Technical analysis by TotoshkaTrades about Symbol PAXG: Sell recommendation (8/21/2025)

TotoshkaTrades

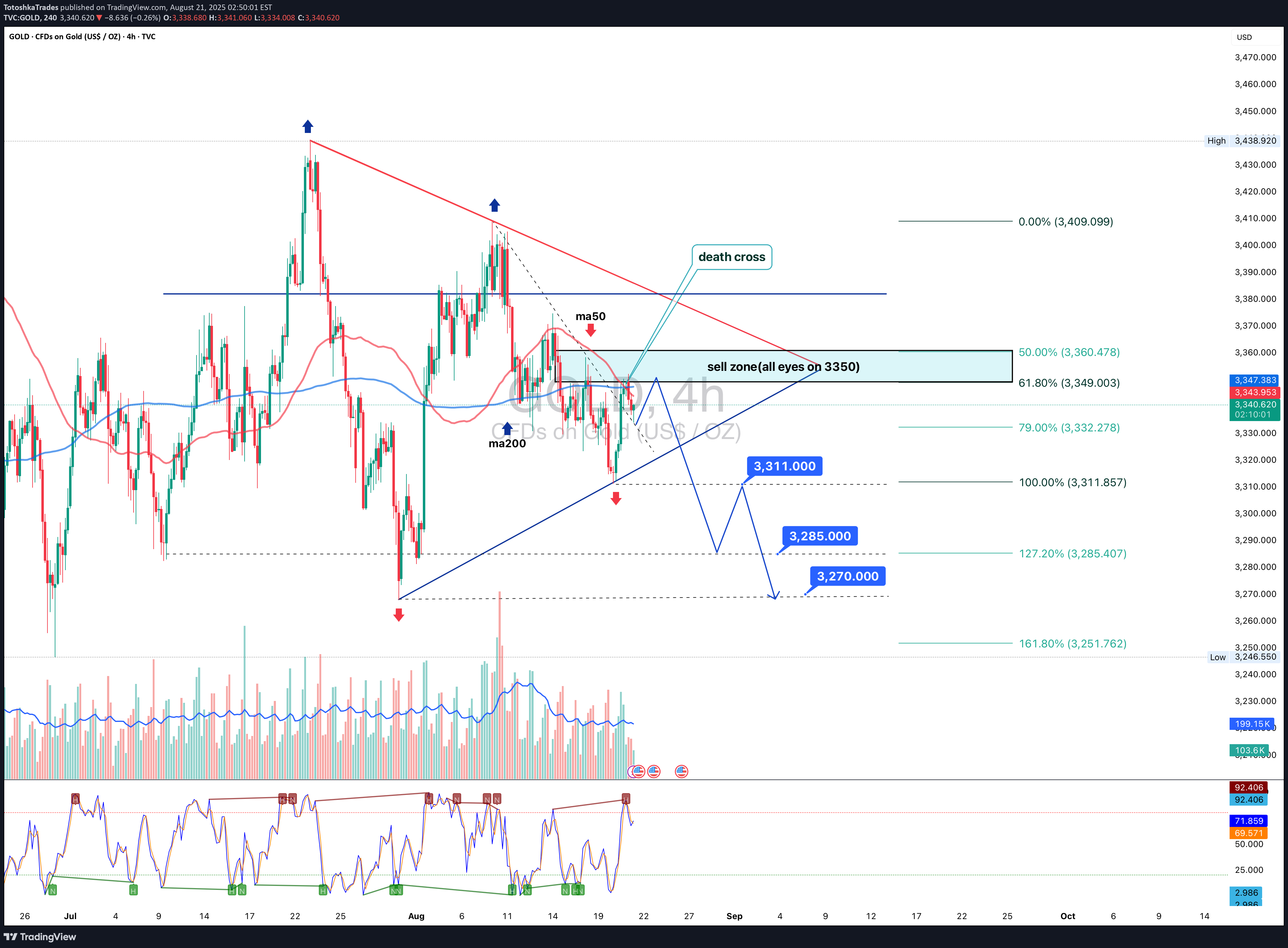

GOLD 4H - all eyes on 3350, death cross at work

The technical picture on gold strengthens the bearish case: on the 4H chart, a death cross (MA50 crossing MA200 downward) has formed, signaling short-term pressure from sellers. The key sell zone is 3350, where the 0.618 Fibonacci, descending trendline, and volume cluster converge. From here, a downward move is expected with first targets at 3311, then 3285, and extended potential towards 3270 (127.2–161.8 Fibo). Volume confirms declining buyer interest near local highs, while RSI shows reversal divergence, adding weight to the bearish scenario. Fundamentally , gold is under pressure as the market factors in the possibility of more aggressive Fed actions if inflation risks persist. At the same time, safe-haven demand is weakening due to DXY stabilization. Geopolitics is not providing immediate triggers for gold hedging, which also cools investor interest. Tactical plan: if 3350 acts as resistance, it opens an attractive short opportunity toward the mentioned targets. However, if price breaks and consolidates above 3350, the scenario must be reassessed as stop-hunting will begin. Ironically, gold - the eternal store of value - acts like a teenager again: offended at 3350 and ready for a tantrum downwards.