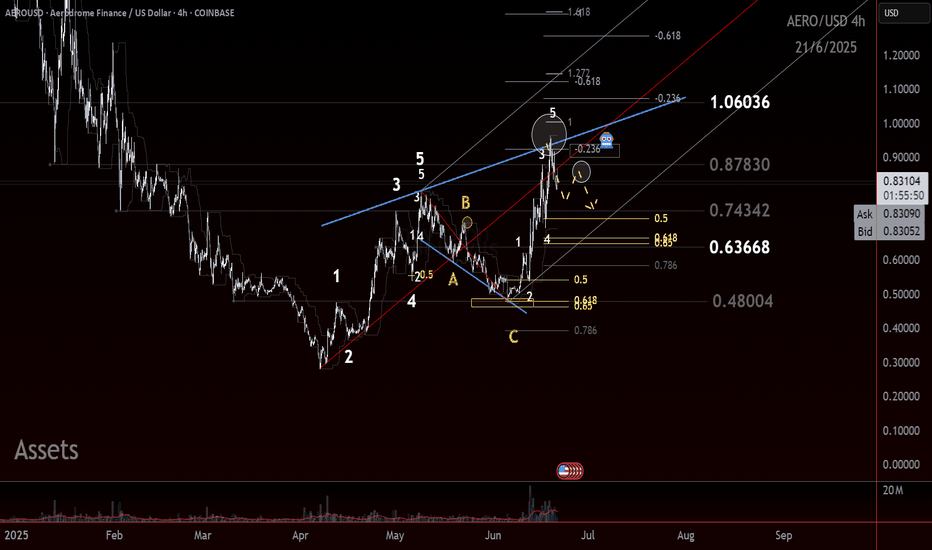

Technical analysis by CryptoKnee about Symbol AERO: Buy recommendation (6/21/2025)

CryptoKnee

AERO gave a valid long setup We were eye a possible retrace of an impulsive move and it displayed enough to trigger a rules-based entry. Technical Breakdown Key structural elements supported the setup: Initial leg up showed impulse-like behavior Pullback found support at a clearly defined AOI Multiple MLT levels aligned with a common zigzag framework Swift bounce off the Golden Corner Pocket (GCP) Break and close above 0.54 completed the impulse structure Prior resistance flipped into support Volume confirmed the move, and price reached the first algo target, producing a reactive wick and confirming potential of algo activity. This created a textbook TDU-style GCP/Algo/C-3 setup with measured entry and exit. Risk Management Partial profit was taken at the first MLT zone Stop loss was moved into profit post-structure break Scenario planning: If move continues: positioned If move stalls as a larger zigzag: no loss Outlook Attention now shifts to the next actionable level, possible second entry long 0.62 is the AOI for re-entry atm Ideal scenario = Continuation in a wave 3, obvi Alt scenario = Clean corrective to AOI + long Bear scenario = Zig Zag complete Conclusion The trade played by the book! Confluence across AOI, GCP, MLT, and volume created a qualified entry — not a guess. This remains a great example of structure over sentiment and waiting for the market to meet criteria before engaging.