Technical analysis by SupertradeOfficial about Symbol ETH: Buy recommendation (9/12/2025)

SupertradeOfficial

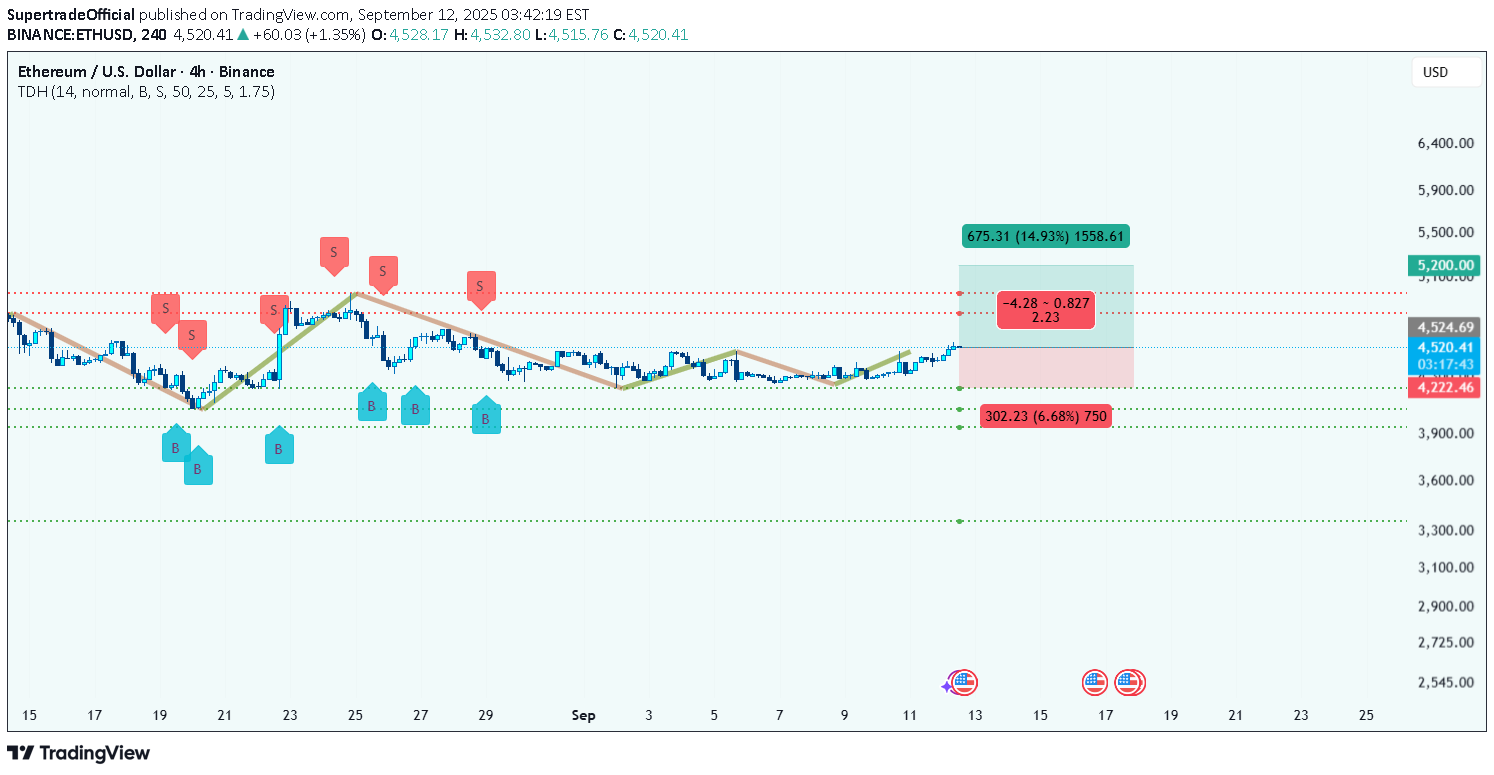

ETH Bulls Target $5,200 Next — Is $5,500 Around the Corner?

