Technical analysis by Henrybillion about Symbol PAXG on 9/10/2025

Henrybillion

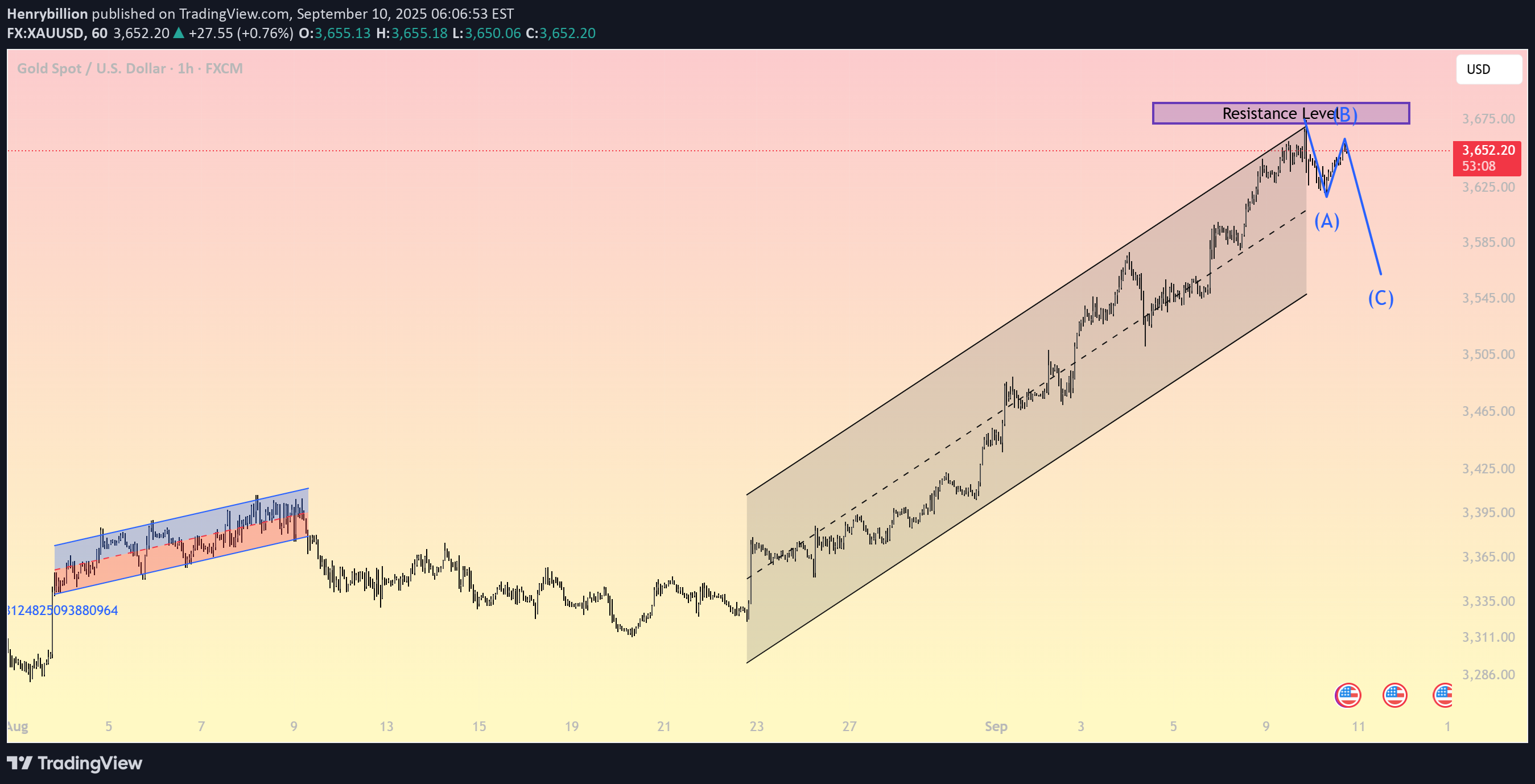

Gold has been in a strong bullish channel since late August, but the current rally is facing a heavy resistance zone at 3,665 – 3,675 USD/oz, where signs of a corrective move are emerging. 1. Technical Outlook Trendline & Channel: Price has been respecting the ascending channel but is now testing resistance and showing weakness. Fibonacci Retracement (from 3,395 → 3,675): 0.382 ~ 3,565 0.5 ~ 3,535 0.618 ~ 3,505 RSI (H1): Overbought (>70) and turning down, suggesting short-term correction. Elliott Wave: A corrective ABC structure is in play. Wave A has started, with Wave C possibly targeting 3,545 – 3,505. 2. Key Levels Resistance: 3,665 – 3,675 Short-term Support: 3,625 – 3,585 Major Support: 3,545 – 3,505 (confluence with Fibonacci 0.5 – 0.618) 3. Trading Strategies Short-term Sell Setup: Entry: 3,655 – 3,665 (resistance zone) TP1: 3,585 TP2: 3,545 – 3,505 SL: 3,685 Medium-term Buy Setup (Buy Limit Strategy): Entry: 3,545 – 3,505 (support & Fibo cluster) TP: 3,625 – 3,665 SL: below 3,485 4. Conclusion Gold is likely entering a corrective phase after testing the strong resistance zone. Traders may consider shorting near resistance and buying back at deeper support levels. - Keep these resistance–support levels on your chart for today’s trading plan, and follow along for more updated strategies.