Technical analysis by ULYSSESTRADER about Symbol POL: Buy recommendation (8/25/2025)

ULYSSESTRADER

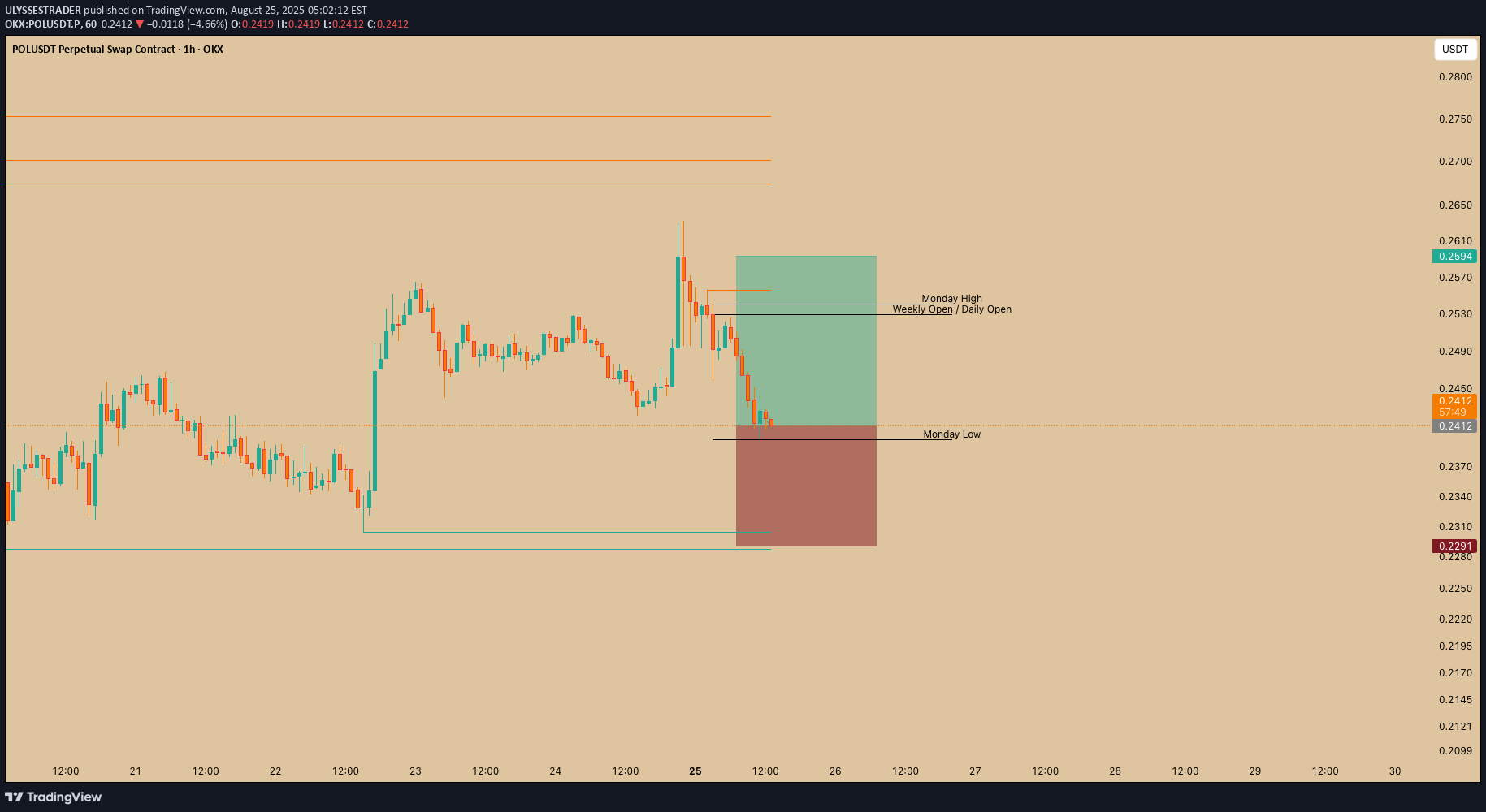

1. Chart Context Pair: POL/USDT Perpetual Swap on OKX Timeframe: 1H Current Price: ~0.2415 USDT Bias: Long (buy) setup 2. Key Levels Weekly Open / Daily Open (~0.2490–0.2500): Important level of interest for bulls; if reclaimed, it strengthens the long thesis. Monday High (~0.2525): First liquidity target above. Monday Low (~0.2410): Currently acting as short-term support. Stop Loss (~0.2291): Below prior liquidity zone to invalidate the long. Take Profit (~0.2594–0.2610): Target aligned with previous resistance area. 3. Trade Setup Entry Zone: Around 0.2410–0.2420 (near Monday Low). Stop Loss: At 0.2291, below the structure and liquidity sweep area. Take Profit: At 0.2594–0.2610, above Monday High and near prior resistance. Risk/Reward Ratio: Roughly 1:2.5 (highly favorable). 4. Rationale Price swept liquidity near Monday Low, trapping shorts and offering a favorable long entry. Strong support confluence at Monday Low with risk defined just below. Upside targets are clearly mapped to Monday High → Weekly Open/Daily Open → Resistance levels (~0.2610). Momentum suggests potential mean reversion after the sharp decline. ✅ In summary: This is a high R:R long setup with entry near 0.2410, invalidation at 0.2291, and targets up to 0.2610. The trade thesis is based on liquidity sweep and reclaiming key opens.