Technical analysis by SupertradeOfficial about Symbol PAXG: Sell recommendation (8/21/2025)

Gold’s Shine Is Fading: XAUUSD Signals Steep Drop Ahead

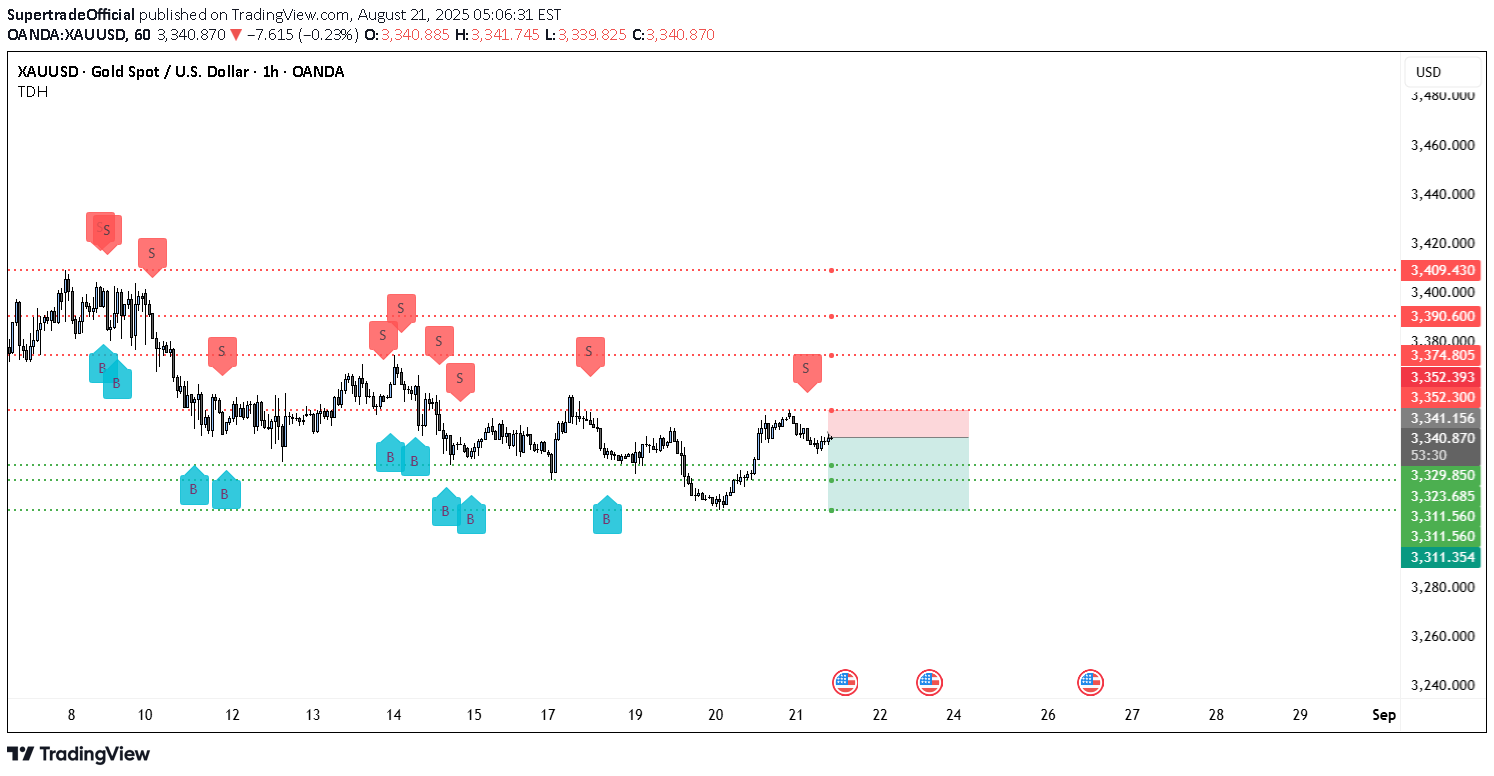

Gold has been in a persistent downtrend on the 1-hour: a sequence of lower-highs from the left of the chart keeps price capped beneath stacked supply. The latest bounce ran into the 3,352 area, which aligns with a prior breakdown and a red dotted resistance line. That area has repeatedly attracted “S” (sell) signals on your chart, confirming it as the near-term ceiling. Price is now rotating lower from just under that band, keeping the bearish structure intact while we hold below it. Key Levels Resistance stack above: 3,352.300 / 3,352.393 (immediate), then 3,374.805, 3,390.600, and 3,409.430. This ladder of red lines shows heavy overhead supply—each rally has met sellers sooner. •Current pivot: Price is sitting around 3,341.310 (blue price marker), just under micro resistance at 3,341.156. •Supports below / profit magnets: 3,329.850 → 3,323.685 → 3,311.560 → 3,311.354 (green dashed cluster). These are the levels price has respected on prior sweeps and where buyers previously appeared. Structurally, the retest-and-roll from ~3,352 looks like a classic bearish continuation: a rally into prior supply, failure to clear, and a drift back toward the green support band. The distribution of “S” markers near 3,352–3,375 and “B” markers only at the lows underscores that sellers control the mid-range. Until bulls can reclaim and hold above 3,352.393, the path of least resistance remains down. You’ve also got U.S. event ahead on the timeline (those small flags), which often spike intraday volatility in XAUUSD. Into those releases, fading into resistance and locking partials into nearby supports is the higher-probability play versus chasing moves. ________________________________________ 🎯 Trading setup (from your chart) •Entry: 3,341.310 (≈ current level) •Stop-loss: 3,352.300 (aggressive) or just above 3,352.393 (safer buffer) 🔒 •Take-profits (scale out): oTP1: 3,329.850 (≈ 1.0R) oTP2: 3,323.685 (≈ 1.6R) oTP3: 3,311.560 (≈ 2.7R) oStretch: 3,311.354 Management idea: If price accepts below 3,341.156, consider moving stop to breakeven; then trail above lower highs as you tag 3,329.850 and 3,323.685. Book small profits 💰 at each objective and let a runner attempt the deeper supports. ________________________________________ Invalidation & alternate path A 1H close back above 3,352.393 would neutralize the immediate short and put 3,374.805 back in play; above that, 3,390.600 → 3,409.430 are the next supply shelves. If that reclaim happens, the short thesis is invalid—step aside and reassess rather than fight the tape. ________________________________________ Risk note (important) XAUUSD can whip around on data and headlines. Size positions to your risk tolerance, keep risk per trade fixed, and take the wins early when the market offers them—especially into those green dashed supports. Consistently booking small profits and protecting capital is how you stay in control during a trend day.