lonelyPlayer0

@t_lonelyPlayer0

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

lonelyPlayer0

Gold: False Breakout at 3500 – 3400 or 3600 Next?

Gold Outlook: Historical Highs Above $3500 – Consolidation or Deeper Correction Ahead? Gold has once again updated its all-time highs above the $3500 mark, confirming the strong bullish trend that has been dominating the market in recent months. However, immediately after this breakout attempt, we saw a corrective pullback triggered by a short-term strengthening of the U.S. dollar. This raises a key question for traders and investors: is this just a temporary pause before new highs, or the beginning of a deeper correction phase? Macro & Fundamental Drivers U.S. Dollar & Fed Expectations: The probability of a September rate cut is now estimated at 90%, which remains one of the strongest supportive factors for gold. Nevertheless, temporary USD strength is weighing on the metal in the short term. Importantly, markets are increasingly focused on concerns regarding the independence of the Federal Reserve, with political pressure (particularly from Trump) casting uncertainty over the Fed’s policy path. Geopolitical Risks: Escalating geopolitical tensions are also adding fuel to safe-haven demand. Recent reports highlight intensified strikes by the Armed Forces of Ukraine on Russian territory, raising fears of further escalation in the Russia-Ukraine conflict. This factor continues to support defensive assets like gold, even in the face of short-term dollar strength. Upcoming U.S. ISM Manufacturing PMI: Today’s key macro event is the release of the ISM Manufacturing PMI. Consensus expects a modest rise to 49, which would still leave the index in the contraction zone. If the data meets or exceeds expectations, the USD could receive temporary support, keeping gold under pressure. If the data misses expectations and shows further weakness, it could accelerate dollar selling and act as a catalyst for gold to retest or break above historical highs. Technical Picture Gold’s sharp rejection above $3500 suggests that the market is not yet ready for a sustainable breakout. At the same time, the long-term bullish structure remains intact. The key levels to watch in the short term are: Resistance: $3485, $3500, $3505 Support: $3467.6, $3441, $3423 A sustained move below $3490–3485 may open the way for a deeper correction into the 3440–3420 support zone. On the other hand, a successful defense of these levels could lead to another retest of $3500–3505, though at this stage the market does not yet show strong momentum for an immediate continuation higher. Trading Scenarios Bearish Case (short-term): Failure to hold above $3485 may trigger selling pressure toward 3467–3440, and possibly even 3423 in the near term. Bullish Case (medium-term): Any dip toward the support zone could attract buyers, especially if fundamentals (weak ISM PMI / dovish Fed expectations / geopolitical tensions) align. A confirmed breakout above $3505 would signal continuation toward new record highs. 🔑 Bottom Line: Gold remains in a bullish long-term uptrend but faces short-term correction risks. Today’s ISM Manufacturing PMI release could be the decisive factor for immediate direction. Watch closely whether bulls can defend the 3485–3490 zone or whether bears push the price lower toward support levels before the next leg higher.

