Technical analysis by FXOpen about Symbol NVDAX on 9/1/2025

FXOpen

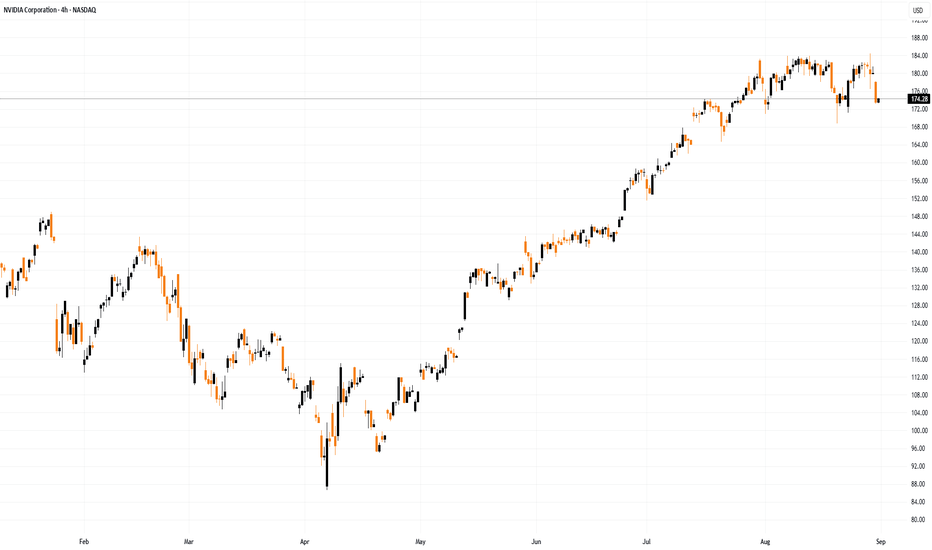

Nvidia (NVDA) Shows Bearish Signs After Earnings Release On Wednesday, Nvidia published a fairly strong quarterly report: → Revenue for the second quarter came in at $46.74 billion (record), up 56% compared with the same period last year; → Adjusted earnings per share (EPS) were $1.05, a 54% year-on-year increase and above analysts’ expectations of $1.01–$1.02. However, in the Data Centre segment (closely watched by the market), results fell slightly short of Wall Street forecasts, which may suggest a slowdown in capital flows into AI infrastructure. This factor could explain why Nvidia (NVDA) underperformed the index later in the week: for instance, the S&P 500 hit a record high on Thursday, while NVDA closed lower. Technical analysis of Nvidia (NVDA) chart Six days ago, we: → Drew an upward channel (shown in blue), capturing NVDA’s price swings after the bullish surge at the end of June; → Highlighted the importance of support at $170 and resistance at $183. Indeed, $183 looks like a solid barrier: → The numbers (1, 2, 3) mark failed attempts by the bulls to break through this resistance, giving grounds to view the chart in the context of a triple top pattern. → The third peak only slightly exceeds the previous highs, which resembles a bull trap and the Upthrust After Distribution (UTAD) pattern in Richard Wyckoff’s methodology, signalling the prospect of lower prices. A bearish gap the following day (shown by the red arrow) and a weak Friday close underline the bears’ aggression. Given the above, we could assume that the bulls may try to keep the price within the channel, relying on support at its lower boundary. Yet the mentioned signals suggest that the bears are intensifying pressure. If we see only a weak rebound from the lower boundary at the start of September, the current channel could be at risk. In the event of a bearish breakout, a move down to test the $170 support could happen. This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.