Technical analysis by Wick-Sniper about Symbol PAXG: Sell recommendation (9/13/2025)

Wick-Sniper

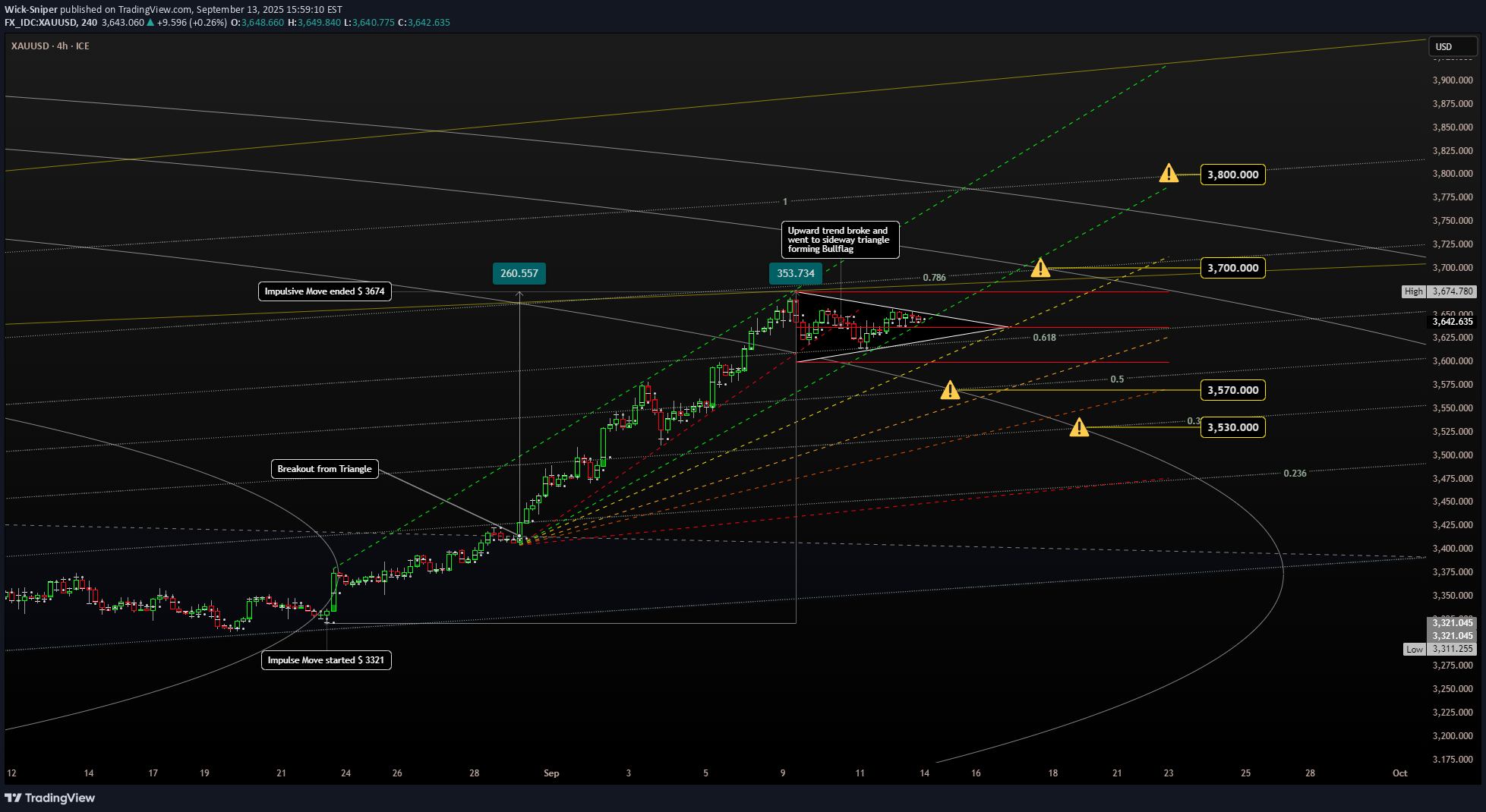

Gold - Everything is Possible, as Always

🚀 XAUUSD Gold's Wild Ride: What's Brewing After the $3674 High? 🤯 Hey Goldbugs! 🤩 Our shiny friend, XAUUSD, has been on an absolute tear lately. Market makers did their magic, nudging Gold to a comfy spot around $3640, just shy of its ALL-TIME HIGH of $3674! 🚀 But now... crickets. What's next for our "always up" precious metal? Let's decode this mystery in a flash! 👇 The Lowdown: Why Gold's Taking a Breather 😴 1. The "Less Bad" News Effect: Recent U.S. data has been... well, "less bad". Inflation/deflation drama is cooling off, and markets are starting to think things aren't as grim as they were. This makes some traders less keen on Gold, but don't forget the big players (institutions!) still need their fix. So, a tug-of-war begins! ⚔️ 2. Overheated Engine Syndrome! 🌡️ Gold's run from $3321 to $3674 was a whopping +10.5% ($353!) at an almost 45-degree angle! That's impressive, but even the best engines need to cool down. Our daily RSI values have been chilling above 75% – that's "overheated" territory! 🔥 A correction is basically Gold taking a well-deserved nap. The "C" Word: What Correction Looks Like 📉 Forget complicated math! A correction is usually a 10-20% price dip. Given Gold's recent sprint, we could be looking at a 20-30% pullback from that $353 gain, meaning a possible $70-$105 drop. 📉 Target Zones? Many eyes are on $3580. But hey, Gold likes surprises! It could go lower, perhaps even test $3550 or more! Your Trader's Toolkit: Don't Get Caught Napping! 🛠️ Want to predict Gold's next move? Here's your cheat sheet: Candlestick Clues: Watch for Shooting Stars 🌠, Hanging Men 🕯️, Spinning Tops, and Dojis. These are like little whispers telling you the trend might be tired. EMA Lines: These are your trend compasses! Fibonacci, Baby! 💫 Seriously, if you haven't, dive into Fibonacci Channels and Circles. They're like a crystal ball for price moves! Economic Calendar: 🗓️ CPI, PPI, NFP, and U.S. Inflation Data are Gold's daily bread and butter. Know them! 🧠 ICT Insights: What the Pros Are Seeing 📊 Market Structure Shift (MSS): After hitting $3674, Gold's current wiggles (Lower Highs & Lower Lows) within this consolidation hint at a short-term shift in order flow. It's not a full reversal, but a pause for thought. If you look closely, you can see a Bull Flag Pole exists and the Flag is forming, currently a triangle, a good sign before the liquidity needs to get taken out from the bottom. Liquidity Magnets: Buy-Side Liquidity (BSL): Loads of orders (and stop losses!) waiting above $3674. That's a juicy