lonelyPlayer0

Gold: Correction & Retest of Broken Level

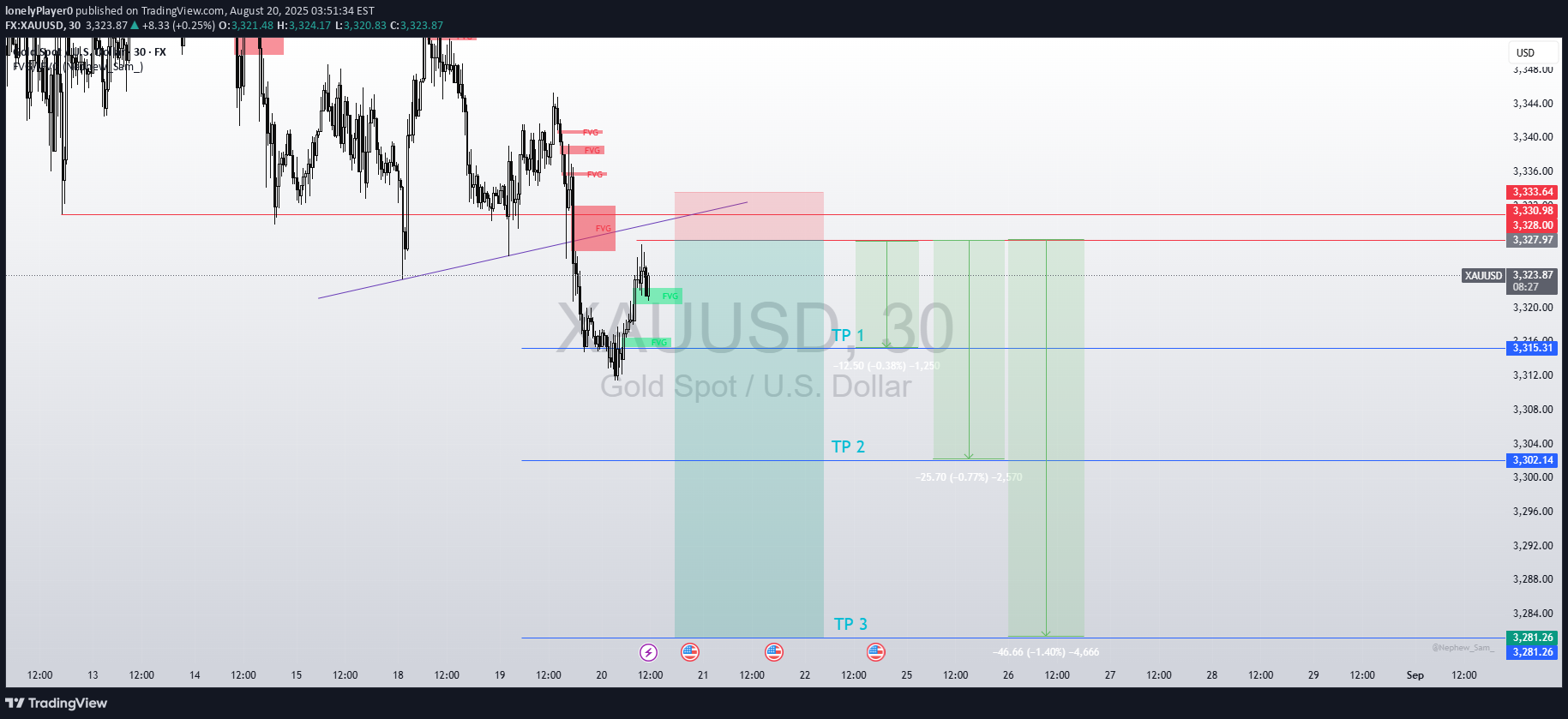

1. Fundamental Outlook Gold is trading close to $3,300, its lowest level in the past three weeks, as market participants remain cautious ahead of key U.S. monetary policy signals. The current weakness is not only tied to technical flows but also to expectations regarding the Federal Reserve’s policy stance. Despite signs of a slowing labor market and softer inflation figures, investors believe that the Fed may resist adopting an overly aggressive easing cycle. The upcoming release of the Fed minutes and, more importantly, Jerome Powell’s speech at the Jackson Hole Symposium, will likely determine the next big move for gold. Until then, sentiment remains defensive, and investors are reluctant to commit to large positions. 2. Dollar Dynamics The U.S. dollar has been strengthening, exerting downward pressure on gold. Several factors are contributing to this: Policy Expectations: Markets still assign around an 85% probability of a September rate cut, but traders expect Powell to signal caution and avoid endorsing steep or rapid cuts. Housing Market Resilience: Strong housing data has reinforced confidence in the U.S. economy, giving further support to the dollar. Geopolitical Headlines: News of potential Ukraine negotiations added a layer of optimism for risk sentiment, while also supporting the dollar as investors adjust safe-haven allocations. As long as the dollar maintains this upward momentum, gold is likely to face headwinds, with upside moves limited to corrective rallies. 3. Technical Setup From a technical standpoint, gold is in the process of a correction following a bearish rally. This corrective phase is characterized by short-term rebounds toward local resistance zones, but without a confirmed breakout, the overall bias remains negative. Resistance Levels: 3328, 3331, 3345 Support Levels: 3314, 3300, 3270 The correction could bring gold to test the 3328–3345 resistance zone. However, if the price fails to sustain above these levels, the risk of renewed selling pressure increases. A confirmed breakdown below 3300 would expose the 3270 area, which serves as the next major downside target. In short, unless gold can establish firm support above 3345, the path of least resistance remains lower. 4. Key Events to Watch The most critical driver for gold in the near term is Jerome Powell’s speech at Jackson Hole on Friday. Investors will focus on whether Powell signals a cautious approach—supporting the dollar—or hints at policy flexibility, which could provide temporary relief for gold. Additionally, the Fed minutes release will be analyzed for any details on how policymakers view the balance between inflation risks and economic weakness. Beyond monetary policy, continued monitoring of U.S. economic data releases and geopolitical developments (particularly around Ukraine) will remain essential for short-term positioning in gold. ✅ Conclusion: Gold remains under pressure, weighed down by a stronger dollar and uncertainty around Fed policy. While technical corrections may push prices higher in the short term, the broader outlook remains cautious. The 3300 level is pivotal—holding above it could allow for a corrective bounce, while a break below may accelerate declines toward 3270. The decisive trigger, however, will come from Powell’s comments at Jackson Hole, which are likely to set the tone for gold’s direction into September.We can update the active stop loss for the position to 3.337.

