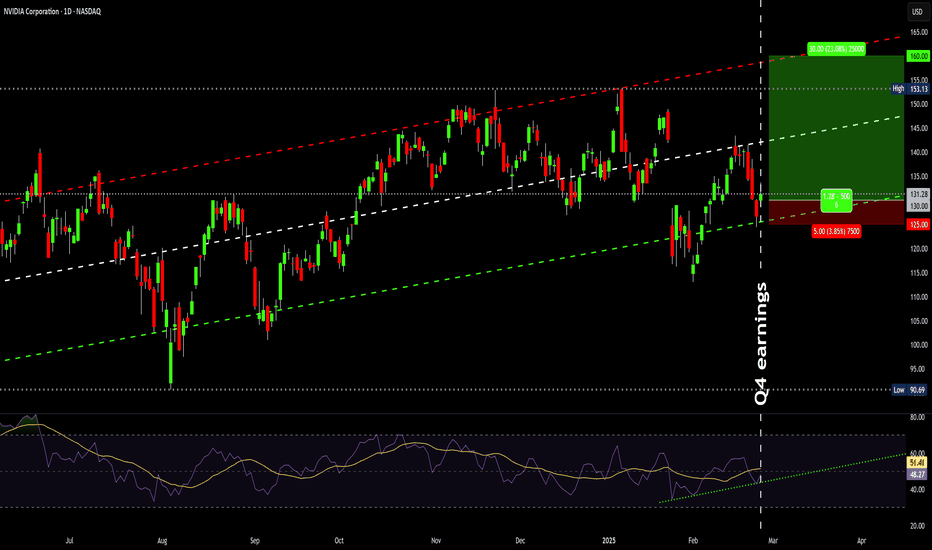

Technical analysis by Options360 about Symbol NVDAX: Buy recommendation (2/27/2025)

AI is not a bubble

NVIDIA reported earnings of 89 cents per share on revenue of $39.33 B for Q4. While revenue grew 77.94% on a year-over-year basis. The consensus earnings estimate was 84 cents per share on revenue of $37.72 B. The company said it expects Q1 revenue of $42.14 B to $43.86 B, and gross margins of 70.5% to 71.5%, which calculates to non-GAAP earnings of 89 cents to 97 per share. Long trade idea: long = 130 stop = 125 profit = 160 NVDA options data: 3/21 expiry Put Volume Total 159,655 Call Volume Total 331,044 Put/Call Volume Ratio 0.48 Put Open Interest Total 1,957,392 Call Open Interest Total 2,368,522 Put/Call Open Interest Ratio 0.83 4/17 expiry Put Volume Total 125,626 Call Volume Total 81,625 Put/Call Volume Ratio 1.54 Put Open Interest Total 521,463 Call Open Interest Total 712,523 Put/Call Open Interest Ratio 0.73 5/16 expiry Put Volume Total 32,339 Call Volume Total 49,339 Put/Call Volume Ratio 0.66 Put Open Interest Total 366,100 Call Open Interest Total 389,827 Put/Call Open Interest Ratio 0.94Long from 126.75 entryDecided to dca at 122.75Update: adjustment to market & plans long avg = 124.75 stop = 119.75 profit = 160dca long at 117.75