Technical analysis by ULYSSESTRADER about Symbol ENS: Buy recommendation (8/27/2025)

ULYSSESTRADER

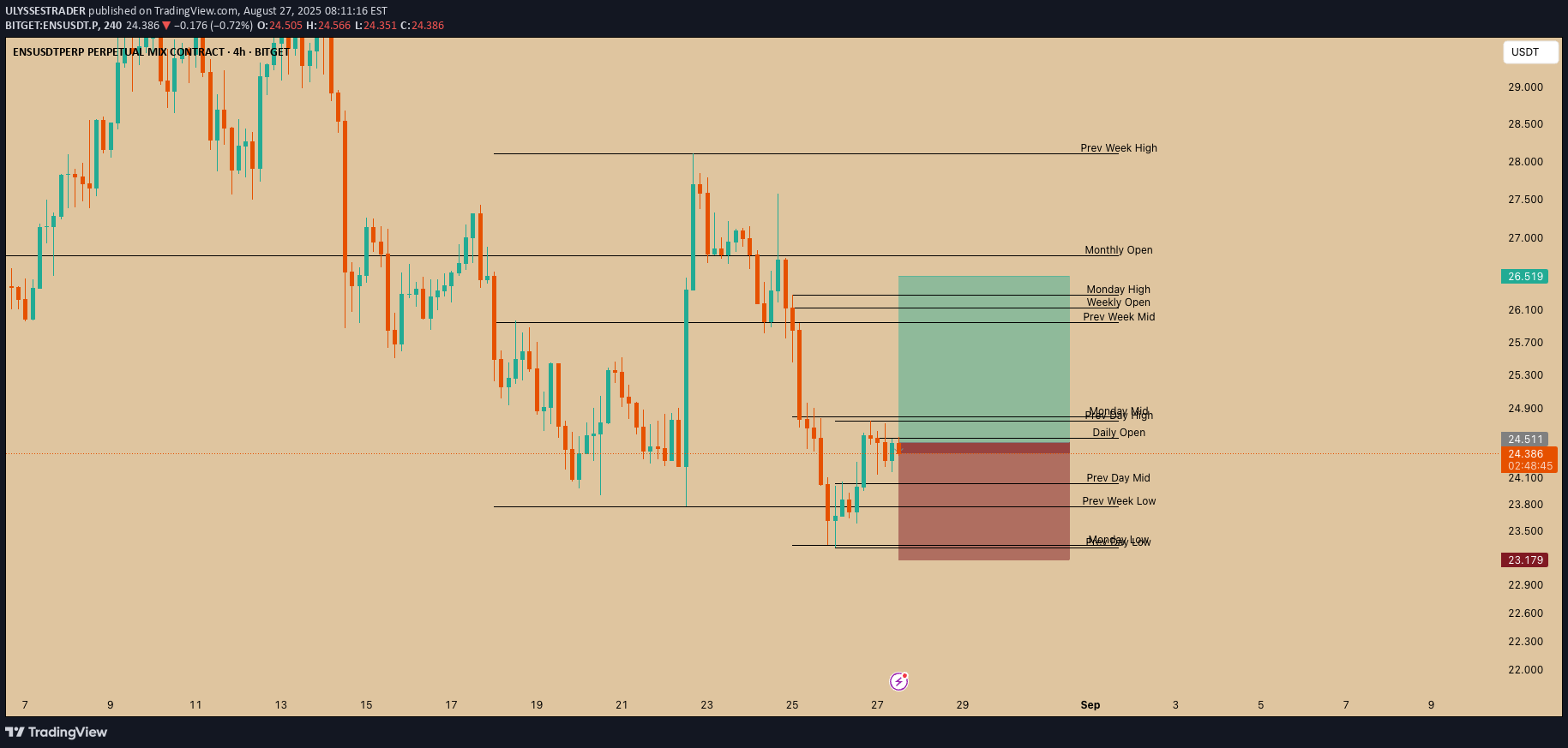

1. Chart Context Pair: ENS/USDT (Perpetual Futures, Bitget). Timeframe: 4H. Current Price: Around $24.39. Bias: Long setup with defined entry, stop loss, and target. 2. Key Levels Marked Daily/Weekly/Monday Opens: Important intraday reference points (act as magnets for price). Prev Week High/Low/Mid: Show where liquidity may rest (potential reversal zones). Prev Day Mid: Useful intraday pivot. Monthly Open: Higher timeframe bias confirmation. 3. Trade Setup Entry Zone: Around $24.40 (just above Daily Open & Monday Mid). Stop Loss: Around $23.18 (below Monday Low & Prev Week Low). Take Profit: Around $26.52 (near Weekly Open & Monday High cluster). This creates a Risk:Reward ratio of ~2.5–3:1. 4. Reasoning Behind Long Liquidity Sweep: Price previously dipped below the Prev Week Low and Monday Low, grabbing liquidity before bouncing. Reclaim of Daily Open: If price sustains above $24.5, it shows bullish momentum. Targeting Untapped Liquidity: Next liquidity zones lie around Prev Week Mid, Weekly Open, and Monday High (~$26.5). Higher Timeframe Confluence: Monthly open is above ($27), supporting long bias if momentum builds. 5. Trade Logic in Words The trader expects ENS to hold above the Daily Open after a liquidity grab below last week’s low. With that support confirmed, price is likely to push toward the Weekly Open & Monday High cluster, giving a clean long opportunity. Stop is safely below recent lows, ensuring protection if price rejects. ✅ In short: This setup bets on ENS holding the $24 zone and pushing toward $26.5+, with a favorable R:R.