target if Gold decides to moon again! Sell-Side Liquidity (SSL): Plenty below the recent low around $3590-$3600. A dip here could be a "stop hunt" before bouncing. Fair Value Gaps (FVG) & Order Blocks (OB): Those rapid green candles left "gaps" and "blocks" during the ascent. Gold loves to retrace and "fill" these gaps or retest these blocks ($3590-$3600 is a key OB zone!) before its next big move. The Verdict? Gold's Not Done Yet! ✨ Is Gold heading for $3700+? YES! But probably not right now. A little cooldown, a bit of retracement to those key support levels and ICT zones, seems inevitable. So, what to do? Be patient, be responsible with your capital, and keep your eyes peeled for those technical clues. Gold's next big move could be around the corner! Next Week's Radar (ignoring the news for a sec): Bullish Target: $3800 🚀 Bearish Target: $3550 🐻 Significant large orders are on Sell Stop: 3611 Sell Limit_ 3657, 3659 Buy Limit: 3600, 3580, 3500 Buy Stop: 4497 ------------------------------------------------------------------------- This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly. Good luck and safe trading! 🚀📊Today went very good for Bulls, but the machine is overheated more than last Friday, I have no worries, this will cool down soon.RSI @ 16 EST 2025/09/15 1d - 79 4h - 68 1h - 71 New ATH made $ 3685, what next, maybe $ 3655 would be a good spot?Over night Asia TZ made a new ATH at $3689, in the early EU Session the next push came up with $ 3694 indicating the unbroken bullish pressure on Gold. Price Action is compressed to a tight range and could lead to a breakout shortly. Be aware about the possibillity of a pullback and set your SL very short.Over the day Gold made another ATH at $ 3703 tumbled down to $ 3678 after announcement of US Retail Sales who were better than expected and was compressed in the range of $ 3686 to $ 3691 for the rest of the session. Now we look for the day before the fed announcement and see gold is stuck for the moment. No big pullback till now before FED is lowering the rates, all buy gold, will it sustain?I expected gold to make a corrective move, and it was not as low as I thought it would be, but it was close. 📉 So, I closed my short position on the down move today at **$3662**. 💰 Profits taken! 🤑 I also opened a small long position that delivered as well. 📈 Now I'm waiting for the FOMC announcement in about 30 minutes. 🕰️ Do not gamble! The expectations are huge and very different. 🤯 Some people are talking about **$3750** today, while others are saying **$3500** in the next few days. 📉 My honest expectation is that a rate cut is about 90% priced in, so I'm staying out of this. 🙅♂️ I'll see what the initial market reactions are tomorrow. 👀