resistance at $ 3893. The general trend is still in the medium and long term, but the short term falls in a decisive stage that may determine whether gold will continue about $ 3950 or return to testing lower levels. The presence of green demand areas on the chart is about $ 3820 and $ 3775 gives gold a strong pivotal base for any possible correction. 🔹 Important Support areas (possible purchase opportunities) 3847 - $ 3850 → First daily support, i.e. stability on it means continuing positive movement. $ 3810 - $ 3820 → Verified strong support zone has already been proven. $ 3775 - $ 3785 → Strategic support for the day, its breaking may change the scene to a short -term descending. 🔹 Daily resistance areas (possible sale opportunities) $ 3889 - $ 3893 → The current barrier, that is, a failure may pay for correction. $ 3913 → An important next summit, its penetration will confirm the continuation of the momentum. $ 3950 - $ 3960 → A potential boarding goal if penetrated $ 3913. 🔹 The expected scenarios for the American period The first scenario (weighted): gold remains in a cross range between $ 3847 - $ 3893, waiting for new news or incentives. The second scenario (climb): a strong penetration and stability above $ 3893 opens the road about $ 3913 first and then $ 3950. The third scenario (landing): a $ 3,847 support will pressure about $ 3820, and in the event of a deep fracture we may see a decline to $ 3775. 🔹 Trading advice and strategies For the short term: Best purchase chances when re -testing $ 3847 - $ 3850 to stop a loss below $ 3820. Opportunities for sale are available when stabilizing above 3890 - $ 3913 with goals at $ 3850. High volatility is expected in the American period, so a clear trading plan and strict risk management must be adhered to. For the long term: Any decline of about 3775 - $ 3785 will be an ideal area for building strategic purchase centers. The general trend remains positive in the long run as long as the price is trading over $ 3700. The remote goals remain at 4000 - 4100 $ if the current upward trend continues. 📌 Conclusion: Gold today stands at a very sensitive crossroads, resistance at $ 3890 is the key to continuing to climb about $ 3950, while frequent failure will lead to a correction of about 3820 - 3775 $. The American period will be decisive with the weight of the price remaining in the scope of strong fluctuation before taking the final direction.