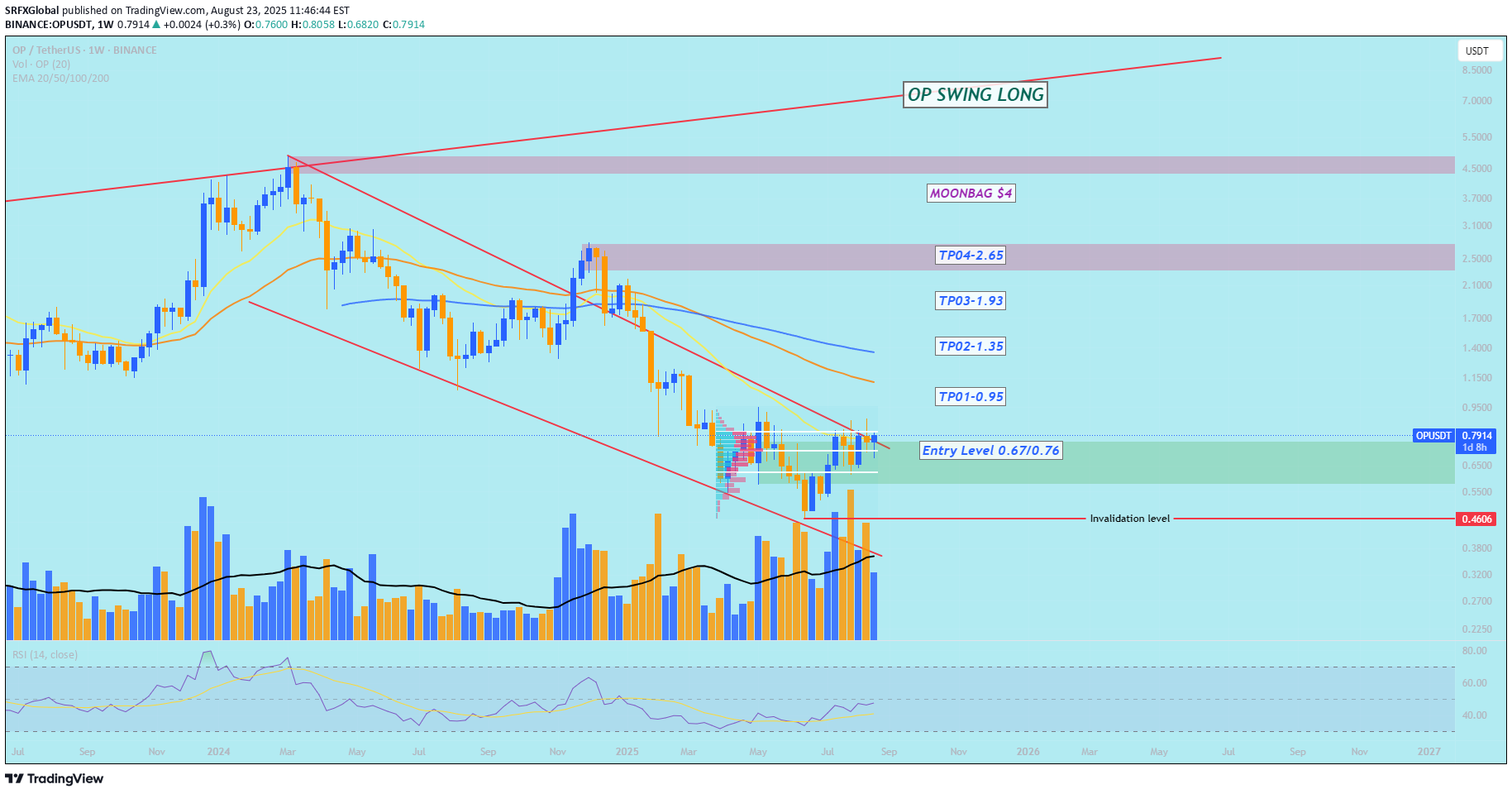

Technical analysis by SRFXGlobal about Symbol OP: Buy recommendation (8/23/2025)

OP SWING LONG SETUP!

Summary / bias - Bias: cautiously bullish (swing long) while price respects the 0.67–0.76 buy zone and shows confirmation on the weekly timeframe. ⏰✅ - Context: after 21 weeks in a range, price is attempting a breakout from the OP range — a logical place for swing entries if the breakout holds. Entry / setup - Buy area: 0.67–0.76 — considered a tactical buying zone on a retest or within-range entry. 💶/💵 - Preferred trigger: weekly candle close within or above the buy zone with supporting momentum (better) — otherwise consider scaling in or waiting for confirmation. Invalidation / stop - Invalidation level: weekly close below 0.4606. Use this to define your hard stop and position size so risk per trade matches your rules. ❌⚠️ - Note: invalidation is “weak” (large distance) — size positions accordingly and consider smaller allocation or staggered entries. Targets / profit-taking - Primary TPs (take partial profits at each): - TP1: 0.95 🎯 - TP2: 1.35 🎯 - TP3: 1.93 🎯 - TP4: 2.65 🎯 - Moongbag zone (longer-term hold): 4.00–4.25 — strong supply zone for very long-term exposure or leftover position. 🌙💰 Trade plan (simple) - Entry: buy within 0.67–0.76 (or wait for weekly confirmation above this area). - Stop: below weekly close 0.4606 (set based on your risk tolerance). - Exits: scale out at TPs listed above; consider trailing stops after TP2 to protect profits. - Position sizing: because invalidation is far, size so the dollar risk is acceptable (e.g., 1–2% of account per trade). Confirmation checklist (before committing) - Weekly close in/above buy zone? ✅ - Momentum supporting the move (RSI rising, bullish candle structure)? ✅ - Volume (or other flow metrics) supportive on breakout/retest? ✅ Risks / things to watch - False breakout: after 21 weeks of range, expect chop and possible pullbacks — rejection at the buy zone or higher resistance can occur. - Macro/news: large events can trigger whipsaws — avoid entering right before high-impact data if you can. - Wide invalidation: keep position size conservative because stop is distant. - Use discipline: scale into positions if unsure, take partial profits at each TP, and trail stops to protect gains. Final note - This is a viable swing-long edge while price respects the 0.67–0.76 area and weekly confirmation occurs. Trade wisely, manage risk, and adapt if price structure changes. Good luck, traders! 🍀📈 Please follow your strategy and updates; this is just Our Idea, and We will gladly see your ideas in this post. Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe. OPUSDT