Technical analysis by The_STA about Symbol PAXG: Buy recommendation (9/11/2025)

The_STA

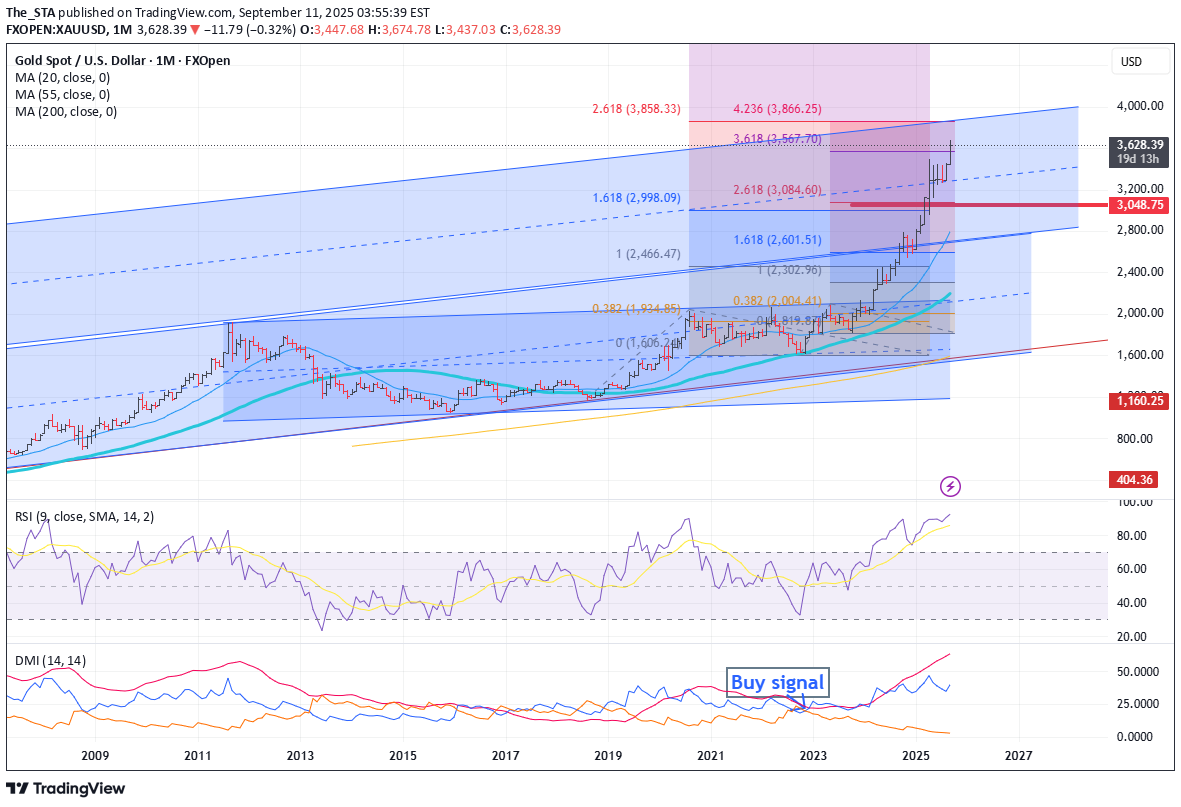

Quick gold update: things are starting to look a little tired up

Quick gold update: things are starting to look a little tired up here. The daily RSI is beginning to roll over, which raises the question—if you're already long, where do you place your stop when nearby support levels are miles away? Personally, I drop down to a shorter time frame like the 4-hour chart and look for what’s consistently held. Since late August, the red baseline on the Ichimoku cloud has done a solid job of supporting the uptrend. If you're after a tighter stop, placing it just below that baseline—around 3,610—could be a reasonable option. Want to give it more breathing room? Then the lower edge of the cloud might be your spot. Either way, it’s time to think about locking in profits. On the monthly chart, our long-term target for gold still sits around 3,850–3,870, where several upside projections and Fibonacci extensions converge. That’s a chunky resistance zone. Also worth noting: the monthly RSI is now at 92. That’s pretty stretched. So if you haven’t already, consider tightening those stops. Disclaimer: The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.