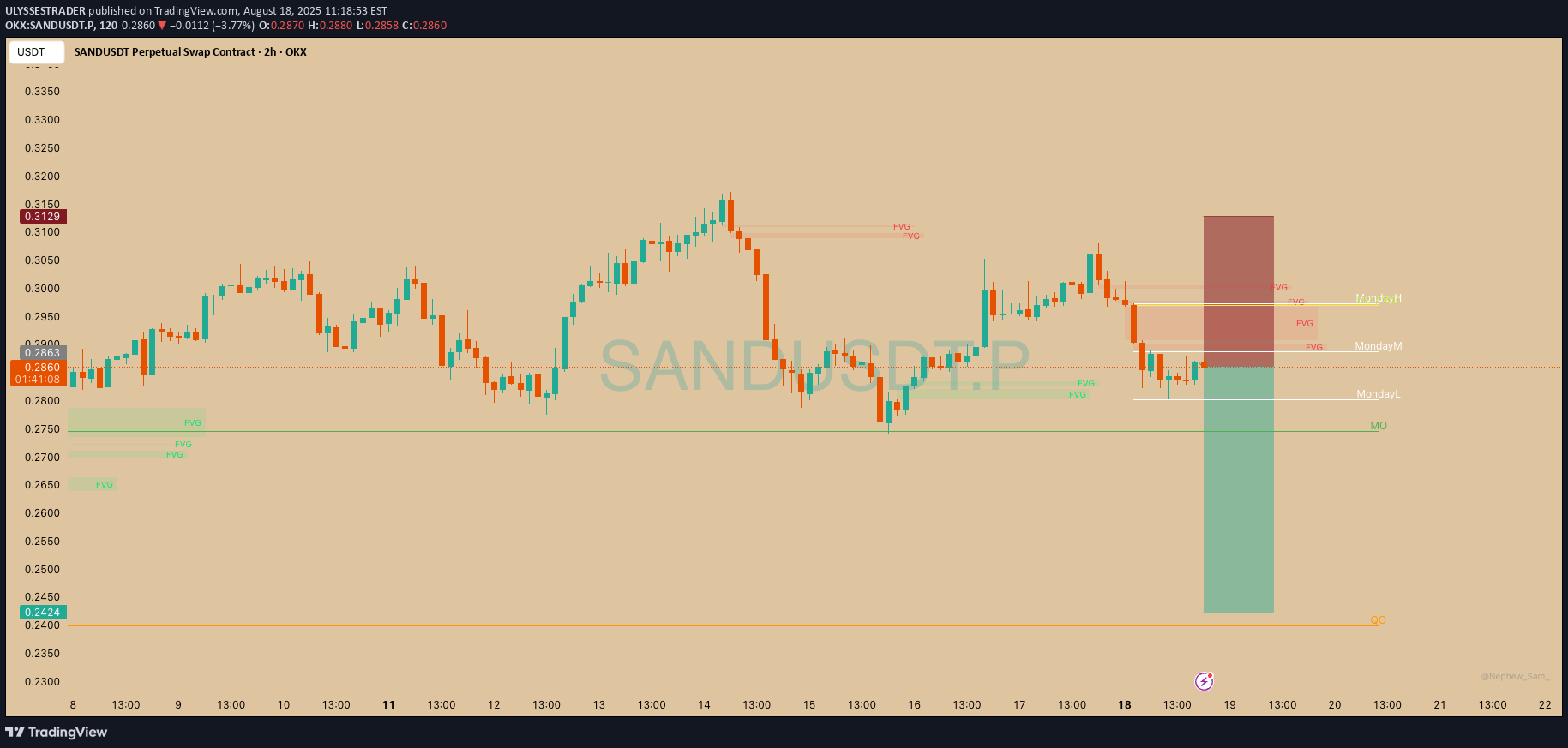

Technical analysis by ULYSSESTRADER about Symbol SAND on 8/18/2025

ULYSSESTRADER

1. Trade Direction: Short The trader is betting on price going down. The red box marks the stop-loss zone above, and the green box shows the take-profit zone below. 2. Key Levels on Chart Monday High (MondayH), Monday Mid (MondayM), Monday Low (MondayL) → Weekly reference points used for intraday/weekly bias. MO (Mid-Open?) and QQ (Quarterly Open) → Higher-timeframe levels for confluence. FVG (Fair Value Gaps) → Highlighted imbalance zones where price may revisit before continuing trend. 3. Reasoning Behind the Short Price is consolidating just under MondayM after rejecting higher FVG zones. Entry is taken at the top of the consolidation (near an FVG supply zone). Stop-loss is set just above the FVG / MondayM area (red box). Target is a liquidity sweep below MondayL and towards the MO level (green box). 4. Risk-to-Reward (RR) The trade setup shows a short entry around 0.286–0.288. Stop-loss near 0.315 (above supply & FVG). Take-profit near 0.242 (major liquidity pool + quarterly open). This gives a ~1:4 to 1:5 RR (risking ~3 cents to gain ~14 cents). 5. Trade Idea Summary Bias: Bearish (short). Reason: Rejection at FVG / supply zone. Price trapped below MondayM. Clear liquidity target below MondayL → MO → QQ. Plan: Enter short at ~0.286–0.288. Stop above 0.315. Target 0.242 (QQ).