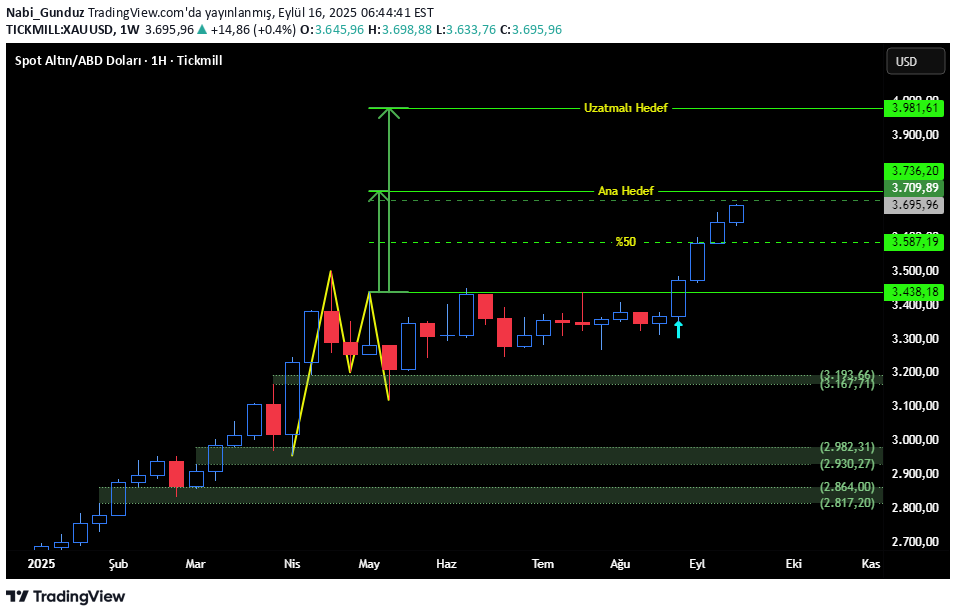

Technical analysis by Nabi_Gunduz about Symbol PAXG on 9/16/2025

Nabi_Gunduz

In my previous analyzes, I shared this drawing week of the break. On August 29, we see that the price that creates a Al signal with a weekly candle closed at 3474.63, rapidly rises towards the main target of the formation after a long consolidation phase. Now the main point to be considered; Will the price will stop this rise in the main target, or will it continue to rise towards the extension target? In any case, the main target will be the right move to realize profit. Because, 3753.28 has an annual R3 level. I believe that the upward fracture of this level on a monthly basis will not be easy. Therefore, although the price may encounter a correction from the range of 3700-3750, profit can be taken from the purchase-oriented transactions and the way to gain from the possible correction movement can be selected by sales signals that may occur in smaller time periods than the weekly time period. Of course, it should be noted that weekly and monthly mathematical levels should be followed carefully. Good gains ...