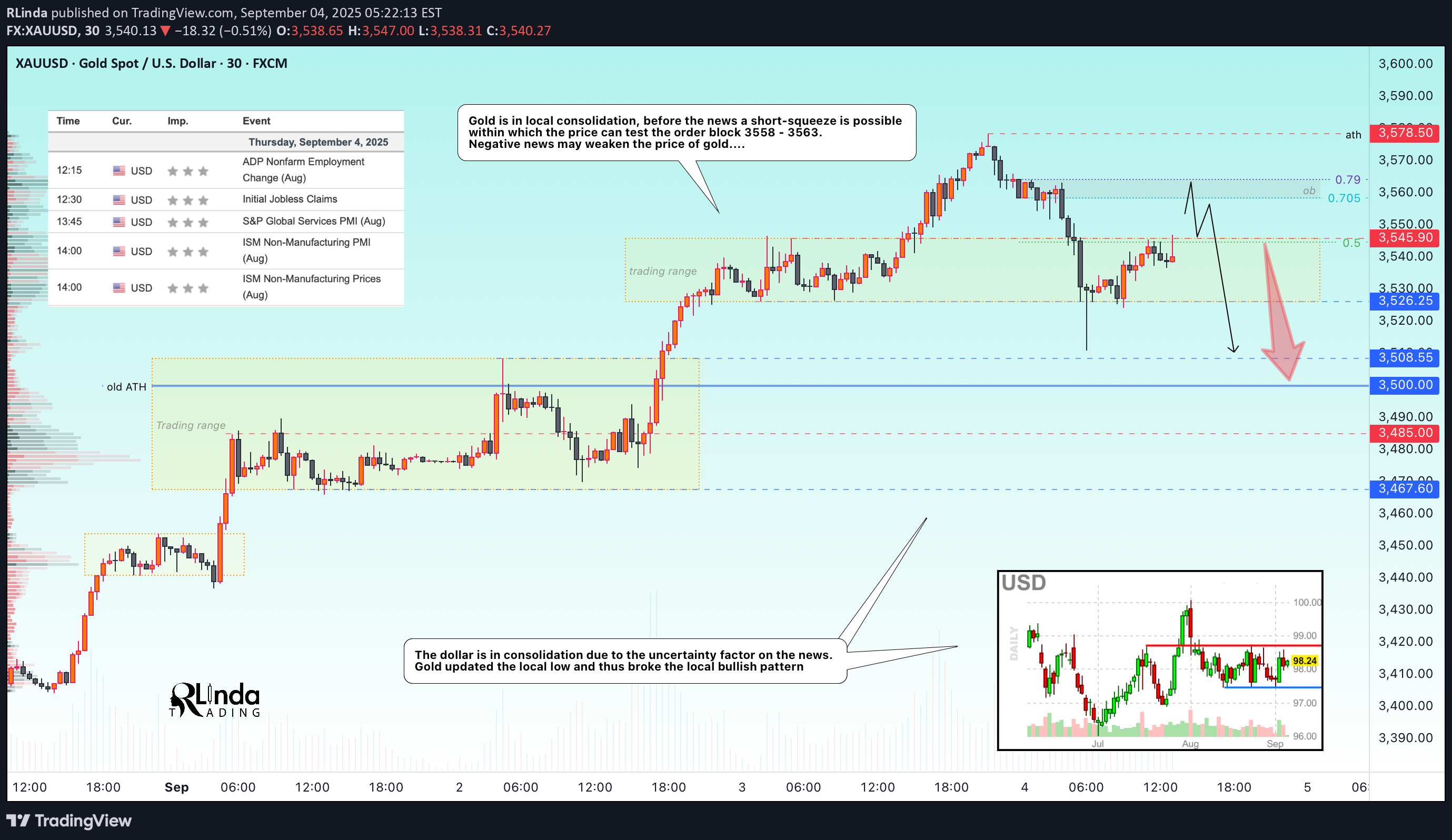

Technical analysis by RLinda about Symbol PAXG on 9/4/2025

RLinda

XAUUSD after updating another high to 3578 went into the phase of profit taking before two busy news days. The trend is aggressively bullish, but the risks of correction are quite high due to the uncertainty factor.... The price pulled back from record highs amid profit taking and reduced panic in the bond market. The dollar stabilized, but remains under pressure due to expectations of Fed rate cuts this year. The key event will be the publication of US employment data (NFP) on Friday. A correction after a sharp rise is a natural reaction, but the expectation of Fed policy easing is supporting the metal's price. Geopolitics: Trade risks (Trump's tariffs) mitigate gold's fall. Gold's correction so far looks like a pause before further movement. The main driver is NFP data, which will determine Fed rate sentiment and USD direction. But, today all eyes are on ADP Nonfarm, Initial jobless claims, and ISM data. Unexpected data may intensify the sell-off.... Resistance levels: 3546, 3559, 3563 Support levels: 3526, 3508 It is difficult to determine the news reaction in advance, we will have to orient ourselves after the fact. Technically, I expect a deeper correction for a healthy market. I expect a retest of the 3560 zone and further decline to local liquidity zones. Regards R. Linda!