Technical analysis by ArmanShabanTrading about Symbol PAXG: Sell recommendation (9/18/2025)

ArmanShabanTrading

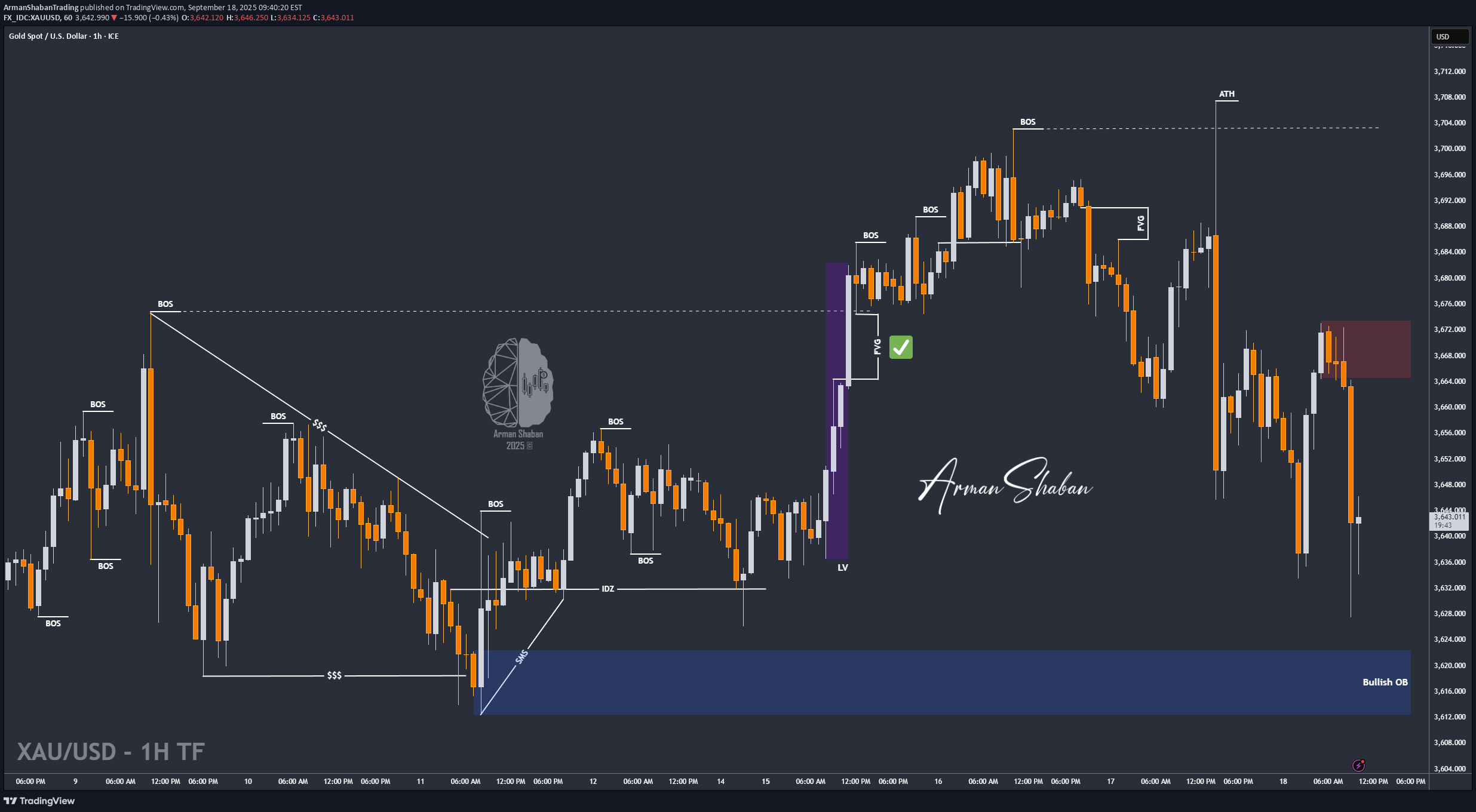

By analyzing the gold chart on the 1-hour timeframe, we can see that after the Fed rate cut announcement, the price first dropped from $3,686 to $3,649, stopping out many buyers. Then, gold rallied sharply, gaining 570 pips up to $3,707 and printing a new ATH, which stopped out sellers. After that, the market turned again, with another heavy drop that stopped out fresh buyers too. As I mentioned yesterday, this move was expected. Many asked why gold dropped despite the rate cut — the reason is that the news was already priced in last month. The market had anticipated the cut, which is why gold had already rallied earlier, and that’s why we saw this sharp drop after the announcement. Currently, gold is trading around $3,637 after falling to $3,627. I expect this decline to continue toward the next target zone at $3,612–$3,622. Once price reaches that level, we’ll review the next scenario. The key supply zones to watch are $3,667, $3,677, $3,684, and $3,691. I hope this analysis was helpful for you — stay tuned for more setups based on this outlook! Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me ! Best Regards , Arman ShabanBy analyzing the gold chart on the 1-hour timeframe, we can see that the price has started to rise and is now trading around $3,662. I expect a possible rejection soon from the first marked supply zone. • The key supply zones are $3,667, $3,677, $3,684, and $3,691. • The key demand zones are $3,627–$3,632 and $3,612–$3,622.