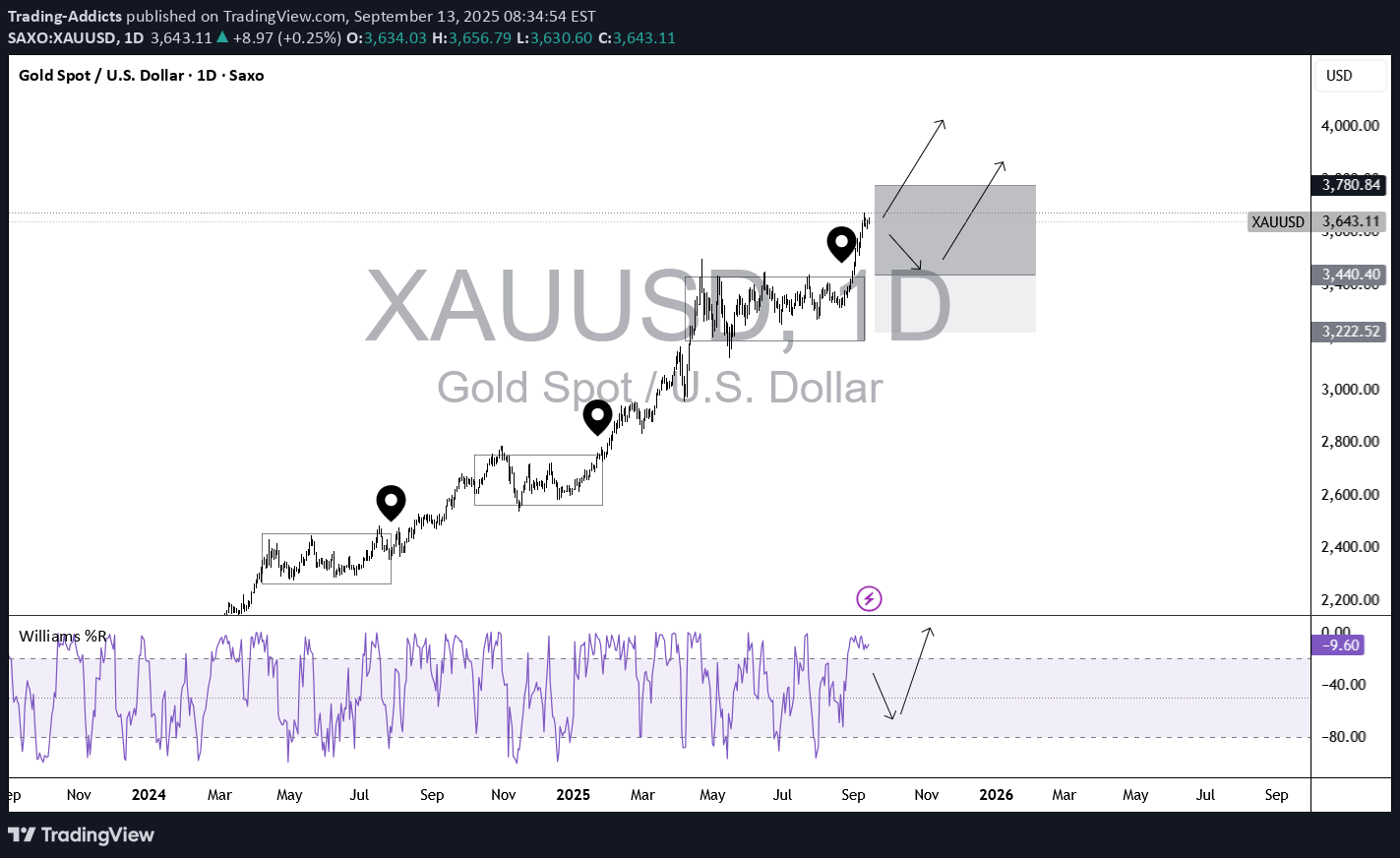

Technical analysis by Trading-Addicts about Symbol PAXG: Buy recommendation (9/13/2025)

xauusd

Reasons to Buy Gold: Fed policy & interest rates Markets expect the Federal Reserve to cut rates within the coming quarters. Lower rates weaken the dollar and reduce yields on US bonds, which makes gold more attractive. Even if cuts are not immediate, the anticipation alone supports gold buying as investors hedge against future USD weakness. Inflation & real yields Even with some moderation, inflation remains sticky in parts of the global economy. Gold is a classic inflation hedge. If real yields (yields adjusted for inflation) fall, gold tends to benefit because the opportunity cost of holding it decreases. Central bank demand Central banks around the world continue to add gold to their reserves as a way to diversify away from the dollar. This steady demand provides a structural tailwind for gold prices. Safe-haven appeal In times of geopolitical tension, economic uncertainty, or equity market volatility, investors often shift into gold. With risks around fiscal deficits, trade tensions, and global conflicts, safe-haven flows could intensify. Technical momentum Gold has broken above key resistance levels in recent months, signaling bullish momentum. Pullbacks have found strong support, suggesting buyers step in on dips. This reinforces the case for trend continuation to the upside. Weaker USD outlook If US data softens (e.g., slower jobs growth, weaker consumer spending), the dollar could weaken further. A softer dollar almost always supports gold since it becomes cheaper for non-USD buyers. ⚠ Risks to a Long Gold Position If US inflation unexpectedly spikes and the Fed turns more hawkish, the dollar could strengthen and gold could fall. Strong US economic growth could reduce demand for safe havens. A major risk-on environment (e.g., global equities surging) might drain flows out of gold. If gold fails to hold support levels after such a strong rally, it could trigger sharp profit-taking. 🎯 Trading Considerations Entry: Buying dips into support levels, rather than chasing highs, can improve risk-reward. Stop-loss: Place below recent swing lows or key support zones to protect against sudden drops. Targets: Near-term upside could retest recent highs; if momentum continues, longer-term targets can extend significantly higher. Catalysts to watch: US CPI/PPI, Fed meetings, global risk events, and central bank purchase data