Technical analysis by Skill-Knowledge-Conduct about Symbol ADA: Buy recommendation (8/16/2025)

Skill-Knowledge-Conduct

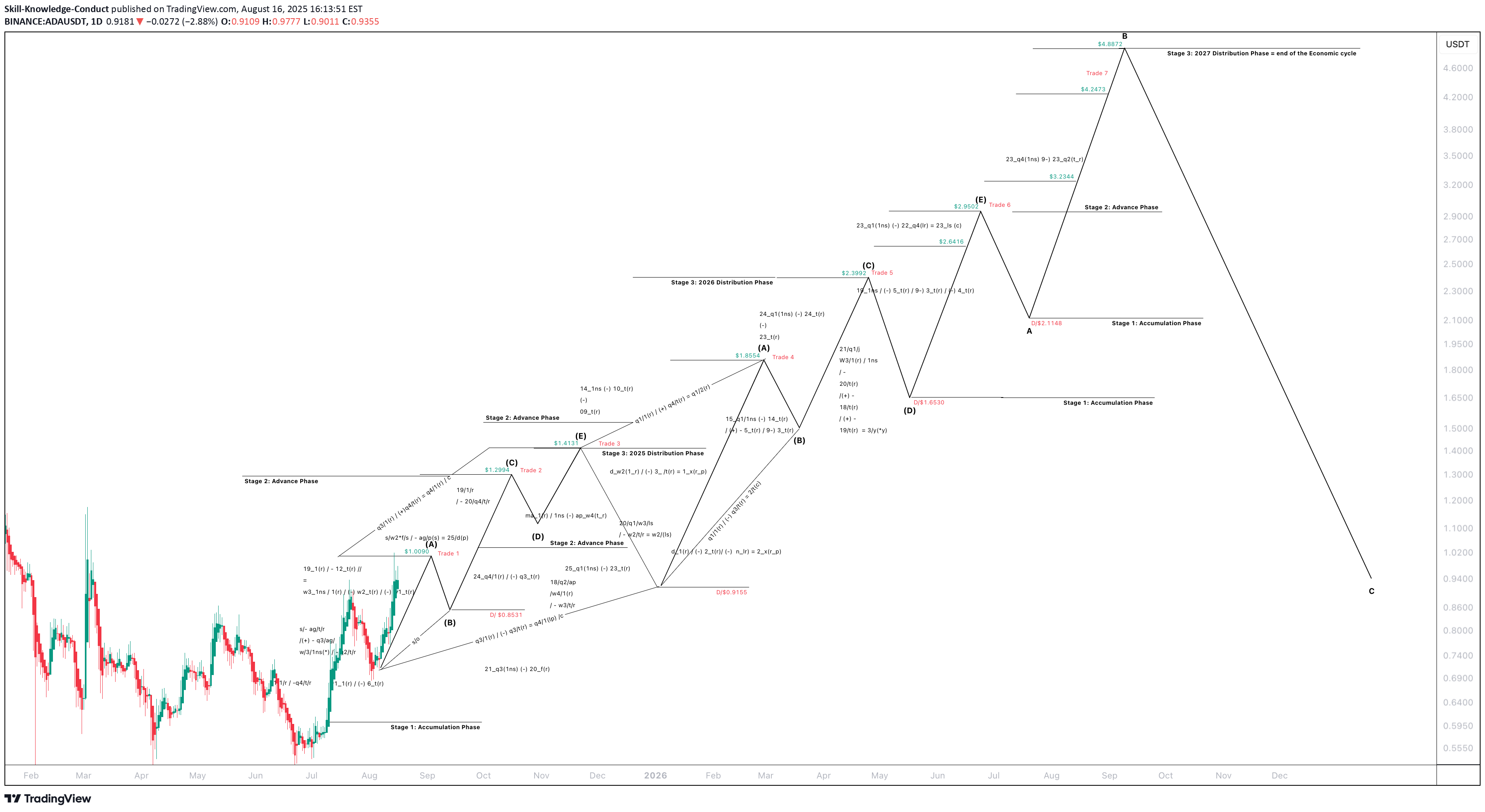

Cardano (ADA) Q3 Forecast: 2025–2027 Distribution Outlook Ticker Symbol: ADA Execution Venue: Binance Overview Support at $0.9590 has been confirmed from the previous forecast, allowing the model to extend into a 2.71- year economic cycle (990 days) projection. This provides a roadmap for ADA's distribution levels across 2025, 2026, and 2027. To calculate the economic that we start breaking each quarter of per previous year which 2 years, 8 months, 14 days. That’s about 2.71 years (990 days ÷ 365.25). 2018 Q2 (Apr - Jun): 59 days (May 3 -Jun 30) - partial 2018 Q3 (Jul -Sep): 92 days 2018 Q4 (Oct - Dec): 92 days 2019 Q1 (Jan - Mar): 90 days 2019 Q2 (Apr–Jun): 91 days 2019 Q3 (Jul - Sep): 92 days 2019 Q4 (Oct - Dec): 92 days 2020 Q1 (Jan - Mar): 91 days 2020 Q2 (Apr - Jun): 91 days 2020 Q3 (Jul - Sep): 92 days 2020 Q4 (Oct - Dec): 92 days 2021 Q1 (Jan -Mar): 16 days (Jan 1 - Jan 16) partial Total: 990 days. How that gives 2 years, 8 months, 14 days: We add add 2 years to May 3, 2018, → May 3, 2020. then add 8 months → Jan 3, 2021. Remaining 14 days → Jan 17, 2021. (990 days ÷ 365.25 = 2.71 years, about 10.84 quarters.) The structure follows three stages: • Stage 1 – Accumulation Phase • Stage 2 – Advance Phase • Stage 3 – Distribution Phase Key Levels (2025 -2027) 🔹 Initial Drop Phase • After $1.0090 → $0.8531 🔹 Distribution Levels • Level 1: $1.2994 – $1.4131 • Drop Level: $0.9155 • Level 2: $1.8554 • Level 3: $2.3992 • Drop Level: $1.6530 • Level 4: $2.9502 • Level 5: $3.2344 • Level 6: $4.2473 – $4.8871 Cycle Implications • 2025: Early distribution → $1.2994 – $1.4131 • 2026: Advance phase targets → $2.3992 – $2.9502 • 2027: Peak distribution → $4.2473 – $4.8871 📌 Conclusion: ADA is aligning with its projected multi-year economic cycle. With Q3 2025 marking the foundation, this roadmap outlines the distribution trajectory into 2026 and peak cycle levels in 2027 before a corrective phase begins. Retail Trader Note: I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility. Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory. This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances. #ADA #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy