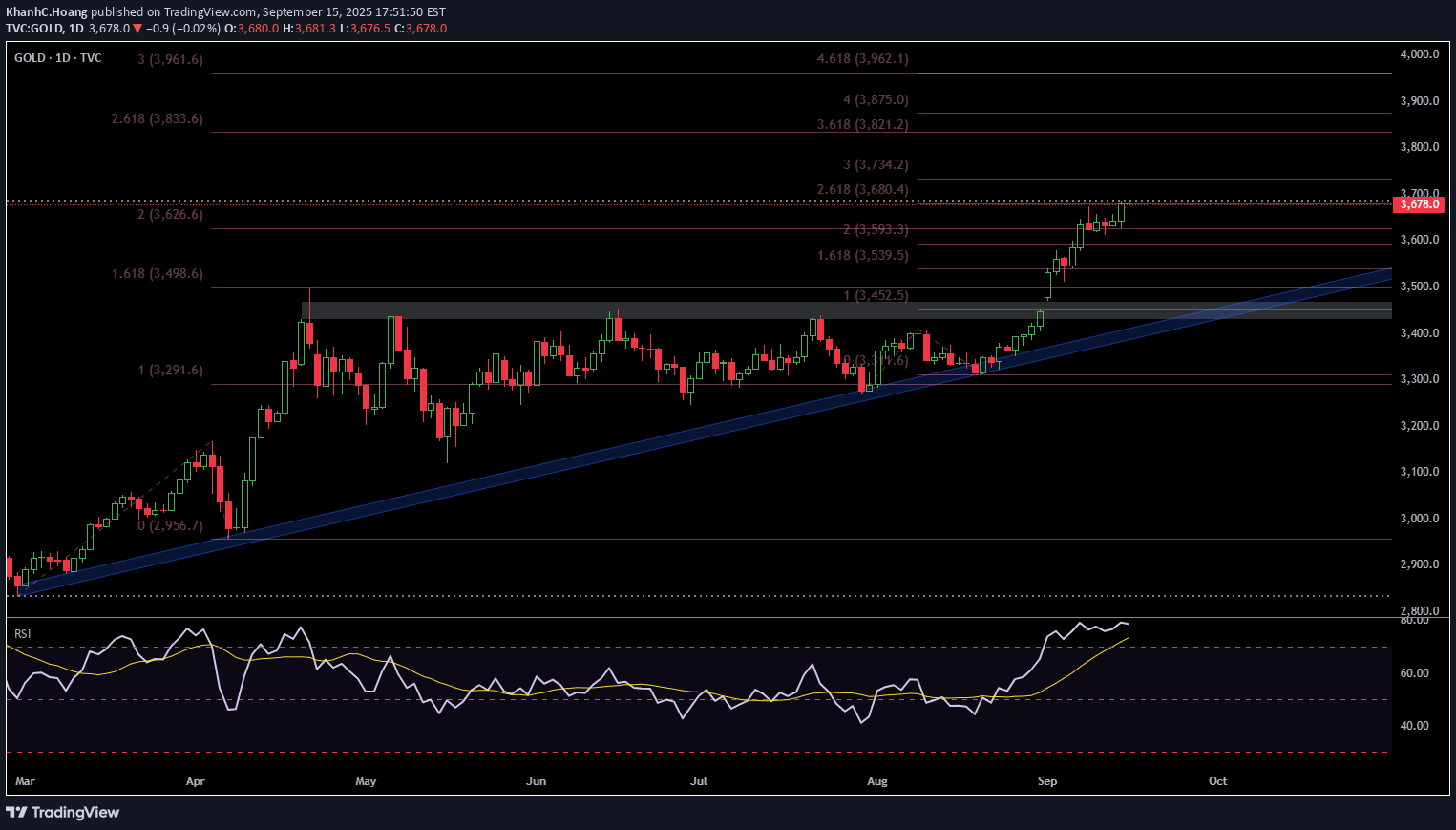

Technical analysis by KhanhC.Hoang about Symbol PAXG: Buy recommendation (9/15/2025)

Can Gold go up to $4000?

Gold’s value is shaped by a fascinating mix of economic forces, psychological triggers, and geopolitical dynamics. Here's a structured breakdown of the key factors that influence its price: --- 🏦 Economic & Monetary Factors - **Inflation**: Gold is a classic hedge against inflation. When currency loses purchasing power, gold tends to hold or increase its value. - **Interest Rates**: Lower interest rates make non-yielding assets like gold more attractive. Rising rates can reduce gold’s appeal. - **Value of the U.S. Dollar**: Gold and the dollar often move inversely. A weaker dollar typically boosts gold prices. --- 🌍 Geopolitical & Market Sentiment - **Global Crises**: Political instability, wars, or pandemics drive investors toward gold as a safe haven. - **Central Bank Activity**: Purchases or sales of gold by central banks (like the Fed or ECB) can significantly impact demand and price. - **Market Volatility**: When stock markets wobble, gold often shines as a store of value. --- ⚒️ Supply & Demand Dynamics - **Mining Output**: Limited or disrupted gold production can constrain supply and push prices higher. - **Jewelry & Tech Demand**: Gold’s use in jewelry and electronics affects its industrial demand. - **ETF & Retail Investment**: Flows into gold-backed ETFs or physical gold buying by retail investors can amplify price movements. --- 🧠 Psychological & Behavioral Drivers - **Investor Sentiment**: Fear, uncertainty, and herd behavior often lead to gold buying sprees. - **Cultural Beliefs**: In countries like India and China, gold holds cultural and ceremonial value, influencing seasonal demand. ---