ETH looks like it’s exiting a sideways/accumulation band and moving back into a bullish regime on the 4-hour chart. The structure recently shifted from range-bound to higher lows → higher highs, which is the first quality check for a sustainable push higher. The move is not yet a blow-off — it’s a controlled attempt to reclaim higher resistance. On the chart I see three clean bands to treat differently: •Near-term supply (resistance) sits just under ~$4,950 and extends to ~$5,200. Price has to clear and hold above this zone to confirm a larger breakout and give bulls runway to $5,500+. •Immediate control / pivot is roughly the present area near $4,500–$4,550 (where buyers re-entered). This zone now acts as short-term support if price holds. •Lower structural demand is near $4,220 (primary invalidation for this bullish thesis) and below that $3,940 is the deeper cushion where previous buyers stepped in strongly. Price behavior to watch: a clean 4H close above $4,950 with follow-through opens the path to $5,200; failure there (rejection on heavy tails) turns the move into a “bull trap” and would require caution. Conversely, a breakdown and decisive 4H close below $4,220 invalidates the bullish plan and suggests revisiting lower structural supports. ________________________________________ Level-by-level careful analysis (why each matters) •$4,220 (primary support / invalidation) — multiple prior reactions here: a daily/4H close below this suggests sellers regained control and the bullish case fails. Use this as your hard invalidation. •$4,500 – $4,550 (current control / entry zone) — recent buyers defended this band; it’s where new longs are being accumulated. A hold/clean bounce here is a good risk-controlled entry region. •$4,950 (first major resistance) — the choke point. This is where supply historically clustered; a close above with volume / hourly follow-through confirms breakout. Partial profit-taking is logical here even if continuation follows. •$5,200 (secondary resistance / breakout confirmation) — significant supply cluster; a sustained break here targets extension to $5,500+. •$3,940 (deep support / liquidity pool) — if price collapses through $4,220 this is the next magnet where buyers likely re-appear. ________________________________________ Numeric recap (all important numbers — copy/paste friendly) •Current price area to watch: $4,500 – $4,550 •Hard invalidation (stop area): $4,220 •Short-term target / TP1: $4,950 •Breakout confirmation zone / TP2: $5,200 •Extended target / TP3: $5,500+ •Deeper demand if invalidated: $3,940 Estimated risk/reward (if entry ~$4,520 & SL $4,220): •Risk = $300 (4,520 − 4,220) •Reward to TP1 = $430 → R:R ≈ 1.43 : 1 •Reward to TP2 = $680 → R:R ≈ 2.27 : 1 •Reward to TP3 = $980 → R:R ≈ 3.27 : 1 ________________________________________ 📈 Trade setup (bullets only) •Entry: buy $4,500 – $4,550 (prefer a constructive 4H bounce inside this zone) •Stop-loss: $4,220 (clean 4H close below = invalidation) •Take Profit 1 (TP1): $4,950 → take 30–40% off •Take Profit 2 (TP2): $5,200 → take another 30–40%; move remaining to breakeven •Take Profit 3 (TP3): $5,500+ → leave a small runner, trail stop under 4H higher lows •Trailing stop plan: after TP1, trail SL to breakeven; after TP2, trail SL under each successive 4H higher low or use 1.5× ATR(20,4H) for dynamic trailing •Risk per trade: keep at 1–2% of account equity; size position so $300 risk equals your dollar risk cap ________________________________________ Execution & risk notes (brief) •Prefer confirmation: either a clean 4H bounce from $4,500–4,550 or a clean 4H close above $4,950 (for breakout entries). •Expect whipsaws near $4,950; partials at TP1 reduce exposure to false breakouts. •If macro events/US data are due, reduce size or wait for post-event clarity — ETH can gap around high-impact crypto or macro news. •Re-evaluate if price closes below $4,220 on 4H — cut and re-plan. ________________________________________