Technical analysis by GoldFxMinds about Symbol PAXG on 9/14/2025

GoldFxMinds

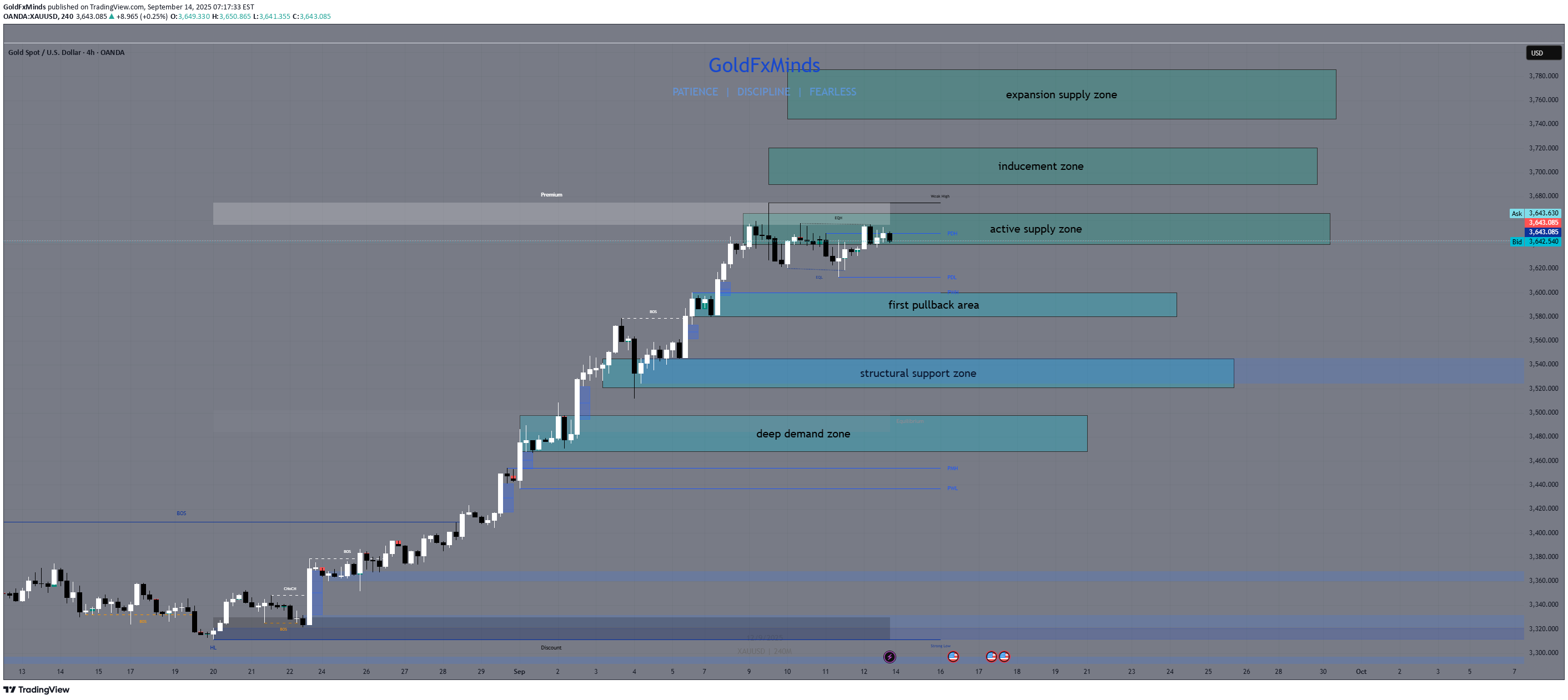

The higher you climb, the sharper the fall... unless you know where the trap is. 👋 Hello traders, We’re heading into a critical week for Gold, with price currently testing the ceiling of an aggressive bullish leg. In this H4 outlook, we’ll break down the 3 key supply zones above price, the demand layers below, and what to expect from market structure, reaction points, and sniper entries. Let’s map it out 👇 🔸 1. H4 Structure & Trend ✅ Trend: Still bullish – price is printing higher highs and higher lows after a strong BOS ⚠️ However: We're now inside a key supply zone, with signs of momentum exhaustion EMAs are still locked, but flattening – indicating early compression 🔸 2. Supply Zones (Above/At Price) 🔴 3640–3666 – Active H4 Supply (Price Inside Now) ‣ We are currently consolidating inside this premium zone ‣ Multiple EQHs indicate inducement ‣ A strong rejection here may trigger pullback toward demand ‣ A clean break above → confirms bullish continuation 🟠 3692–3720 – Inducement + FVG Zone ‣ Matches 1.272 Fibonacci extension ‣ Imbalance + wick gap + low resistance ‣ Likely to act as a trap zone for breakout chasers if tested 🔴 3745–3785 – Final Expansion Supply Zone ‣ 1.618–2.0 fib projection + HTF inefficiency ‣ High-probability reversal zone if price extends bullish without pullback ‣ Only reachable if bulls dominate and structure confirms breakout above 3720 🔸 3. Demand Zones (Below Price) 🟦 3600–3580 – First Pullback Demand ‣ Minor OB + FVG from previous impulse ‣ Likely to hold first tap if 3640–3666 fails ‣ Watch for bullish reaction 🟦 3544–3520 – Internal OB + EMA50 Zone ‣ Structure-support zone + previous BOS origin ‣ Stronger continuation setup if 3580 fails 🟦 3500–3470 – Full Reaccumulation Zone ✅ ‣ Clean OB + deep discount pricing + last institutional demand ‣ EMA100 confluence ‣ Final valid long zone before major sentiment shift ‣ If broken, trend may flip to bearish 🔸 4. Confluences ✅ EMA 5/21/50: Locked bullish, but flattening – signs of slowing trend ✅ RSI: Cooling off from overbought → early warning of exhaustion ✅ Equal Highs: Inducement logic building below 3666 ✅ FVGs: Gaps both above and below → price remains imbalance-driven ✅ Fibonacci: 1.272 → 1.618 extensions align with supply zones above 🔸 5. Scenarios for the Week 📈 Bullish Scenario ‣ If price breaks and holds above 3666, we expect a push toward 3720, and possibly 3745–3785 ‣ Ideal reentry long zones: 3600 and 3544, with confirmation ‣ Trend remains bullish above 3520 📉 Bearish Scenario ‣ Rejection from 3640–3666 or EQH sweep = short-term top ‣ Target pullbacks: 3580 → 3544 → 3500–3470 ‣ Only a break below 3470 flips sentiment into correction mode 📍Price now inside 3640–3666 → this is the battlefield for the early week. 🔚 Final Thoughts This week’s setup is clear: Gold is inside a live decision zone. Watch how price reacts — breakout or rejection will decide the next 300+ pips. Don't get baited by the EQHs... precision and confirmation are everything. — 👉 If this clarified your map for the week, drop a LIKE to support the effort, FOLLOW GoldFxMinds for more daily sniper-level updates, and let’s stay sharp, structured, and two steps ahead all week long 💥🔥🚀