Technical analysis by Skill-Knowledge-Conduct about Symbol NVDAX: Buy recommendation (9/16/2025)

Skill-Knowledge-Conduct

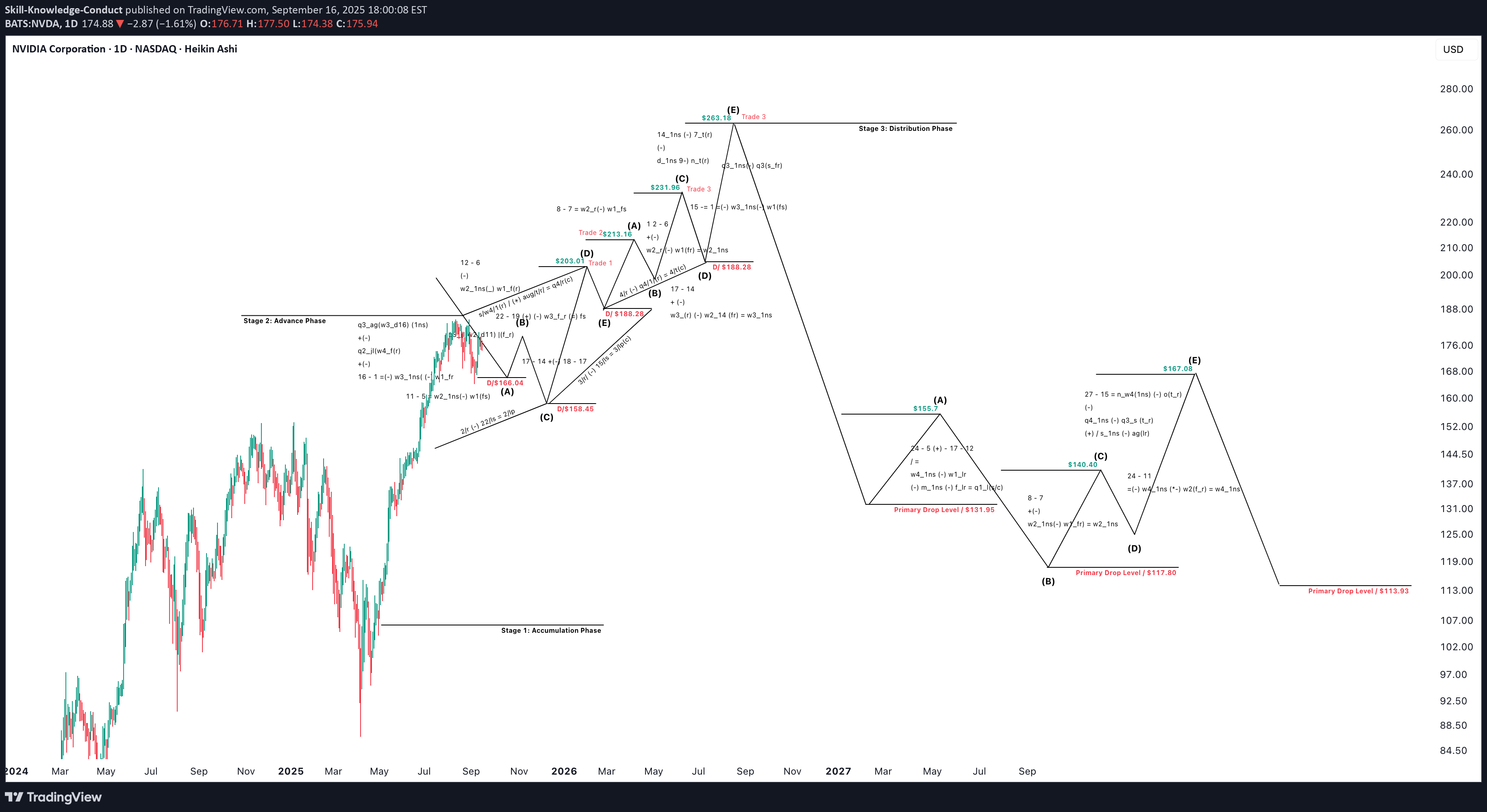

NVIDIA Corporation (NASDAQ: NVDA) – - 2025 - 2026 Distribution Summary Our proprietary cycle model identifies NVIDIA as entering the late stages of its advance phase and transitioning into distribution. The forecast highlights multiple distribution levels that represent key liquidity zones where price expansion and profit - taking are most likely to occur. Confirmed Distribution Levels (2025): •Level 1: $203.01 •Level 2: $213.16 •Level 3: $231.96 •Level 4: $263.29 Next Distribution Levels (2025 - 2026): •Level 1: $280.72 •Level 2: $311.76 •Level 3: $414.32 •Level 4: $427.22, $446.64, $450.35 •Level 5: $461.68, $468.28 This forecast implies that NVIDIA has significant upside potential in the medium term, with price action likely to consolidate at each level before advancing toward higher distribution zones. The cluster of levels between $427.22 and $468.28 represents the final stages of distribution and a potential exhaustion zone before a larger corrective phase begins. This publication is intended for institutional and wholesale investors seeking precise price - level forecasting to enhance timing strategies across NVIDIA’s upcoming market cycle. Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory. This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances. #(NVIDIA) #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy