Technical analysis by MMFlowTrading about Symbol PAXG on 9/13/2025

MMFlowTrading

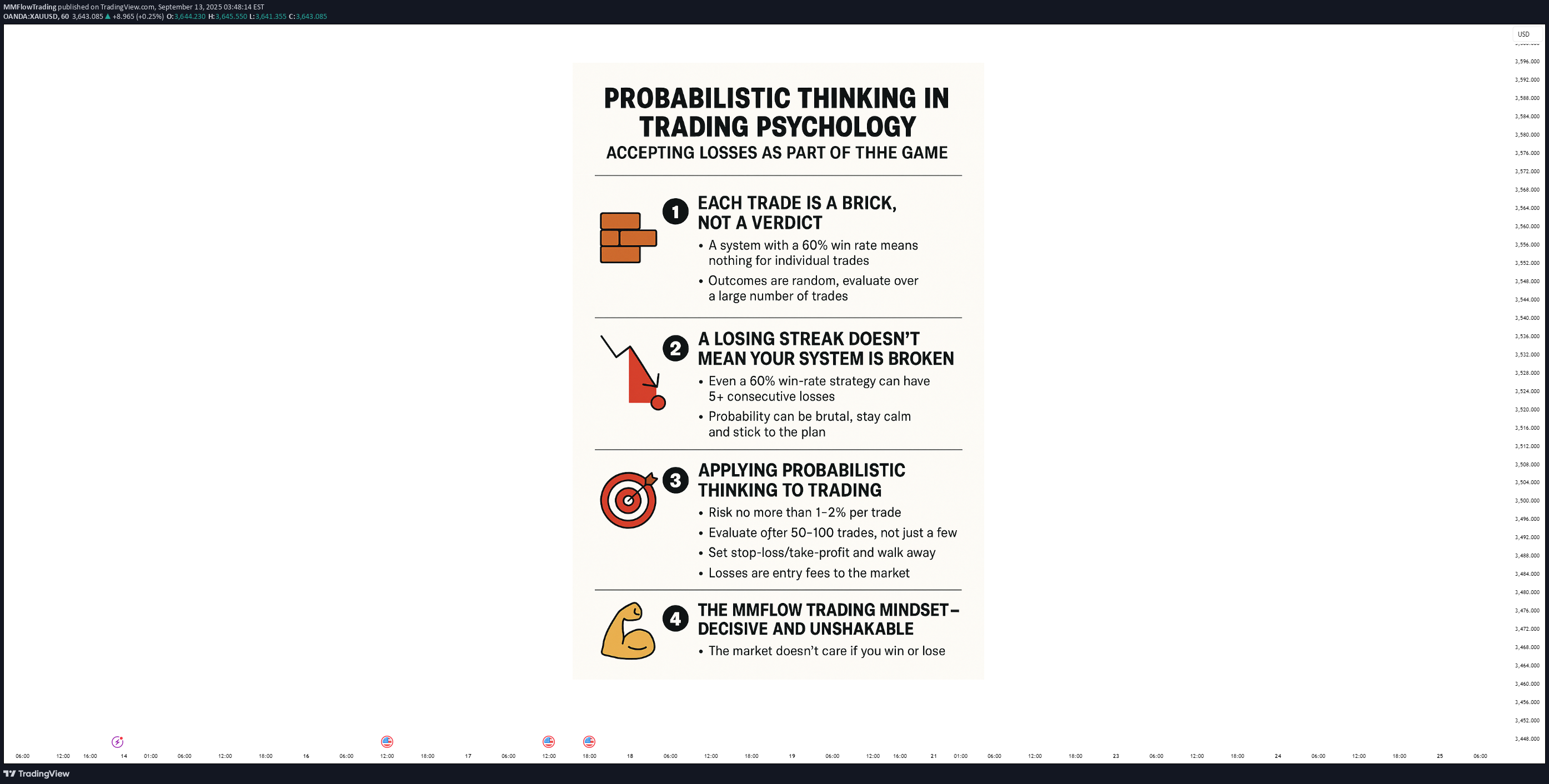

⚡ Probabilistic Thinking in Trading Psychology: Accepting Losses as Part of the Game Trading psychology separates successful traders from those the market eliminates. In Forex and Gold trading, many lose not because their strategy is weak but because they fail to accept the reality of probability. Every trade is just one sample in a long statistical series—nothing more, nothing less. 🧠 1. Each Trade Is a Brick, Not a Verdict A system with a 60% win rate sounds impressive. But that percentage only matters over a large number of trades. For individual trades, the outcome is random. Example: An MMFLOW trader places 100 trades, risking 1% per position. After losing 6 in a row, he remains calm: “These are just 6 steps in a 1,000-step journey.” During NFP news, Gold drops 300 pips. An inexperienced trader abandons their plan after two stop-loss hits. A professional sticks to the system because probability needs time to show its edge. 📊 2. A Losing Streak Doesn’t Mean Your System Is Broken Even a 60% win-rate strategy can experience 5–7 consecutive losses. That’s the ruthless yet fair nature of probability. Traders without probabilistic thinking panic, break discipline, or abandon their edge prematurely. Example: A breakout system shows long-term profitability. After 10 trades, it loses 7 times. A weak-minded trader quits. A seasoned trader stays the course and wins 20 out of the next 30 trades—recovering all losses and more. 🚀 3. Applying Probabilistic Thinking to Forex/Gold Trading Rock-solid risk management: Risk no more than 1–2% per trade to survive losing streaks. Long-term evaluation: Judge your system after 50–100 trades, not just a handful. Non-negotiable discipline: Set stop-loss/take-profit and walk away—emotions don’t press “Close.” Trading journal: Record outcomes and emotions to identify cognitive biases. Warrior mindset: Losses are entry fees to the market, not personal failures. 💪 4. The MMFLOW Trading Mindset – Decisive and Unshakable The market doesn’t care whether you win or lose. The only thing that matters is keeping your statistical edge long enough to let it work. Professionals: Stay calm through losing streaks. Refuse to “revenge trade” when emotions flare. Stick to the plan because 500 trades will speak louder than 5. 📈 5. Conclusion – Mastering Trading Psychology In Forex and Gold, probabilistic thinking is the shield that protects your mindset. Accepting losses as part of the game helps you: Reduce emotional pressure and avoid impulsive decisions. Maintain discipline and effective risk management. Leverage your system’s long-term edge for sustainable account growth.