Technical analysis by ProjectSyndicate about Symbol PAXG: Sell recommendation (8/18/2025)

ProjectSyndicate

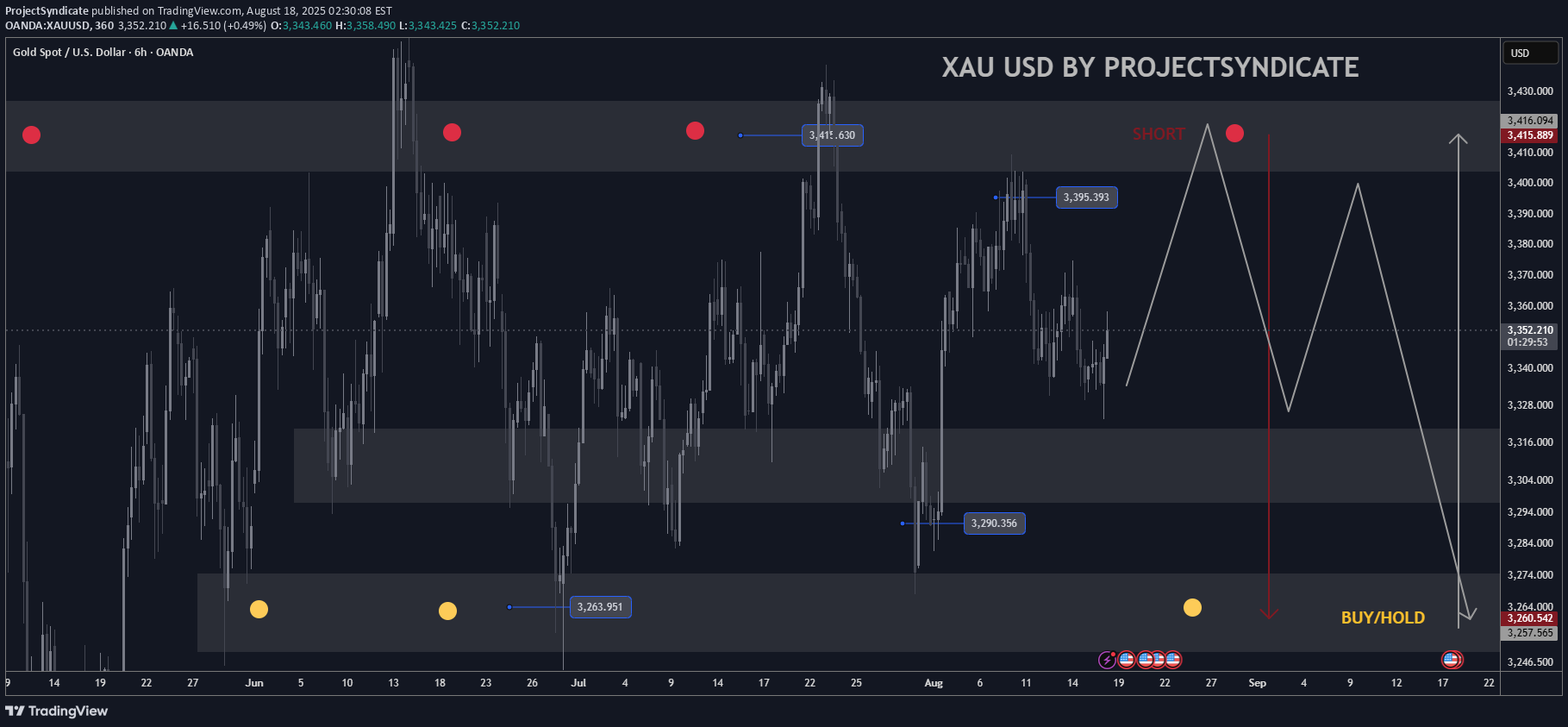

________________________________________ 📊 Gold Technical Outlook Update – H4 & 2H Chart 📰 Latest Summary Headlines • 🟡 Gold edges firmer as weaker USD provides short-term lift. • 📉 Technical compression on charts signals potential sharp move. • ⚠️ Rising wedge formation hints at possible breakdown risk. • 🎯 Traders eye a slide toward $3,225 if bearish pattern confirms. ________________________________________ 🏆 Market Overview • 💰 Current gold price hovers near $3,345–3,348 per ounce, consolidating in a tight range. • 🔄 Price action remains choppy, with no breakout beyond key levels in recent sessions. • ⛔ Strong resistance sits at $3,410–3,420 USD, keeping rallies capped. • ⚖️ Major support remains at $3,300–3,310 USD, forming the lower boundary of the range. • 💱 Market sentiment is driven by softer USD and yields, with gold unable to gain decisive momentum. • 🌪️ Volatility expected to persist as traders await stronger catalysts. ________________________________________ ⭐️ Recommended Trade Strategy • 🎯 Bearish Setup (2H/H4): Short gold near $3,410–3,420 resistance. • 🛑 Stop-loss: Above $3,430 recent highs. • ✅ Take profit: Initial target $3,310 USD, extension to $3,300 USD. • 📊 Range trading remains the favored play—sell near resistance, buy near support. • ⚡ Stay nimble for sharp moves if the wedge pattern resolves. • 🛡️ Risk management is critical: use tight stops and scale positions accordingly. ________________________________________ 💡 Gold Market Highlights • 🛡️ Safe-haven demand underpins gold as investors hedge against uncertainty. • 🏦 Institutional flows remain strong, though short-term pullbacks are likely. • 💥 Compression on charts suggests an explosive move once direction is chosen. • 📈 Current market levels: Gold spot ~$3,345–3,348, ETF (GLD) trades around $307. ________________________________________ 📌 Summary • 📏 Gold remains locked in a multi-week range between $3,300 support and $3,410 resistance. • 📉 The wedge pattern on short-term charts favors a potential breakdown toward $3,225. • 🐻 Short-sellers should wait for confirmation, while 🐂 bulls will defend key support zones. • 🧭 Tactical range trading remains the best approach until a decisive breakout occurs. ________________________________________Blueprint to Becoming a Successful Gold Trader in 2025