lonelyPlayer0

Gold: Rebounding and Stabilizing Near 3340

Gold Market Outlook: Watching Inflation, Technical Pressure BuildsMarkets are squarely focused on the upcoming U.S. Consumer Price Index (CPI) release, which could serve as a pivotal moment for shaping Federal Reserve policy expectations ahead of the September meeting. Current market pricing suggests a roughly 52% probability of a rate cut, but this is highly sensitive to how inflation data unfolds. The consensus anticipates headline CPI growth of 0.2% and core inflation at 0.3%. Any deviation—especially a softer reading—could significantly sway sentiment in favor of monetary easing, thereby reinforcing gold’s appeal as a defensive asset.Beyond the macroeconomic calendar, broader geopolitical undercurrents continue to influence the landscape. Optimism stemming from recent progress in U.S.-China trade discussions has buoyed risk appetite, yet this is tempered by lingering concerns after a court ruling upheld former President Trump’s authority to maintain certain tariffs. This legal development introduces fresh layers of ambiguity, keeping the U.S. dollar on the defensive and lending indirect support to gold prices.From a technical standpoint, gold remains confined within the narrowing bounds of a symmetrical triangle pattern—a classic sign of consolidation and potential volatility ahead. The price action reflects a broader indecisiveness prevalent across multiple asset classes, as traders await clearer macro signals before committing to directional moves.Key support lies at 3301, 3330, and 3340, while resistance is seen at 3349, 3361, and 3375. Special attention should be paid to the critical 3330–3340 range, which has acted as a magnet for price in recent sessions. A decisive break and sustained hold above this zone—especially if supported by softer inflation data—could hand the bulls a tactical advantage, opening the door for a push toward higher resistance areas and renewed bullish momentum.In summary, gold is at a technical and fundamental crossroads. Inflation data will likely determine whether the metal can break free from its current consolidation or remain range-bound amid ongoing uncertainty.Target hit. Well done

lonelyPlayer0

Gold Range Resistance: Short Opportunity

XAU/USD Outlook: Testing Resistance at 3330 — Bulls Face Critical Inflection PointGold (XAU/USD) is once again drawing attention as it tests a major resistance level near $3330, where the descending trendline intersects with the previous weekly high (PWH). This area marks a key decision zone for market participants, as it could either validate the recent bullish recovery or serve as the launchpad for another leg lower.After rebounding off a higher low earlier this month—demonstrating the continued respect of buyers for the broader bullish structure—gold has climbed back toward the upper boundary of its short-term consolidation range. However, the battle at $3330 will determine whether this rally was a corrective move within a downtrend or a prelude to a renewed push higher.Currently, price remains confined within a widening upward channel that has defined the medium-term bullish trend. The ascending channel continues to act as a supportive structure, yet the presence of a descending trendline acting as dynamic resistance adds tension to the setup. A decisive break above this resistance would signal that bulls are reclaiming control and open the path toward the next significant target at $3494, an area of historical importance that aligns with the upper boundary of the channel.🔍 Technical Setup and ScenariosResistance Zone – $3330:This level is particularly critical due to the confluence of multiple technical factors: the downward-sloping trendline from recent highs and the prior weekly high both converge here. A clean breakout above this resistance zone—ideally followed by a retest confirming it as new support—would be a powerful signal of bullish continuation.Higher Low Confirmation:Gold’s recent bounce off the higher low reaffirms ongoing buying interest, and unless the price breaks below $3215, the bullish structure remains intact. The market is thus navigating a delicate balance between continuation and correction.Support Zone – $3215 to $3230:This is the key area to watch if price gets rejected from the current resistance. A decline back to this zone would not necessarily invalidate the broader uptrend, as long as buyers step in to defend it again. However, a decisive break below $3215 would mark a major structural shift and could usher in a deeper correction.📈 Key Trade LevelsBuy Zone: $3215 – $3230This is the optimal range for dip buyers if price revisits it, especially if bullish reversal patterns emerge at these levels.Buy Trigger:A confirmed breakout above $3330, followed by a successful retest of the trendline and/or prior resistance, would validate a bullish setup. Ideally, this should be accompanied by strong momentum and volume.Sell Trigger:A clear rejection from $3330, particularly if followed by bearish candlestick formations (e.g., shooting star, bearish engulfing), may prompt a decline back toward $3215 and beyond.Upside Target: $3494This represents a logical profit-taking zone on a bullish breakout, marking a measured move and upper channel resistance.⚠️ Risk Factors and Market CatalystsMacro Volatility Ahead:Scheduled economic data and macro events—such as FOMC decisions, U.S. CPI releases, or geopolitical headlines—can introduce sharp volatility in gold. These events may invalidate technical setups temporarily or create false breakouts.Trendline Pressure:Repeated failures to break above the descending trendline increase the likelihood of bearish exhaustion and may embolden sellers to target lower levels.Structural Breakdown Risks:As long as $3215 holds, the higher-low structure remains valid. However, a decisive breakdown below this level would suggest that the bears are gaining strength and could accelerate downside momentum, potentially shifting sentiment toward a more bearish medium-term outlook.📌 Conclusion: Gold at a Pivotal JunctureXAU/USD stands at a crossroads, with a key resistance test underway at $3330. The broader trend remains bullish within the confines of an upward channel, but the descending trendline poses a meaningful obstacle. A breakout above this barrier would likely confirm bullish continuation toward $3494, while a rejection could drag price back toward $3215, testing the resolve of buyers.With macroeconomic catalysts looming and technical tension building, traders should prepare for increased volatility and consider both bullish breakout and bearish rejection scenarios in their risk management and positioning. Flexibility and responsiveness to key levels will be crucial in navigating the next major move in gold.

lonelyPlayer0

GOLD Tap & Turn Down

GOLD – Fragile Recovery Faces Dual PressureGold shows mild recovery following a week of losses, yet upside remains capped. Dollar softness and Moody’s U.S. downgrade offer tailwinds, but elevated bond yields and optimism over potential U.S. trade deals act as brakes.Traders await Fed remarks and developments in U.S. trade talks. Despite fiscal worries and weak data that could buoy gold, any breakthrough on trade might quickly flip sentiment.Key zones:Resistance – 3257, 3265Support – 3206, 3153A failed breakout above 3265 followed by a pullback below 3257 may signal a momentum shift, opening the door for deeper losses.

