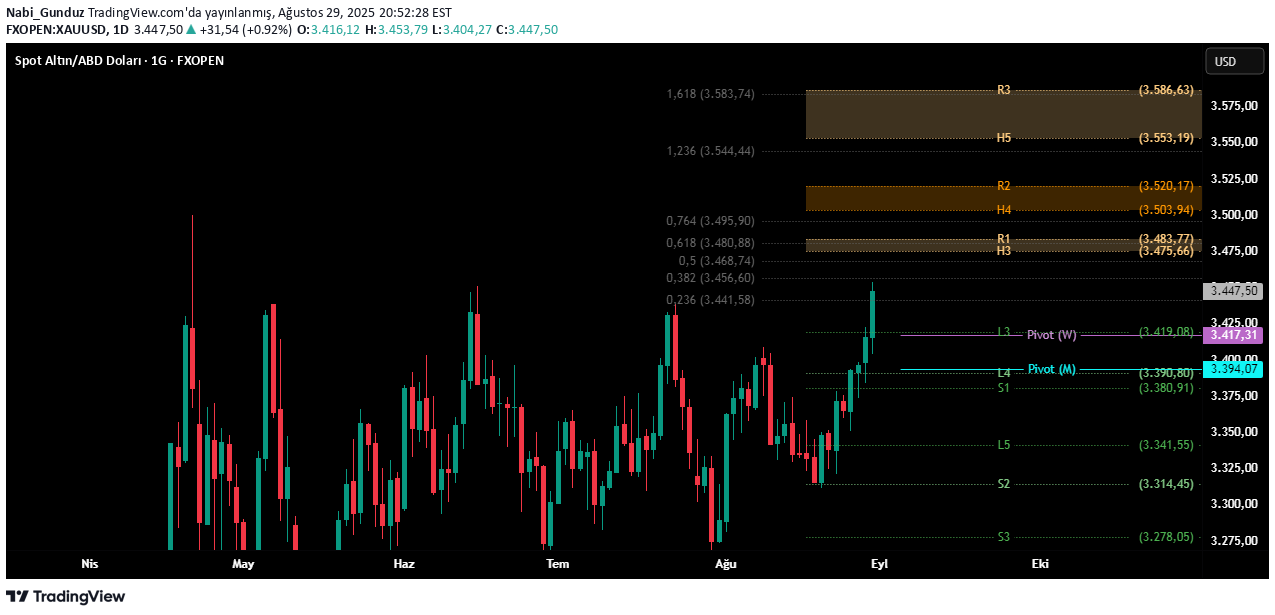

Technical analysis by Nabi_Gunduz about Symbol PAXG on 8/30/2025

Nabi_Gunduz

Hello, Weekly Pivot: 3417.31 Monthly Pivot: 3394.07 It is not technically accurate to open a private process without daily candle closure below 3417.31 next week. Likewise, it will not be technically correct in September without seeing the weekly candle closure under 3394.37 in September. In the graph, you see the weekly mathematical levels that you will follow with daily candle closures. The weekly pivot in 3417 and Camarilla Reversal Level L3 levels in 3419 should be followed as an important support zone next week. In case of retreats that may happen to this region, the purchase process can be opened provided that it is under 3417, provided that it is stop. On the other hand, the region of 3475 - 3483 is the first resistance zone where the price will face. After the daily closing of 3483.77, this region will be transformed into support zone and the above regions will be the target. In the comments section below, I will share and interpret a few more graphics. Probably after examining all these shares, you will be able to have an idea about Ons Gold ... Triangle Breeding and Market Break (MSB) In this graph, you can see the possible goals of the formation ... The triangular breakdown in the weekly time period has been realized, but the formation will be active ... Although the suspect required us to look, the pennant structure has been broken and activated ... FVG regions ... Fracture of the rise formation and possible goals ...