Technical analysis by jacesabr_real about Symbol DASH: Buy recommendation (9/17/2025)

jacesabr_real

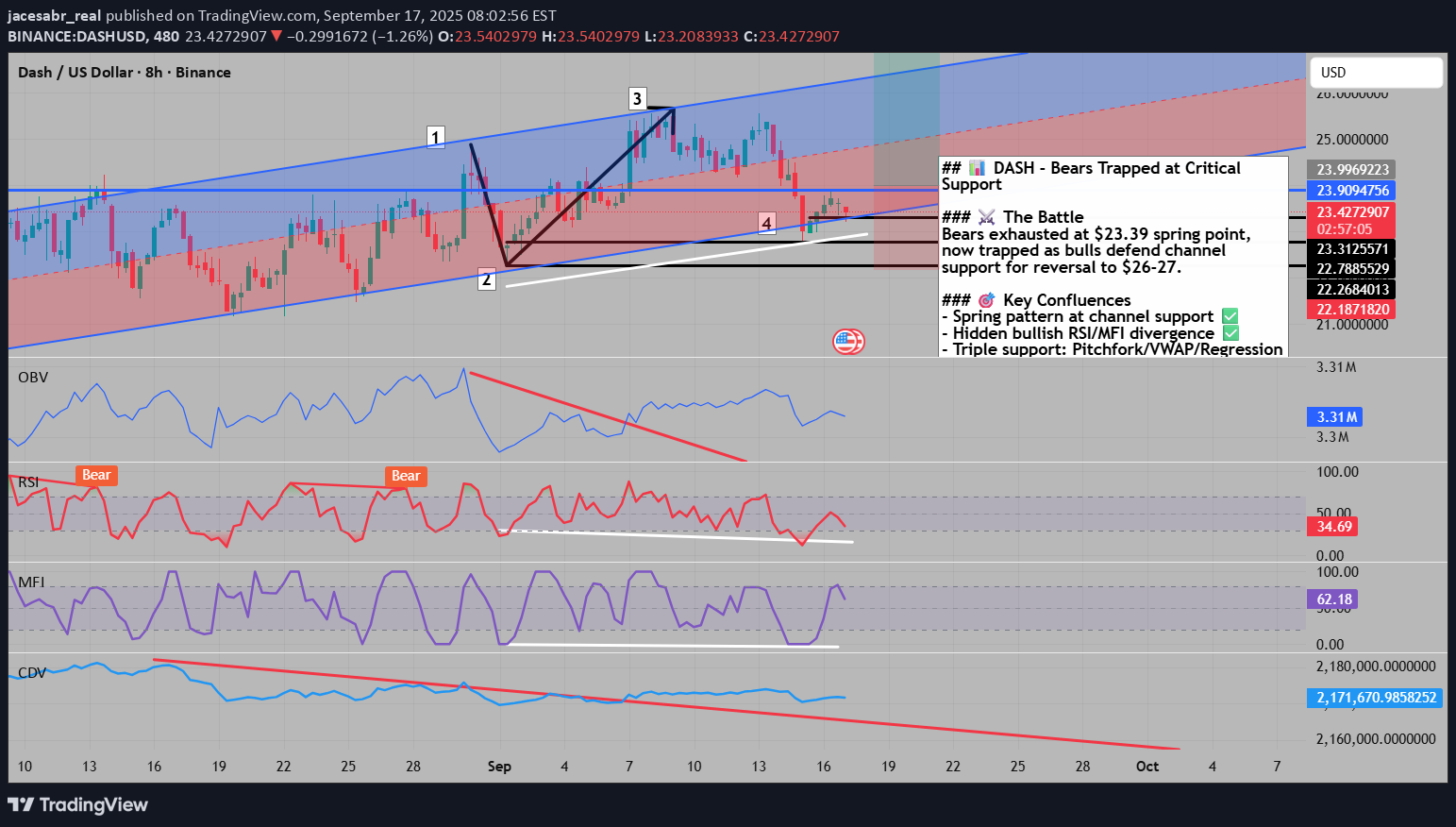

The Market Participant Battle: Bulls have successfully trapped aggressive bears at the $23 support level, creating a powerful spring formation after sellers exhausted themselves pushing price down from $26. With bears now caught offside after failing to break critical support despite multiple attempts, price is coiling for a reversal back toward $26-27 as trapped shorts are forced to cover their positions. Confluences: Confluence 1: Channel Support Spring with Hidden Bullish Divergence The 8-hour chart shows a textbook spring pattern where price touched the lower channel boundary at point 4 ($23.39), creating a false breakdown that trapped late sellers. The RSI and MFI both show hidden bullish divergence at this level - price made a higher low while oscillators made lower lows, confirming internal strength. The fact that price immediately rejected this level and closed back inside the channel signals bears have lost control. Additionally, both OBV and CDV maintain uptrends while breaking their own downtrend lines, showing accumulation despite the price pullback. Confluence 2: Major Pitchfork and Deviation Band Rejection Multiple technical tools converge at the $23.39 level: Andrews Pitchfork outer median line provided perfect support, VWAP 2nd deviation acted as a floor before price snapped back above the 1st deviation, and the linear regression channel shows price bouncing from its 2nd standard deviation. This triple confluence of dynamic support levels creates an extremely high-probability reversal zone. The numbered pattern (1-3 progression with 4 as the spring) confirms that when price closes above point 1, point 2 becomes validated as a major low. Web Research Findings: - Technical Analysis: TradingView analysis shows DASH technical ratings as "strong buy" today , with oscillators showing neutral and moving averages showing strong sell - Recent News/Earnings: DASH faces regulatory challenges with Bybit delisting in March 2025 , but community sentiment remains bullish despite 6.7% weekly decline - Analyst Sentiment: Multiple analysts noting support between $20-21 USD with safe entry above $21 - Data Releases & Economic