lonelyPlayer0

Gold's Downtrend Persists

Gold's Bearish Outlook Continues Despite Temporary Upside SpikeMarket Overview:The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among analysts and traders alike.The unexpected bullish reaction came shortly after former U.S. President Donald Trump announced a 90-day suspension on reciprocal tariffs—a development that typically would not warrant such a dramatic price rally in gold. Normally, easing geopolitical or economic tensions would dampen safe-haven demand, causing gold to retreat. In this case, however, the opposite occurred, which suggests the possibility of non-fundamental drivers at play, potentially even artificial market influence or manipulation.Technical Outlook:Despite the sudden upward movement, gold’s larger technical structure has not changed significantly. The overall trend remains bearish unless we see a sustained breakout above the 3167 resistance level. A clean breach above that threshold would be uncharacteristic based on current fundamentals and could indicate external interference or speculative overreaction rather than a genuine shift in sentiment or macroeconomic conditions.The price action continues to favor the bears, with lower highs and lower lows still forming on the larger timeframes. Until there’s clear evidence to the contrary, any rallies should be viewed with skepticism and treated as potential selling opportunities rather than the start of a new bullish trend.Key Support Zones:Looking at potential areas where gold may find some temporary footing, the following support levels should be closely monitored:3054 – Minor support; could serve as a short-term pause point.3000 – A psychological level and round number that often acts as a magnet for price action.2925 – More significant historical support zone with prior buying interest.2840 – Deeper support, aligning with the longer-term bearish trajectory.Conclusion:In summary, while gold has shown a sudden upward burst, the broader picture remains cautious. The technical indicators, market context, and recent price behavior all point toward a continuation of the downtrend unless key resistance levels are convincingly breached. Traders are advised to remain vigilant, avoid emotional reactions to short-term volatility, and refer closely to technical signals when making decisions.The chart provides further clarity on this setup—feel free to review it for a more visual representation of the analysis.Thank you for reading, and best of luck in the markets!

lonelyPlayer0

Gold: Economic Risks May Drive Prices Up

Gold Surges Amid Global Uncertainty, Testing Key ResistanceGold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.Target hit

lonelyPlayer0

Golden Horizons on the Precipice

Gold on the Brink of a Downturn: A Shift in Market SentimentGold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!gold reaches target 1

lonelyPlayer0

Gold’s Uptrend Intensifies: 2955 in Focus

Fundamental Factors Driving Gold Prices1. Record Highs and Investor SentimentGold is currently trading near its all-time high of $2,956, a level that represents a key psychological threshold for market participants. The fact that the price has not seen significant rejection from these highs suggests that the bullish momentum remains strong, but investors are pausing to reassess market conditions before committing to further upside movement.2. Trade War Fears: Trump's Tariff Policies & Export Restrictions on NvidiaA major geopolitical factor influencing gold at the moment is renewed trade war fears following Donald Trump’s statements regarding tariffs and export controls. The former U.S. president has hinted at imposing stricter tariffs and additional restrictions on high-tech exports, particularly those involving Nvidia’s advanced semiconductor chips being sent to China.This development is crucial because:It revives U.S.-China tensions, which have historically been a strong bullish catalyst for gold as a safe-haven asset.It could weigh on global equity markets, causing risk aversion and prompting investors to seek protection in gold.It increases uncertainty in global trade and economic growth projections, which supports demand for non-yielding assets like gold.3. Risk Sentiment & U.S. Dollar StrengthWhile gold benefits from safe-haven demand, its gains are currently being partially offset by a stronger U.S. dollar. The greenback has been gaining traction amid concerns about global economic stability, which puts some downward pressure on gold. However, this is being counterbalanced by lower U.S. Treasury yields, which make non-yielding assets like gold more attractive in comparison.4. Federal Reserve Policy OutlookAnother key factor supporting gold’s bullish case is the growing expectation of Federal Reserve rate cuts. With inflation showing signs of moderation and economic uncertainty rising, market participants are increasingly pricing in the possibility that the Fed could ease monetary policy sooner than expected. This expectation puts downward pressure on bond yields and the dollar, both of which typically support gold prices.5. Key Economic Events to WatchGold’s price action will be closely tied to upcoming economic data, particularly:U.S. Consumer Confidence Report – A weaker-than-expected reading could fuel recession fears, increasing demand for gold.Tariff Negotiation Developments – Any new statements from U.S. or Chinese officials regarding trade relations could cause sharp movements in gold prices.Technical Analysis: Key Levels & PatternsResistance Levels to Watch$2,940 – This is a local resistance level that gold needs to break in order to continue its ascent. A strong bullish move above this area would indicate that buyers are ready to push for higher targets.$2,954.5 – This is a critical breakout level and potential trigger for further bullish momentum. If gold breaks and holds above this level, it would likely confirm a continuation of the rally.$2,960-$2,970 Range – If gold breaks above $2,954.5, the next potential target would be in this range, with a strong possibility of testing new all-time highs.Support Levels to Watch$2,930.7 – A key support level where buyers may step in if gold experiences a short-term pullback.$2,921 – A stronger support zone that, if broken, could indicate a deeper correction before a potential bullish continuation.Ascending Triangle Support – Gold’s ascending triangle pattern has a dynamic support trendline, meaning that higher lows are forming over time. As long as price action respects this trendline, the bullish structure remains intact.Scenario 1: Bullish Breakout Above $2,954.5If gold successfully breaks above $2,954.5 with strong volume and momentum, we could see an acceleration towards $2,960-$2,970.Beyond that, a test of the psychological $3,000 mark is a possibility, especially if risk-off sentiment continues to dominate global markets.Scenario 2: Range-Bound Consolidation Between $2,940 - $2,954.5If gold remains trapped in this range, traders should watch for low volatility periods that might precede a breakout.This scenario could last until a significant catalyst (e.g., economic data, Fed statements, trade war news) triggers a decisive move.Scenario 3: Bearish Pullback to $2,930.7 or LowerIf gold fails to break $2,954.5 and sees increased selling pressure, it may retest support at $2,930.7 or even dip toward $2,921 before attempting another leg higher.A break below $2,921 would weaken the bullish case and shift the focus to deeper support levels.Market Outlook: Factors to ConsiderBullish Drivers:Strengthening safe-haven demand due to geopolitical risks.Lower bond yields increasing gold’s appeal as a non-yielding asset.Potential Fed rate cuts in the coming months.Bearish Risks:Strengthening U.S. dollar, which could limit gold’s upside.Profit-taking near all-time highs, causing short-term pullbacks.Conclusion: Gold Positioned for a Potential Breakout, But Key Levels Must Be ClearedGold remains in a bullish technical setup, with an ascending triangle signaling potential for an upward breakout. However, the next major move depends on whether gold can decisively break the $2,954.5 resistance level or if it will continue consolidating before another push higher.With geopolitical tensions, central bank policies, and upcoming economic data releases in focus, traders should remain cautious but prepared for high volatility in the coming sessions. A breakout above $2,954.5 could trigger a strong rally, while a failure to sustain momentum may lead to a short-term pullback.

lonelyPlayer0

Gold (XAU/USD) Outlook: Navigating Key Support Amid Economic UncertaintyGold prices remain in a bullish trend, rebounding from previously tested trend support and signaling a potential upside continuation. The metal’s safe-haven appeal remains intact as global economic uncertainties persist, driving investor interest. However, market sentiment is influenced by key geopolitical and macroeconomic developments.Geopolitical & Economic Factors Influencing GoldInvestors remain highly cautious ahead of the upcoming US-Russia discussions in Saudi Arabia, where efforts to negotiate a resolution to the Ukraine conflict will take center stage. Any significant breakthroughs or escalations from these talks could inject volatility into the markets, impacting gold’s movement.Meanwhile, a weak risk appetite is currently supporting the US dollar. The greenback is benefiting from cautious rhetoric by Federal Reserve officials, who continue to express concerns about inflation. Policymakers are urging patience in easing monetary policy, which reduces the likelihood of imminent rate cuts. The market’s focus now shifts to upcoming Fed speeches and the release of the January FOMC meeting minutes, which could provide further insights into the central bank’s stance on interest rates.Technical Analysis: Key Levels & Market StructureIn the Asian trading session, gold successfully broke above the 2905 level, which now serves as a critical support zone. This level has historically played a key role in price action, and its ability to hold could determine gold’s short-term trajectory.Immediate resistance levels: 2922 and 2938Support levels: 2905 and 2893The most probable scenario is a retest of the 2905 support zone, given the existing liquidity interest below this level. However, the broader bullish trend suggests that any dips are likely to be met with renewed buying pressure. Additionally, an imbalance in favor of buyers could continue pushing the price upward.A decisive breakout and consolidation above 2915 could act as a catalyst for further gains, potentially driving the price toward the next key resistance levels. Conversely, if gold fails to maintain support, a deeper retracement toward 2893 could unfold before any renewed bullish momentum takes over.ConclusionGold’s price action remains highly sensitive to both economic and geopolitical developments. While the broader uptrend remains intact, short-term fluctuations driven by risk sentiment, Federal Reserve commentary, and geopolitical negotiations will play a crucial role. Traders and investors should closely monitor price reactions at key support and resistance levels, as well as upcoming macroeconomic events, to assess the next move in XAU/USD.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.