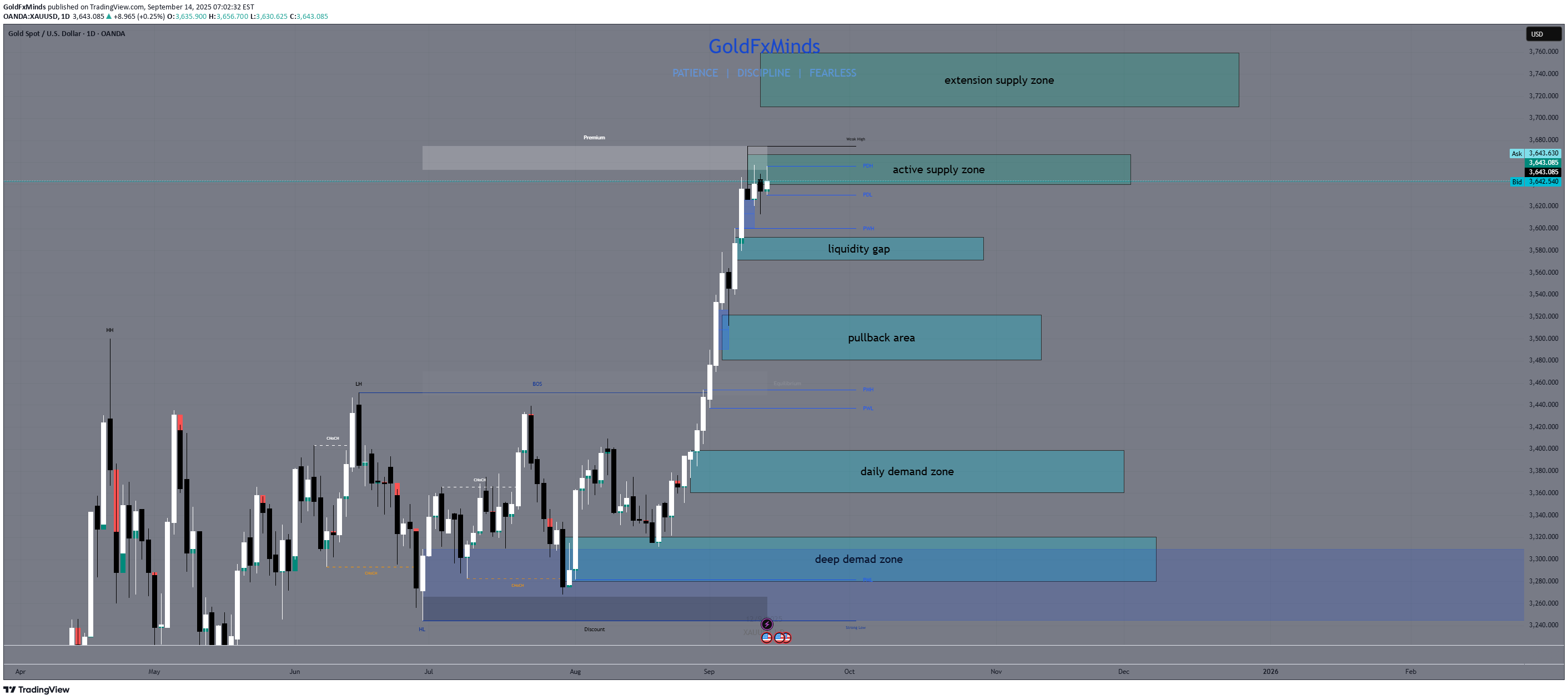

Technical analysis by GoldFxMinds about Symbol PAXG on 9/14/2025

GoldFxMinds

Gold enters the premium battlefield – will buyers exhaust or continue the climb? 🔸 1. Market Structure & Trend Trend: Strong bullish continuation Structure: Price broke the last LH with a clean BOS and is now pushing deep into premium territory, trading inside a daily supply. No signs of weakness yet – just consolidation inside a potential reversal zone. 🔸 2. Daily Supply Zones (Above Price) 🔺 3640–3666 – Active Daily Supply Zone ‣ Price is currently consolidating inside this premium wick zone. ‣ High-probability area for liquidity grab or rejection. ‣ A clean daily close above 3666 opens space for bullish expansion. 🔺 3710–3760 – Expansion Target Zone ‣ 1.272–1.618 Fibonacci extension from last bullish swing ‣ Wide, clean zone with historical inefficiencies and no strong structure blocking ‣ Only reachable if 3666 breaks with momentum 🔸 3. Liquidity & Pullback Zones (Below Price) 🔸 3592–3572 – First Liquidity Magnet ‣ Minor inefficiency zone below current price ‣ If rejection from supply occurs, this is likely the first pullback zone 🔸 3520–3480 – Mid Impulse Zone ‣ Midpoint of previous leg, includes small demand + EMA21/50 confluence ‣ Valid for short-term reaction if market begins deeper correction 🔸 4. Major Daily Demand Zones (Discount Structure) 🟦 3400–3360 – First Strong Daily Demand ‣ Unmitigated OB + FVG + EMA50 zone ‣ Key bullish continuation level if price pulls back aggressively ‣ First major structural base below premium 🟦 3320–3280 – Swing Accumulation Zone ‣ Old HL base before breakout ‣ Minor imbalance + OB structure ‣ Valid if deeper retracement begins 🟦 3300–3180 – HTF Extreme Demand ‣ Old CHoCH zone + macro structural HL ‣ Full imbalance below – final level before trend change ‣ Only reachable on macro bearish shift or news-driven breakdown 🔸 5. Confluences & Indicators ✅ EMA 5/21/50: Fully locked bullish ✅ RSI: Overbought – signals momentum stretch ✅ FVGs: All remain unfilled below ✅ Fibonacci: Price expanded beyond 1.0 – now in 1.272–1.618 stretch zone 📊 Volume : Elevated – indicates strong interest at highs 🔸 6. Bias & Scenarios 📈 Bullish Bias (as long as 3572 holds): ‣ A breakout above 3666 leads toward 3710–3760 expansion ‣ Retracement into 3592 or 3520 can offer reentry long setups ‣ Bullish structure remains intact until 3360 breaks 📉 Bearish Scenario (only if supply holds + rejection): ‣ A strong bearish daily close inside 3640–3666 may trigger profit-taking ‣ Break of 3572 → opens path to 3520 and deeper retracements ‣ Only under 3360 do we consider sentiment flipped 🔹 Final Thoughts Gold is showing no weakness yet, but it’s walking on hot coals inside a major premium zone. Bulls need a clear breakout to extend toward 3710+, while bears wait for signs of exhaustion. This is where patience pays – let the daily candle speak before acting. — 🔍 What do you think of this full daily battlefield? Are you ready to break it down on H4 and hunt the next sniper setup? 👇 Don’t forget to like and follow GoldFxMinds for sharp, structured daily updates — clarity before entry is power 🚀✨.