Calendar: Fed decision today at September 17, 2025 with 93% chance of 25 basis point cut according to CME FedWatch - Interest Rate Impact: Lower fed funds rate makes it easier for money to flow through economy, helping boost markets with declining interest rates typically resulting in higher crypto prices Layman's Summary: Think of this trade like a rubber band that's been stretched too far - bears pushed price down hard but couldn't break the critical $23 level. Now they're trapped because they bet on further downside that isn't coming. Today's likely Fed rate cut could be the catalyst that sends trapped bears scrambling to exit, pushing price higher. The technical setup shows multiple reliable indicators all pointing to the same reversal zone, like having three different GPS systems all confirming you've reached your destination. Machine Derived Information: - Image 1: 8H chart showing numbered wave pattern with RSI/MFI divergences - Significance: Confirms spring pattern completion at point 4 with hidden bullish divergence across multiple oscillators - AGREES ✔ - Image 2: Clean 8H chart highlighting channel structure - Significance: Shows clear respect of ascending channel boundaries with point 4 touching lower support - AGREES ✔ - Image 3: Volume footprint analysis with POC levels - Significance: Reveals bullish POCs providing support and potential upside targets if price closes above horizontally stacked levels - AGREES ✔ Actionable Machine Summary: All three charts confirm the same story: bears pushed too hard into a major support confluence and are now trapped. The volume footprint shows buyers defending key POC levels, the channel structure remains intact despite the test, and momentum indicators flash reversal signals. When multiple independent analysis methods reach the same conclusion, probability shifts heavily in favor of the predicted move. Action: Enter longs at current levels with stops below $22.78. Conclusion: Trade Prediction: SUCCESS Confidence: High The convergence of trapped bears at major support, hidden bullish divergence, intact channel structure, bullish volume POCs, and potential Fed rate cut catalyst creates an exceptionally high-probability reversal setup. Risk/reward favors aggressive long entries with tight stops below the spring low.