Technical analysis by Alexgoldhunter about Symbol BTC: Buy recommendation (8/29/2025)

Alexgoldhunter

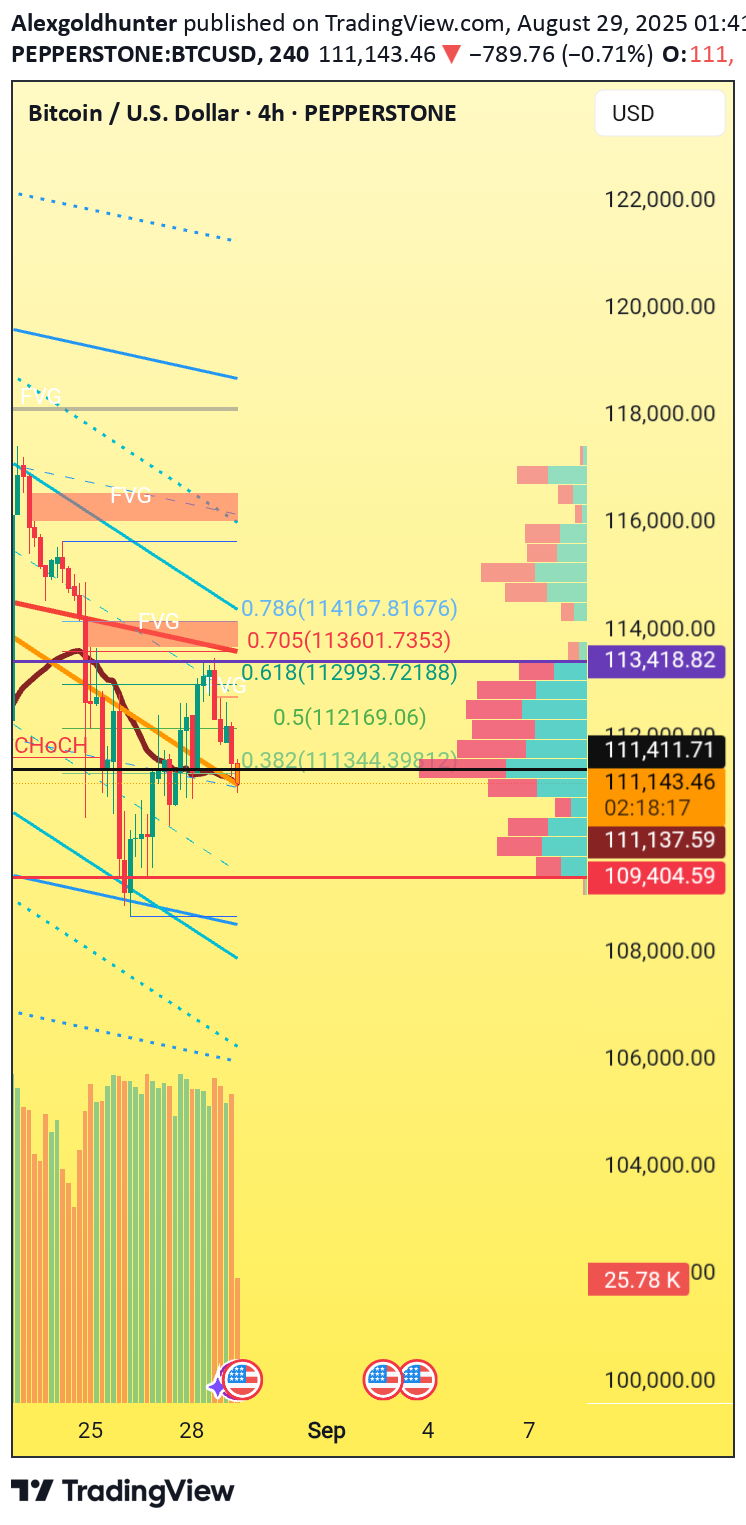

Liquidity Engineered | Wave 5 Ignition Zone

XAUUSD Liquidity Engineered | Wave 5 Ignition Zone 🧠 Smart Money Concepts (SMC) ChoCH (Change of Character) is clearly marked, signaling a shift from bullish to bearish structure. Fair Value Gap (FVG) near 116k suggests unmitigated institutional imbalance—likely a magnet for price. Liquidity Zones: Price recently swept below a prior low near 111k, hinting at engineered liquidity grab before reversal. Order Block: Bullish OB sits just below 111k, aligning with the 0.5 Fibonacci level—potential mitigation zone. Trap Setup: The sweep below 111k followed by a sharp recovery could be a classic “stop hunt” before rallying into premium. 🌊 Elliott Wave Theory Wave Count: Appears to be in Wave 4 corrective phase after a strong impulsive Wave 3. Corrective Structure: Likely forming a flat or expanded flat, with Wave C targeting the 0.786 retracement (~116.1k). Forecast: If Wave 5 initiates, expect a push toward 118k–120k zone, aligning with volume profile resistance. 📈 Dow Theory Primary Trend: Higher highs and higher lows confirm an uptrend. Volume Confirmation: Volume spikes align with bullish moves, supporting accumulation phase. Divergence: Dow’s bullish structure slightly contradicts SMC’s ChoCH—suggesting short-term bearish trap within a larger bullish context. 🕯️ Candlestick Patterns Engulfing Candle near 111k zone supports bullish reversal. Pin Bar rejection at 0.618 level (~113k) adds confluence for upward momentum. Inside Bar formation near 112k signals consolidation before breakout. 📊 RSI Analysis Current RSI: Hovering near 40–45, approaching oversold territory. Bullish Divergence: RSI forming higher lows while price made lower lows—classic reversal signal. Multi-Timeframe Confluence: 4H and 1D RSI both show bullish divergence—strengthens reversal thesis. 📉 MACD Analysis MACD Crossover: Bullish crossover forming, histogram shifting from red to green. Momentum Shift: Histogram shows decreasing bearish momentum—potential start of Wave 5. MACD Divergence: Price made lower lows while MACD made higher lows—supports bullish bias. 🚀 BTC/USD Long Setup Buy Entry: 111,400 TP1: 113,800 TP2: 116,000 SL: 110,200 🧭 Actionable Insights & Psychological Checkpoints Confluence Zone: 111k–113k is a high-probability reversal pocket supported by SMC, Elliott Wave, RSI, and MACD. Risk Management: SL below OB and liquidity sweep ensures protection against deeper manipulation. Mindset Tip: Stay disciplined—don’t chase candles. Let price confirm with volume and structure before entry. Watch for: Break above 113k with volume = confirmation of Wave 5. Failure = possible deeper retracement. ⚠️ Disclaimer:This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Trading involves risk, and past performance is not indicative of future results. Always conduct your own research and consult with a licensed financial advisor before making investment decisions. The author is not responsible for any financial losses incurred from trading decisions based on this content.