Technical analysis by lonelyPlayer0 about Symbol PAXG: Sell recommendation (8/20/2025)

lonelyPlayer0

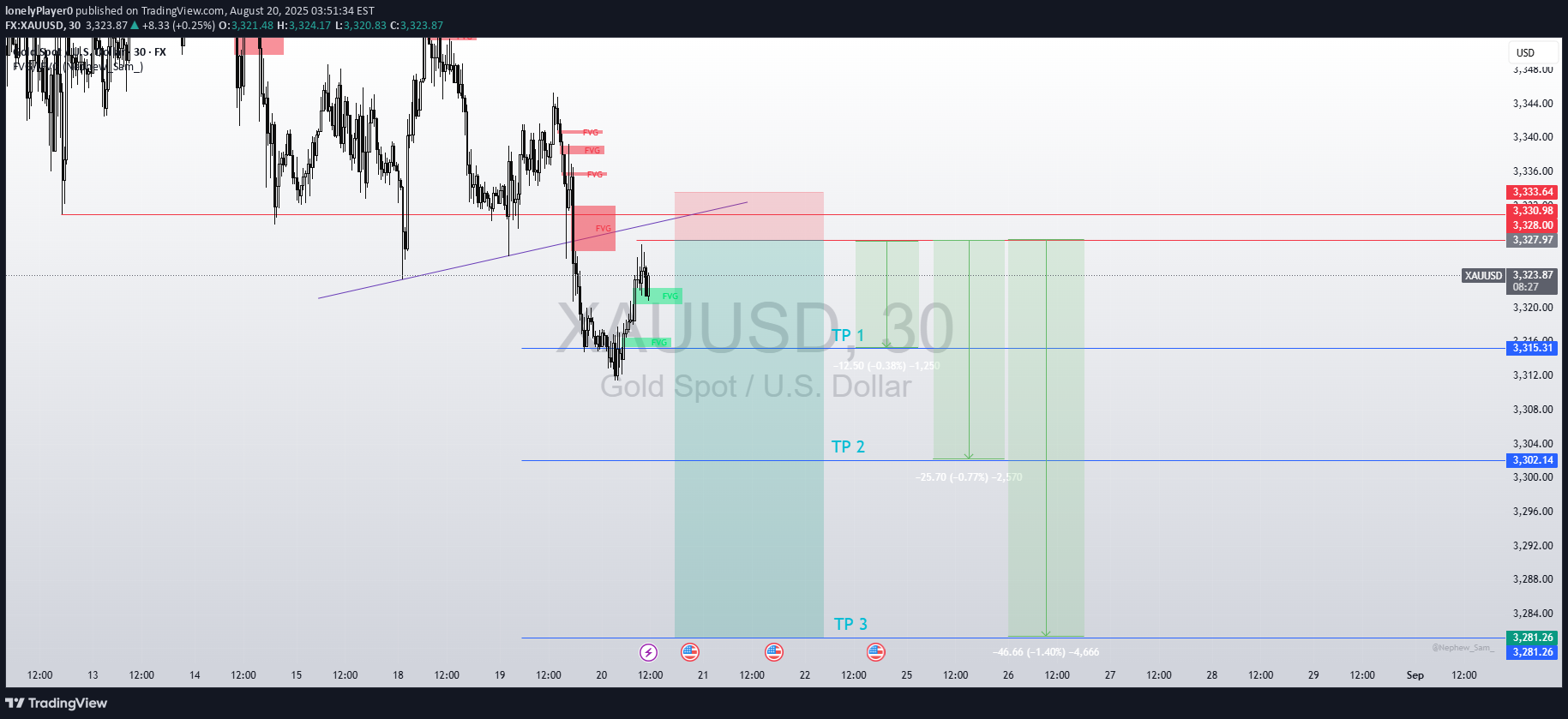

Gold: Correction & Retest of Broken Level

1. Fundamental Outlook Gold is trading close to $3,300, its lowest level in the past three weeks, as market participants remain cautious ahead of key U.S. monetary policy signals. The current weakness is not only tied to technical flows but also to expectations regarding the Federal Reserve’s policy stance. Despite signs of a slowing labor market and softer inflation figures, investors believe that the Fed may resist adopting an overly aggressive easing cycle. The upcoming release of the Fed minutes and, more importantly, Jerome Powell’s speech at the Jackson Hole Symposium, will likely determine the next big move for gold. Until then, sentiment remains defensive, and investors are reluctant to commit to large positions. 2. Dollar Dynamics The U.S. dollar has been strengthening, exerting downward pressure on gold. Several factors are contributing to this: Policy Expectations: Markets still assign around an 85% probability of a September rate cut, but traders expect Powell to signal caution and avoid endorsing steep or rapid cuts. Housing Market Resilience: Strong housing data has reinforced confidence in the U.S. economy, giving further support to the dollar. Geopolitical Headlines: News of potential Ukraine negotiations added a layer of optimism for risk sentiment, while also supporting the dollar as investors adjust safe-haven allocations. As long as the dollar maintains this upward momentum, gold is likely to face headwinds, with upside moves limited to corrective rallies. 3. Technical Setup From a technical standpoint, gold is in the process of a correction following a bearish rally. This corrective phase is characterized by short-term rebounds toward local resistance zones, but without a confirmed breakout, the overall bias remains negative. Resistance Levels: 3328, 3331, 3345 Support Levels: 3314, 3300, 3270 The correction could bring gold to test the 3328–3345 resistance zone. However, if the price fails to sustain above these levels, the risk of renewed selling pressure increases. A confirmed breakdown below 3300 would expose the 3270 area, which serves as the next major downside target. In short, unless gold can establish firm support above 3345, the path of least resistance remains lower. 4. Key Events to Watch The most critical driver for gold in the near term is Jerome Powell’s speech at Jackson Hole on Friday. Investors will focus on whether Powell signals a cautious approach—supporting the dollar—or hints at policy flexibility, which could provide temporary relief for gold. Additionally, the Fed minutes release will be analyzed for any details on how policymakers view the balance between inflation risks and economic weakness. Beyond monetary policy, continued monitoring of U.S. economic data releases and geopolitical developments (particularly around Ukraine) will remain essential for short-term positioning in gold. ✅ Conclusion: Gold remains under pressure, weighed down by a stronger dollar and uncertainty around Fed policy. While technical corrections may push prices higher in the short term, the broader outlook remains cautious. The 3300 level is pivotal—holding above it could allow for a corrective bounce, while a break below may accelerate declines toward 3270. The decisive trigger, however, will come from Powell’s comments at Jackson Hole, which are likely to set the tone for gold’s direction into September.We can update the active stop loss for the position to 3.337.