Technical analysis by MMFlowTrading about Symbol PAXG: Buy recommendation (9/11/2025)

MMFlowTrading

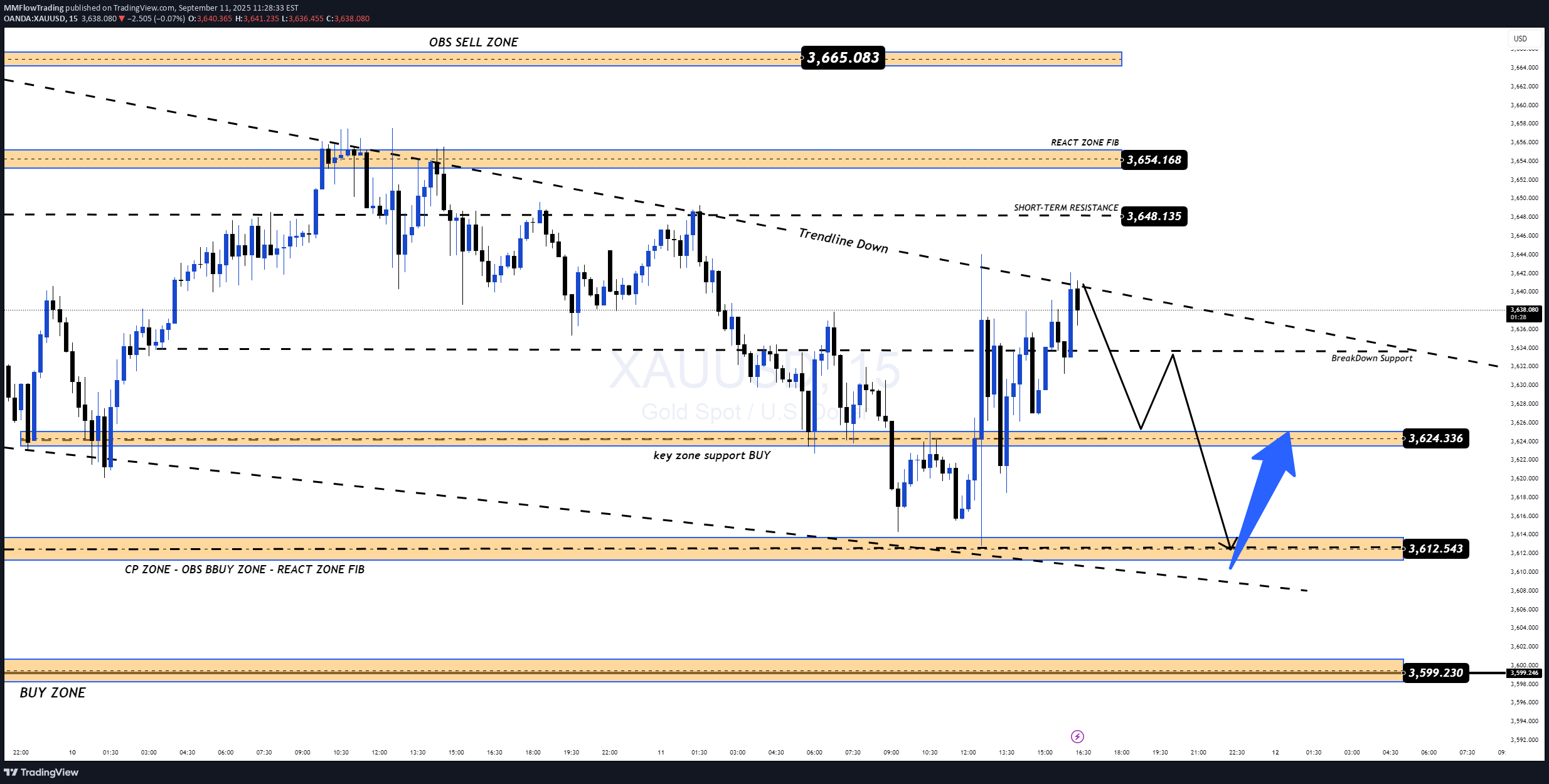

🚀 XAUUSD – CPI Data Breakdown & Professional Insight | MMFLOW TRADING 📊 CPI Results (September) Core CPI m/m: 0.3% (In line with forecast: 0.3%, previous: 0.3%) CPI m/m: 0.4% (Above forecast: 0.3%, previous: 0.2%) CPI y/y: 2.9% (In line with forecast: 2.9%, previous: 2.7%) 📈 MMFLOW Insight – What This Means for Gold (XAUUSD) 1️⃣ Headline CPI Beat Signals Sticky Inflation The uptick to 0.4% m/m surprised markets and indicates inflationary pressures are not cooling as much as expected. This strengthens USD short-term and pushes Treasury yields higher. The initial reaction is selling pressure on gold as traders price in a more hawkish Fed stance. 2️⃣ Core CPI Stability Offers Mixed Sentiment Core CPI staying flat at 0.3% suggests underlying price pressures remain steady. This tempers extreme hawkish expectations, leaving room for gold to recover after initial volatility, especially if yields stabilize. 3️⃣ Medium-Term Implications Despite today’s stronger headline CPI, inflation remains on a downtrend y/y (2.9%), supporting the broader narrative of a Fed pivot in the coming months. Central banks (esp. PBoC & EM countries) continue to accumulate gold, which underpins long-term bullish bias. 🔑 Technical Reaction Zones (M15/M30) Resistance: 3,648 – 3,654 (Trendline/React FIB) Support / Liquidity Zones: • 3,624.33 – Key Zone Support BUY • 3,612.54 – CP/React Zone FIB • 3,599.23 – Major BUY Zone 🛠 Trading Approach After CPI Expect whipsaw price action: an initial spike lower (USD strength) followed by potential recovery if buyers defend liquidity zones. SELL Scalp: Only on strong rejection from 3,648–3,654 with tight SL. BUY Opportunity: Watch for confirmed bounce signals at 3,624 / 3,612 / 3,599. Stay nimble: CPI-induced volatility can sweep both sides before choosing direction. ✅ Summary The hotter CPI print adds near-term pressure to gold, but the overall structure and central bank demand remain supportive. Expect liquidity sweeps before a potential bullish continuation. 👉 Follow MMFLOW TRADING for real-time execution updates, liquidity setups, and professional market insights during this volatile post-CPI session.