Technical analysis by GoldFxMinds about Symbol PAXG on 9/15/2025

GoldFxMinds

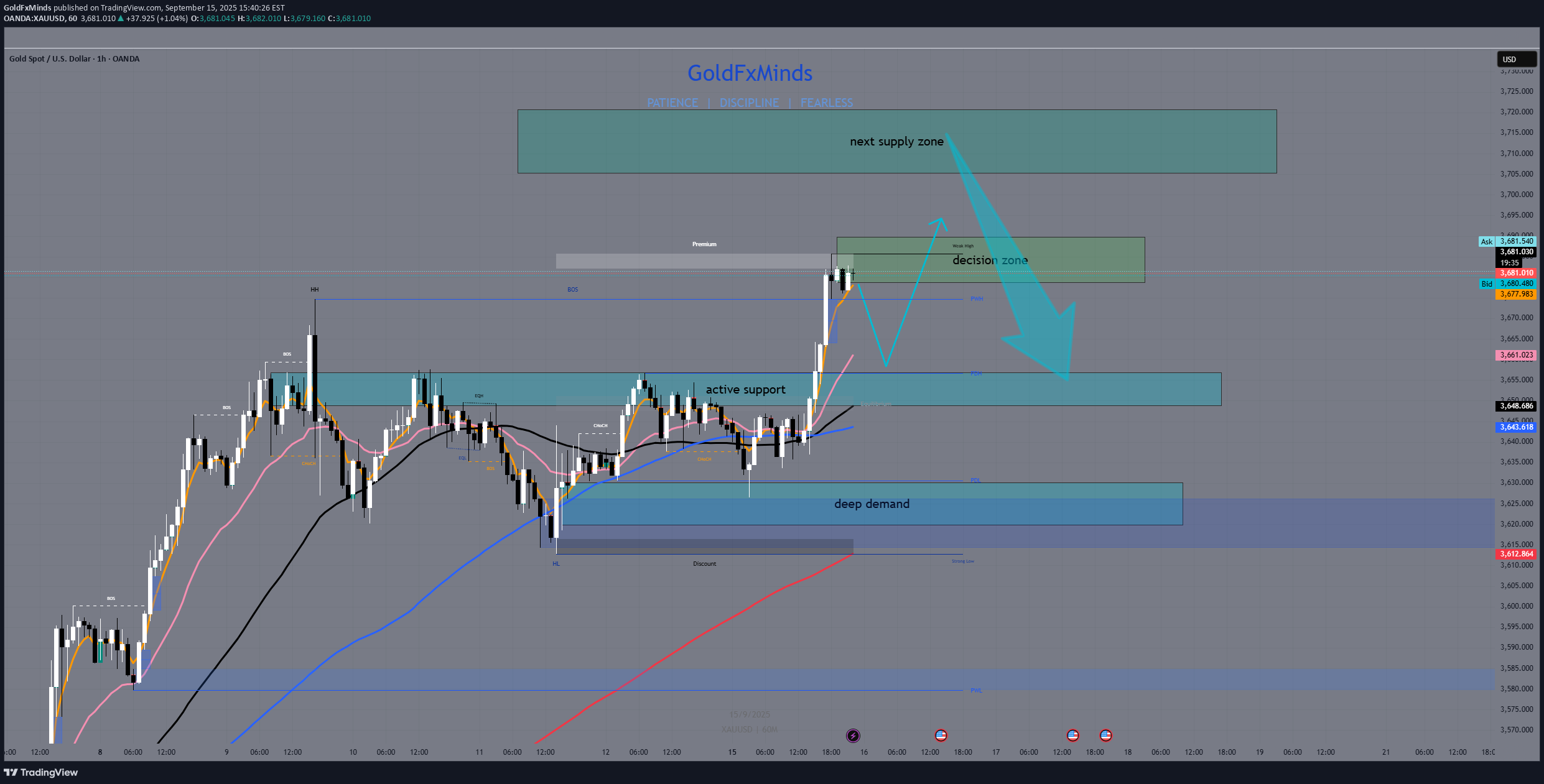

🟡 Gold Daily Outlook | September 16 Hello traders, today we’re mapping the Gold battlefield step by step – from the Higher Timeframe structural zones down to intraday sniper levels. With U.S. Retail Sales on the calendar, tomorrow’s volatility could set the tone for the week. Let’s break it down 👇 🔸 HTF Structure (D1 + H4) Trend: Strong bullish continuation, price extended above 3680. Structure is intact with buyers still in control. Key Demand Base: 3630–3620 remains the clean foundation from the last retest. Key Supply Band: 3700–3710 acts as the next major resistance above. RSI: Daily reading above 80 shows strong momentum but signals stretched conditions. 🔸 Intraday Map Support floor: 3652–3645, aligned with prior breakout structure. Decision zone: 3680–3690 – holding above favors continuation; rejection could trigger a pullback. Momentum: Flow remains bullish, but risk of retracement before the news release. 🔸 Scenarios for Tomorrow Bullish 📈: If 3680 holds and Retail Sales data comes in weak, gold may extend toward 3705 → 3720 with strong momentum. Bearish 📉: If price rejects 3688–3690 and Retail Sales beat expectations, a retrace toward 3660 → 3650 becomes likely. ✅ Conclusion HTF: Bullish structure still intact. Intraday: 3680–3690 is the pivot range. LTF: Key demand at 3660–3655, tactical supply near 3690–3700. Tomorrow’s U.S. Retail Sales could ignite the next move. Keep your levels sharp, wait for confirmation, and let the market show its hand. ✨ Will Gold push through 3700 or correct first? Drop your thoughts below 👇, hit like, and follow GoldFxMinds for more daily precision plans 🚀✨