Technical analysis by ProjectSyndicate about Symbol PAXG: Buy recommendation (9/4/2025)

ProjectSyndicate

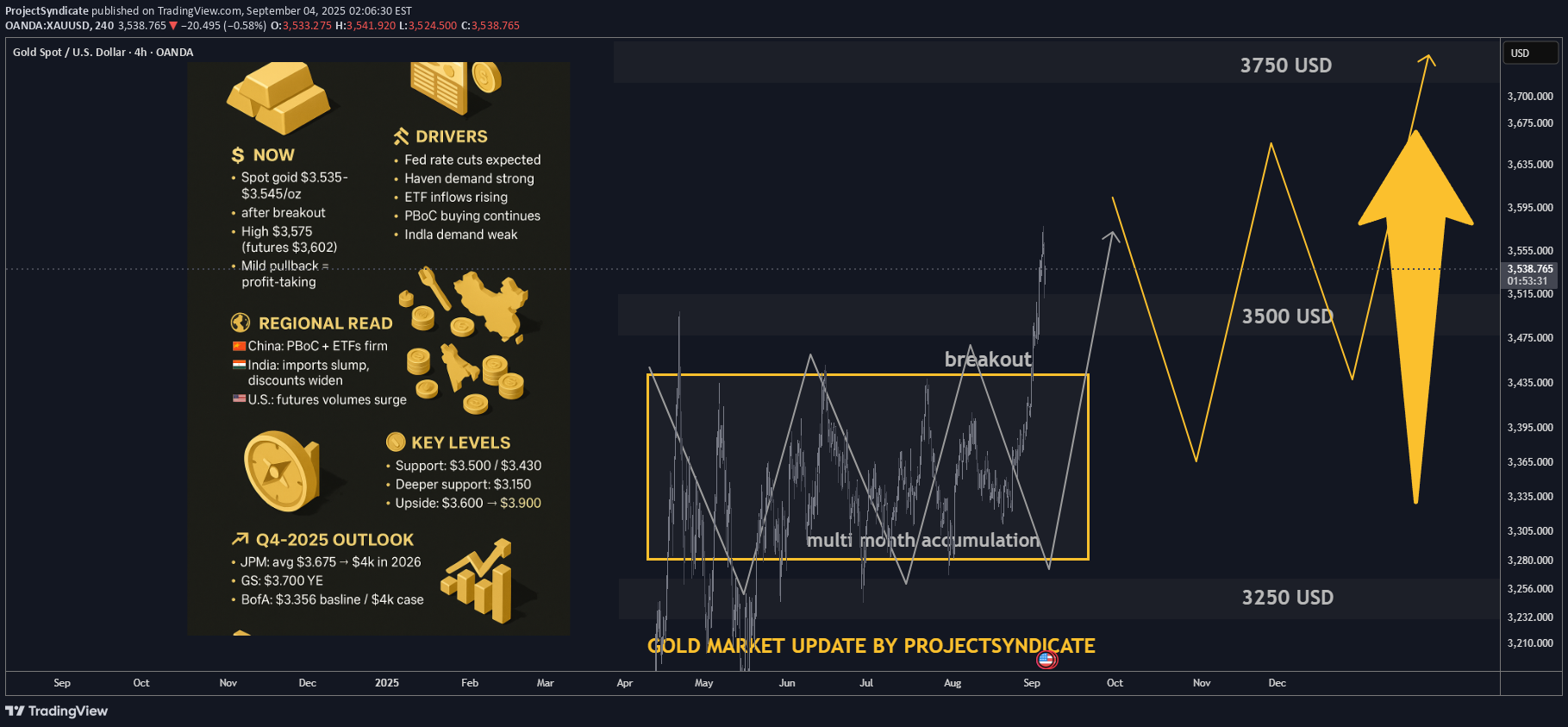

💰 Gold Prices Live Update • Spot gold consolidating $3,535–$3,545/oz, after a decisive breakout above the multi-month range ($3,300–$3,450). • Fresh all-time highs were set this week, with spot hitting $3,575 and U.S. futures spiking to $3,602 intraday. • Current pullback appears mild and orderly, suggesting profit-taking post-breakout rather than trend reversal. ________________________________________ 📰 Fresh headlines • Gold powers to record highs on safe-haven demand. • Breakout above $3,500 confirms bullish momentum. • Futures hit $3,600+ as central banks, ETFs add to positions. • Weekly close strong despite pullback, as rate-cut bets intensify. • ETF holdings surge to highest since 2022; central banks remain active buyers. • Analysts eye $3,600–$3,900 near-term targets. ________________________________________ 🔧 What’s driving the breakout • Technical breakout: Months of range-bound trade ($3,300–$3,450) built a strong base; breach above $3,500 unleashed momentum buying. • Macro tailwinds: Fed rate-cut expectations and falling real yields are lifting gold’s appeal. • Haven demand: Political tensions and policy uncertainty amplify defensive flows. • Institutional support: ETF inflows accelerating, GLD holdings climbing. • Official sector: PBoC and other central banks continue steady accumulation. • Physical drag: India demand subdued at elevated prices; local imports hit multi-year lows. ________________________________________ 🌍 Regional quick read • 🇨🇳 China: PBoC extends buying streak; local ETFs resilient. • 🇮🇳 India: Imports at 2-year low, physical discounts widen as prices bite. • 🇺🇸 U.S.: Futures volumes surge on breakout; non-farm payrolls eyed for near-term volatility. ________________________________________ 🧭 Key levels • Immediate support: $3,500 (psychological + breakout retest). • Secondary support: $3,430 (prior range top). • Deeper pullback zone: $3,150 (major base support if correction extends). • Upside targets: $3,600 already tested; $3,750–$3,900 in play if flows persist. • Positioning: Open interest + volumes confirm breakout conviction; current dip orderly. ________________________________________ 🔭 Q4-2025 outlook • JPMorgan: avg $3,675, path to $4,000 in 2026. • Goldman Sachs: $3,700 by year-end. • BofA: $3,356 baseline, $4,000 stretch case. • Citi: Near-term $3,500+, but warns of risks if demand fades. • Consensus: $3,500–$3,750 base case; bullish tail $3,900, bearish tail $3,250–$3,400. ________________________________________ 🧱 Risks & swing factors • U.S. payrolls + Fed meeting: Short-term catalysts for volatility. • ETF flows + lease rates: Critical to sustaining momentum. • Geopolitical noise: Keeps haven demand sticky. • Physical demand weakness: Especially in India, could cap rallies. ________________________________________ ⚡ Key takeaways • 💥 Breakout confirmed: Gold shattered the $3,300–$3,450 range, powered through $3,500, and tagged $3,575 — clearing multi-month resistance. • 📈 Pullback healthy: Current drift lower looks like mild profit-taking, not distribution. • 🏦 Flows remain bullish: Central banks + ETFs underpinning the rally. • 🧭 Q4 outlook intact: $3,500–$3,750 base case; $3,900 bullish tail / $3,300 bearish tail. • 🇮🇳 Physical demand soft: Indian weakness may keep rallies from overheating.Blueprint to Becoming a Successful Gold Trader in 2025